Question: If you could write out the calculations (variable names preferably) for solved numbers, I would greatly appreciate it. The Mixing Department manager of Malone Company

If you could write out the calculations (variable names preferably) for solved numbers, I would greatly appreciate it.

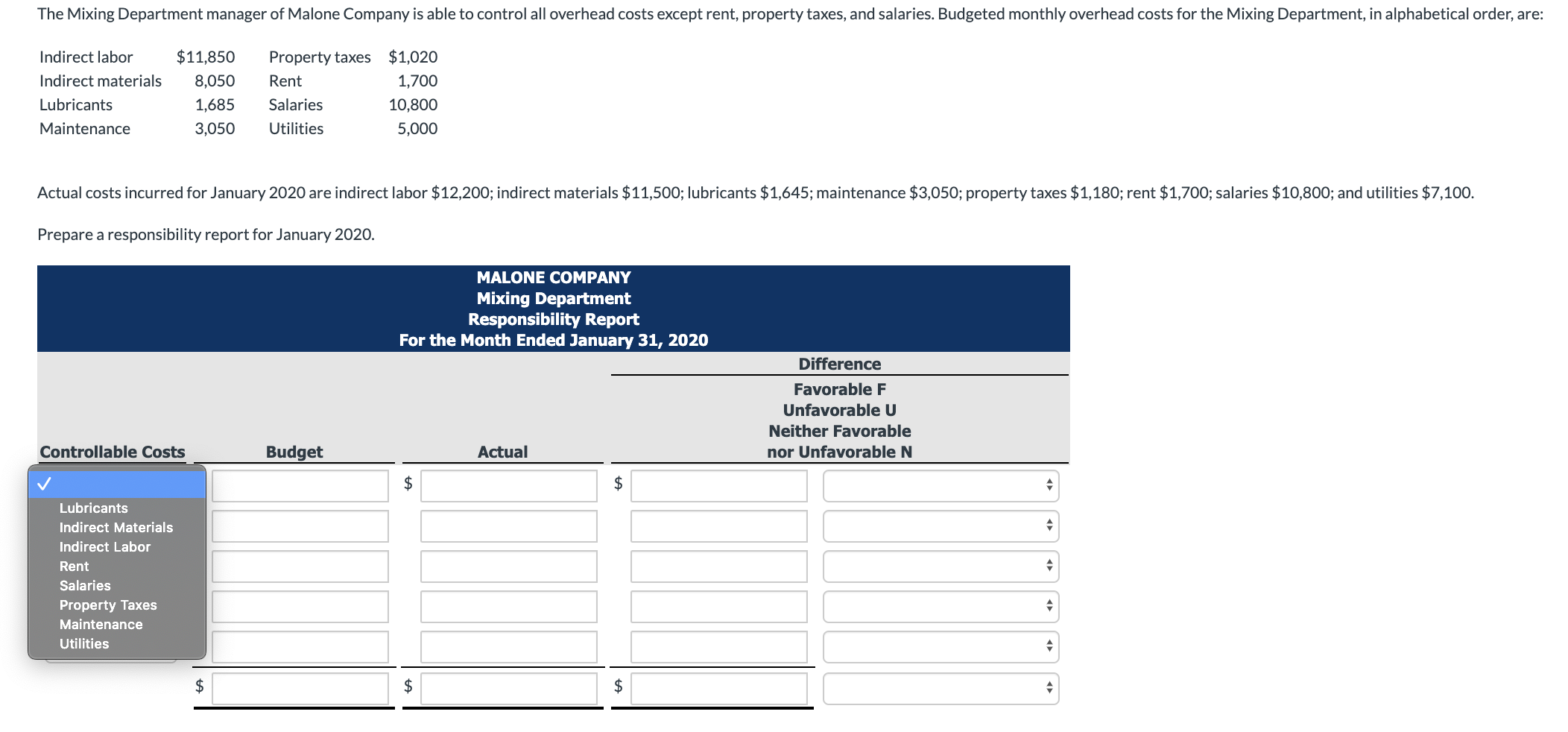

The Mixing Department manager of Malone Company is able to control all overhead costs except rent, property taxes, and salaries. Budgeted monthly overhead costs for the Mixing Department, in alphabetical order, are: Indirect labor Indirect materials Lubricants Maintenance $11,850 8,050 1,685 3,050 Property taxes $1,020 Rent 1,700 Salaries 10,800 Utilities 5,000 Actual costs incurred for January 2020 are indirect labor $12,200; indirect materials $11,500; lubricants $1,645; maintenance $3,050; property taxes $1,180; rent $1,700; salaries $10,800; and utilities $7,100. Prepare a responsibility report for January 2020. MALONE COMPANY Mixing Department Responsibility Report For the Month Ended January 31, 2020 Difference Favorable F Unfavorable U Neither Favorable nor Unfavorable N Controllable Costs Budget Actual Lubricants Indirect Materials Indirect Labor Rent Salaries Property Taxes Maintenance Utilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts