Question: if you could help explain this. I would appreciate it. An investor wants to allocate money between two risky investments. The investor follows a mean-variance

if you could help explain this. I would appreciate it.

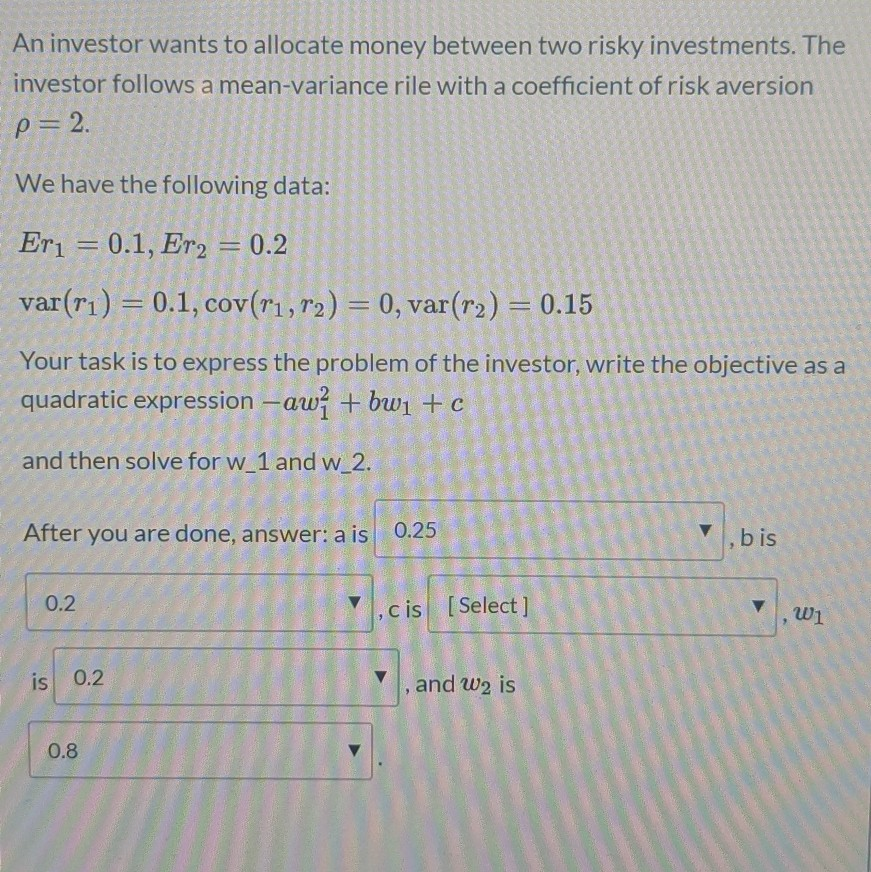

An investor wants to allocate money between two risky investments. The investor follows a mean-variance rile with a coefficient of risk aversion p=2. We have the following data: Er = 0.1, Er2 = 0.2 var(r) = 0.1, cov(T1,r2) = 0, var(r2) = 0.15 Your task is to express the problem of the investor, write the objective as a quadratic expression -awi + bwi +c. and then solve for w_1 and w_2. . bis After you are done, answer: a is 0.25 0.2 cis [Select] W1 is 0.2 , and W2 is 0.8 An investor wants to allocate money between two risky investments. The investor follows a mean-variance rile with a coefficient of risk aversion p=2. We have the following data: Er = 0.1, Er2 = 0.2 var(r) = 0.1, cov(T1,r2) = 0, var(r2) = 0.15 Your task is to express the problem of the investor, write the objective as a quadratic expression -awi + bwi +c. and then solve for w_1 and w_2. . bis After you are done, answer: a is 0.25 0.2 cis [Select] W1 is 0.2 , and W2 is 0.8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts