Question: If you could explain how you solved for it, I would appreciate it. Determining Bond Selling Price Calculate the bond selling price for the three

If you could explain how you solved for it, I would appreciate it.

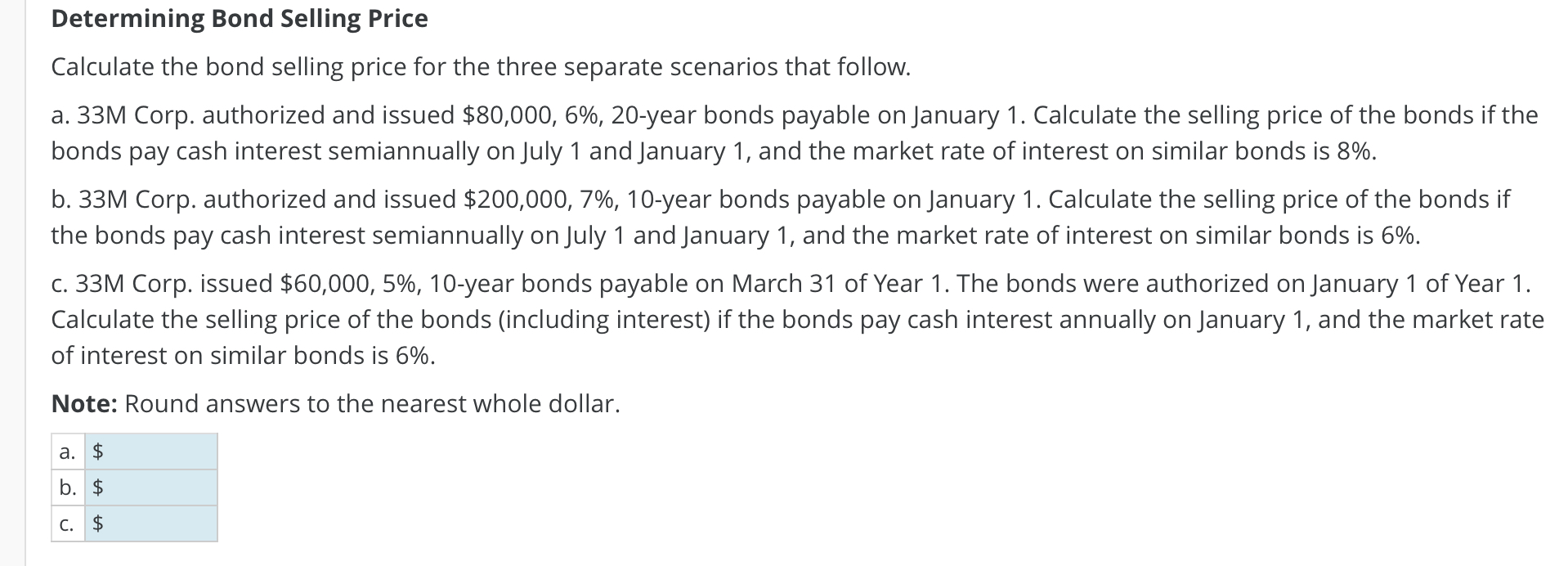

Determining Bond Selling Price Calculate the bond selling price for the three separate scenarios that follow. a. 33M Corp. authorized and issued $80,000,6%,20-year bonds payable on January 1 . Calculate the selling price of the bonds if the bonds pay cash interest semiannually on July 1 and January 1 , and the market rate of interest on similar bonds is 8%. b. 33M Corp. authorized and issued $200,000,7%,10-year bonds payable on January 1 . Calculate the selling price of the bonds if the bonds pay cash interest semiannually on July 1 and January 1 , and the market rate of interest on similar bonds is 6%. c. 33M Corp. issued $60,000,5%,10-year bonds payable on March 31 of Year 1 . The bonds were authorized on January 1 of Year 1. Calculate the selling price of the bonds (including interest) if the bonds pay cash interest annually on January 1 , and the market rate of interest on similar bonds is 6%. Note: Round answers to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts