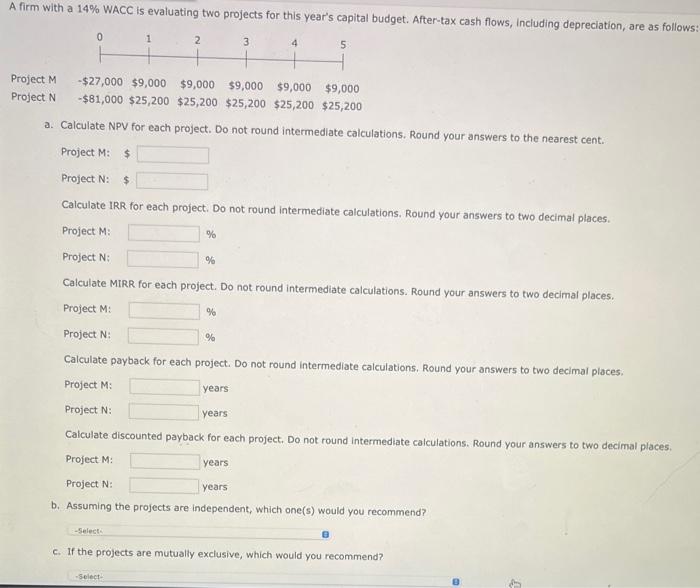

Question: if you could show any steps that u can on a finance caculator, that would be amazing:) a. Calculate NPV for each project. Do not

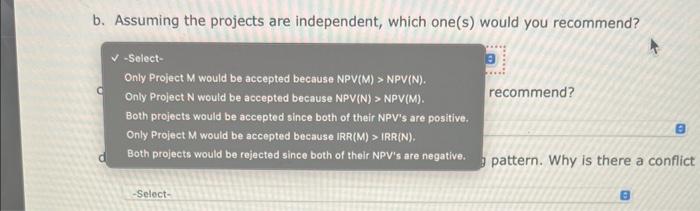

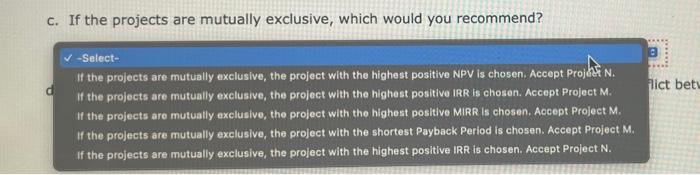

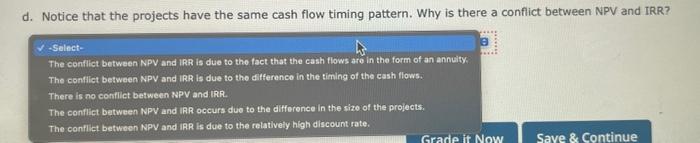

a. Calculate NPV for each project. Do not round intermediate calculations. Round your answers to the nearest cent. Project M:$ Project N:$ Calculate IRR for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: % Project N : % Calculate MIRR for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: % Project N : % Calculate payback for each project. Do not round intermediate calculations, Round your answers to two decimal places. \begin{tabular}{l|l} Project M: & years \\ \hline Project N: & years \end{tabular} Calculate discounted payback for each project. Do not round intermediate calculations. Round your answers to two decimal places. ProjectM:ProjectN:yearsyears b. Assuming the projects are independent, which one(s) would you recommend? c. If the projects are mutually exclusive, which would you recommend? Assuming the projects are independent, which one(s) would you recommend? c. If the projects are mutually exclusive, which would you recommend? d. Notice that the projects have the same cash flow timing pattern. Why is there a conflict between NPV and IRR? Wi-Salect- The conflict between NPV and IRR is due to the fact that the cash flows are in the form of an annily: The conflict between NPV and IRR is due to the difference in the timing of the cash flows. There is no conflict between wPV and IRR. The conflict batween NPV and IRR occurs due to the difference in the size of the projects. The conflict between NPV and IRR is due to the relatively high discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts