Question: if you could help me with all this, I would really appreciate it as it is one question as a whole. If you get a

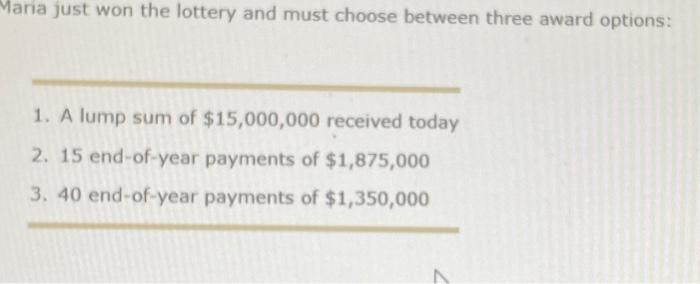

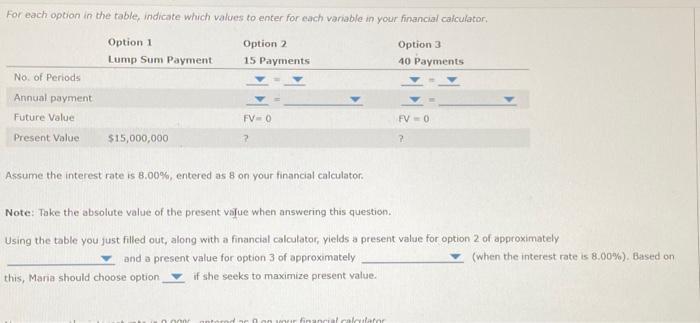

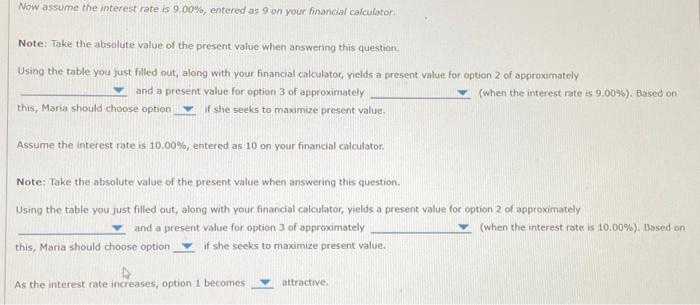

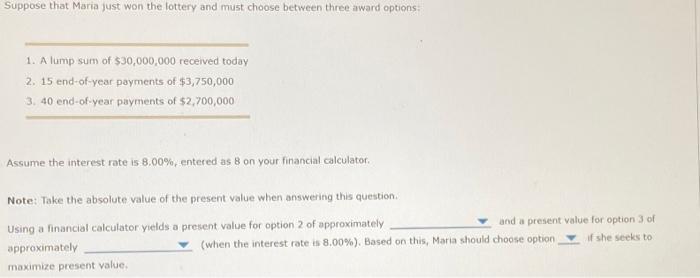

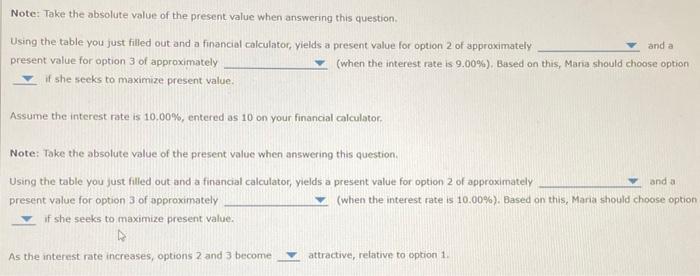

For each option in the table, indicate which values to enter for each vaniable in your financial calculator. Assume the interest rate is 8.00%, entered as 8 on your financial calculator. Note: Take the absolute value of the present vilue when answering this question. Using the table you just filled out, along with a financial calculator, yields a present value for option 2 of approximately and a present value for option 3 of approximately (when the interest rate is 8,00% ). Based on this, Maria should choose option if she seeks to maximize present value. Note: Take the absolute value of the present value when answering this question. Using the table you just filled out and a financial calculator, yields a present value for option 2 of approximately and a present value for option 3 of approximately (when the interest rate is 9.00% ). Based on this, Maria should choose option if she seeks to maximize present value. Assume the interest rate is 10.00%, entered as 10 on your financial calculator. Note: Take the absolute value of the present value when answering this question. Using the table you just filled out and a financial calculator, yields a present value for option 2 of approximately and a present value for option 3 of approximately (when the interest rate is 10.00% ). Based on this, Maria should choose option if she seeks to maximize present value. As the interest rate increases, options 2 and 3 become attractive, relative to option 1. Maria just won the lottery and must choose between three award options: 1. A lump sum of $15,000,000 received today 2. 15 end-of-year payments of $1,875,000 3. 40 end-of-year payments of $1,350,000 Now assume the interest rate is 9.00%, entered as 9 on your financial calculator. Note: Take the absolute value of the present value when answering this question. Using the table you fust filled out, along with your financial calculator, yields a present value for option 2 of approximately and a present value for option 3 of approximately (when the interest rate is 9.00% ). Based on this, Maria should choose option if she seeks to maximize present value. Assume the interest rate is 10.00%, entered as 10 on your financial calculator. Note: Take the absolute value of the present value when answering this question. Using the table you just filled out, along with your financial calculator, vields a present value for option 2 of approximately and a present value for option 3 of approximately (when the interest rate is 10,00% ), Based on this, Maria should choose option if she seeks to maximize present value. As the interest rate increases, option 1 becomes attractive. Assume the interest rate is 8.00%, entered as 8 on your financial calculator. Note: Take the absolute value of the present value when answering this question. Using a financial calculator yelds a present value for option 2 of approximately and a present value for option 3 of approximately (whien the interest rate is 8.00% ). Based on this, Maria should choose option if she seeks to maximize present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts