Question: If you use handwriting, please write it clearly. But I prefer answers in typing. Encik Fahmi, 54 years old is a Malaysian tax resident for

If you use handwriting, please write it clearly.

But I prefer answers in typing.

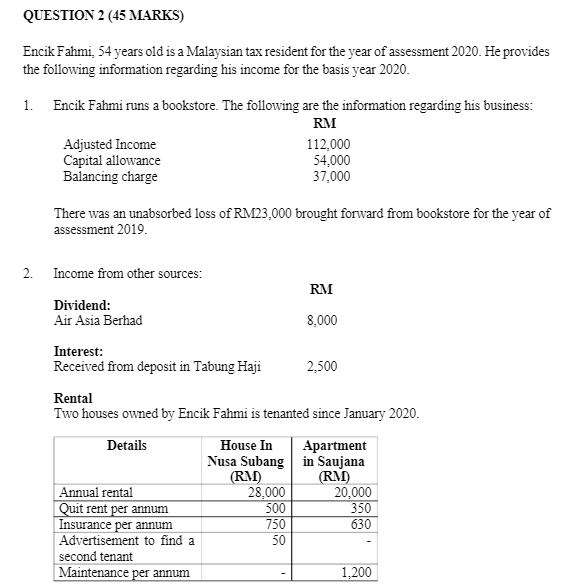

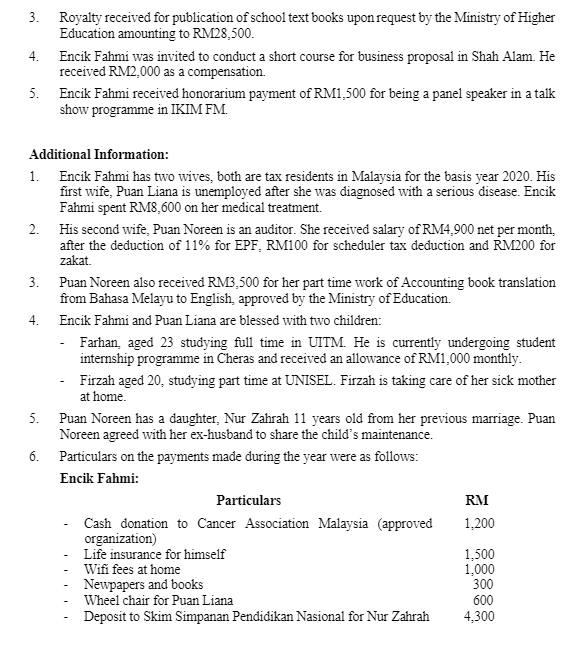

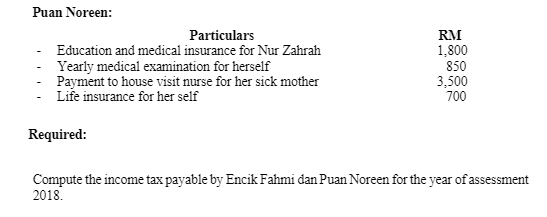

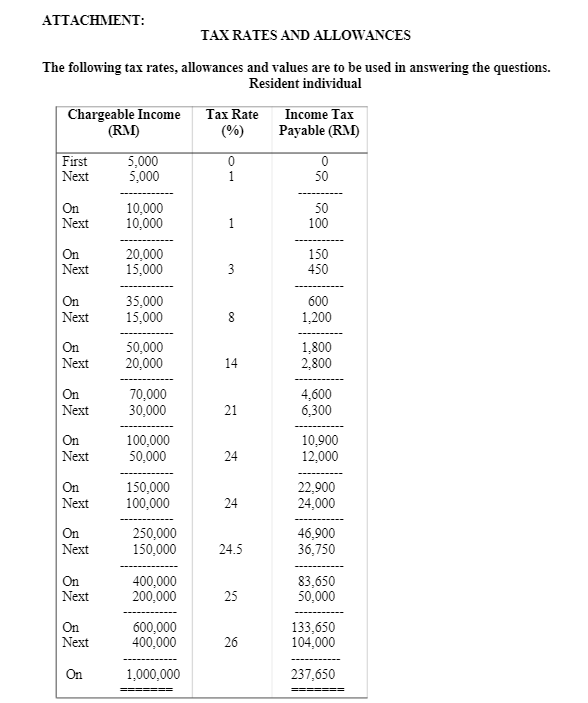

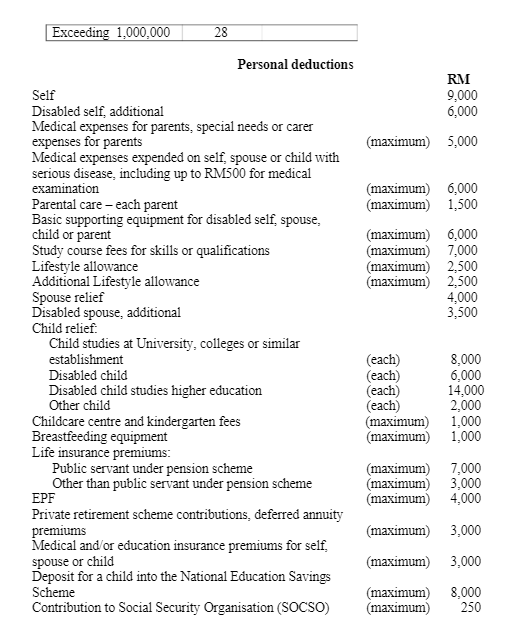

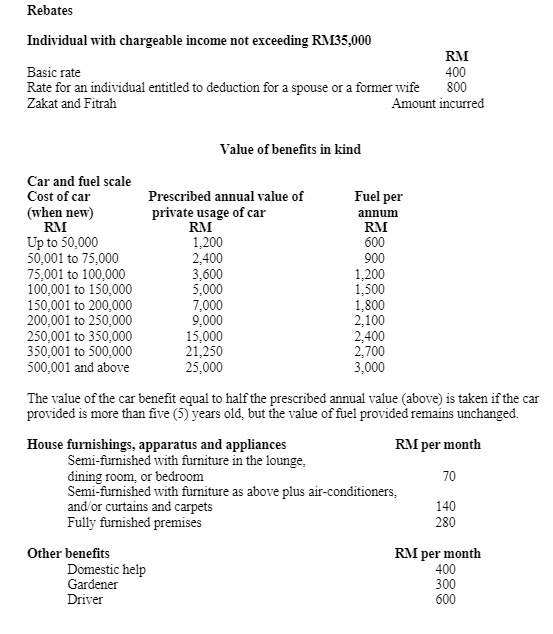

Encik Fahmi, 54 years old is a Malaysian tax resident for the year of assessment 2020 . He provides the following information regarding his income for the basis year 2020. 1. Encik Fahmi runs a bookstore. The following are the information regarding his business: There was an unabsorbed loss of RM23,000 brought forward from bookstore for the year of assessment 2019. 2. Rental Two houses owned by Encik Fahmi is tenanted since January 2020. 3. Royalty received for publication of school text books upon request by the Ministry of Higher Education amounting to RM28,500. 4. Encik Fahmi was invited to conduct a short course for business proposal in Shah Alam. He received RM2,000 as a compensation. 5. Encik Fahmi received honorarium payment of RM1,500 for being a panel speaker in a talk show programme in IKIM FM. Additional Information: 1. Encik Fahmi has two wives, both are tax residents in Malaysia for the basis year 2020. His first wife, Puan Liana is unemployed after she was diagnosed with a serious disease. Encik Fahmi spent RM8,600 on her medical treatment. 2. His second wife, Puan Noreen is an auditor. She received salary of RM4,900 net per month, after the deduction of 11% for EPF, RM100 for scheduler tax deduction and RM200 for zakat. 3. Puan Noreen also received RM3,500 for her part time work of Accounting book translation from Bahasa Melayu to English, approved by the Ministry of Education. 4. Encik Fahmi and Puan Liana are blessed with two children: - Farhan, aged 23 studying full time in UITM. He is currently undergoing student internship programme in Cheras and received an allowance of RM1,000 monthly. - Firzah aged 20, studying part time at UNISEL. Firzah is taking care of her sick mother at home. 5. Puan Noreen has a daughter, Nur Zahrah 11 years old from her previous marriage. Puan Noreen agreed with her ex-husband to share the child's maintenance. 6. Particulars on the payments made during the year were as follows: Encik Fahmi: Compute the income tax payable by Encik Fahmi dan Puan Noreen for the year of assessment 2018. The following tax rates, allowances and values are to be used in answering the questions. Resident individual \begin{tabular}{|l|l|} \hline Exceeding 1,000,000 & 28 \\ \hline \end{tabular} Personal deductions Individual with chargeable income not exceeding RM35,000 BasicrateRateforanindividualentitledtodeductionforaspouseoraformerwife400800 Zakat and Fitrah Amount incurred Value of benefits in kind The value of the car benefit equal to half the prescribed annual value (above) is taken if the car provided is more than five (5) years old, but the value of fuel provided remains unchanged. Encik Fahmi, 54 years old is a Malaysian tax resident for the year of assessment 2020 . He provides the following information regarding his income for the basis year 2020. 1. Encik Fahmi runs a bookstore. The following are the information regarding his business: There was an unabsorbed loss of RM23,000 brought forward from bookstore for the year of assessment 2019. 2. Rental Two houses owned by Encik Fahmi is tenanted since January 2020. 3. Royalty received for publication of school text books upon request by the Ministry of Higher Education amounting to RM28,500. 4. Encik Fahmi was invited to conduct a short course for business proposal in Shah Alam. He received RM2,000 as a compensation. 5. Encik Fahmi received honorarium payment of RM1,500 for being a panel speaker in a talk show programme in IKIM FM. Additional Information: 1. Encik Fahmi has two wives, both are tax residents in Malaysia for the basis year 2020. His first wife, Puan Liana is unemployed after she was diagnosed with a serious disease. Encik Fahmi spent RM8,600 on her medical treatment. 2. His second wife, Puan Noreen is an auditor. She received salary of RM4,900 net per month, after the deduction of 11% for EPF, RM100 for scheduler tax deduction and RM200 for zakat. 3. Puan Noreen also received RM3,500 for her part time work of Accounting book translation from Bahasa Melayu to English, approved by the Ministry of Education. 4. Encik Fahmi and Puan Liana are blessed with two children: - Farhan, aged 23 studying full time in UITM. He is currently undergoing student internship programme in Cheras and received an allowance of RM1,000 monthly. - Firzah aged 20, studying part time at UNISEL. Firzah is taking care of her sick mother at home. 5. Puan Noreen has a daughter, Nur Zahrah 11 years old from her previous marriage. Puan Noreen agreed with her ex-husband to share the child's maintenance. 6. Particulars on the payments made during the year were as follows: Encik Fahmi: Compute the income tax payable by Encik Fahmi dan Puan Noreen for the year of assessment 2018. The following tax rates, allowances and values are to be used in answering the questions. Resident individual \begin{tabular}{|l|l|} \hline Exceeding 1,000,000 & 28 \\ \hline \end{tabular} Personal deductions Individual with chargeable income not exceeding RM35,000 BasicrateRateforanindividualentitledtodeductionforaspouseoraformerwife400800 Zakat and Fitrah Amount incurred Value of benefits in kind The value of the car benefit equal to half the prescribed annual value (above) is taken if the car provided is more than five (5) years old, but the value of fuel provided remains unchanged

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts