Question: > Problem 11-9 Special Deductions and Limitations (LO 11.3) In 2022, Citradoria Corporation is a corporation that contributes $35,000 cash to qualified charitable organizations

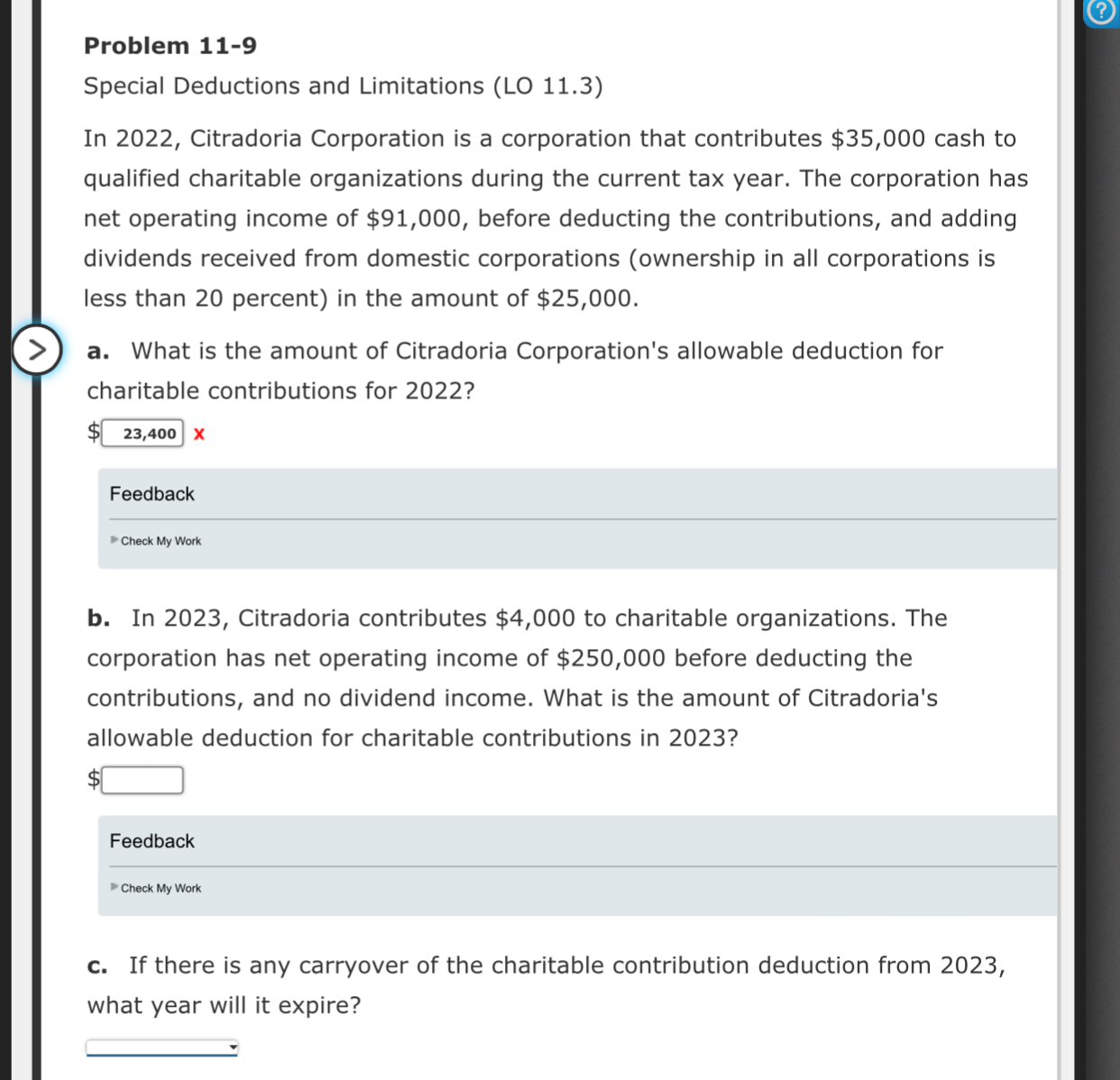

> Problem 11-9 Special Deductions and Limitations (LO 11.3) In 2022, Citradoria Corporation is a corporation that contributes $35,000 cash to qualified charitable organizations during the current tax year. The corporation has net operating income of $91,000, before deducting the contributions, and adding dividends received from domestic corporations (ownership in all corporations is less than 20 percent) in the amount of $25,000. a. What is the amount of Citradoria Corporation's allowable deduction for charitable contributions for 2022? 23,400 X Feedback Check My Work b. In 2023, Citradoria contributes $4,000 to charitable organizations. The corporation has net operating income of $250,000 before deducting the contributions, and no dividend income. What is the amount of Citradoria's allowable deduction for charitable contributions in 2023? Feedback Check My Work c. If there is any carryover of the charitable contribution deduction from 2023, what year will it expire?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts