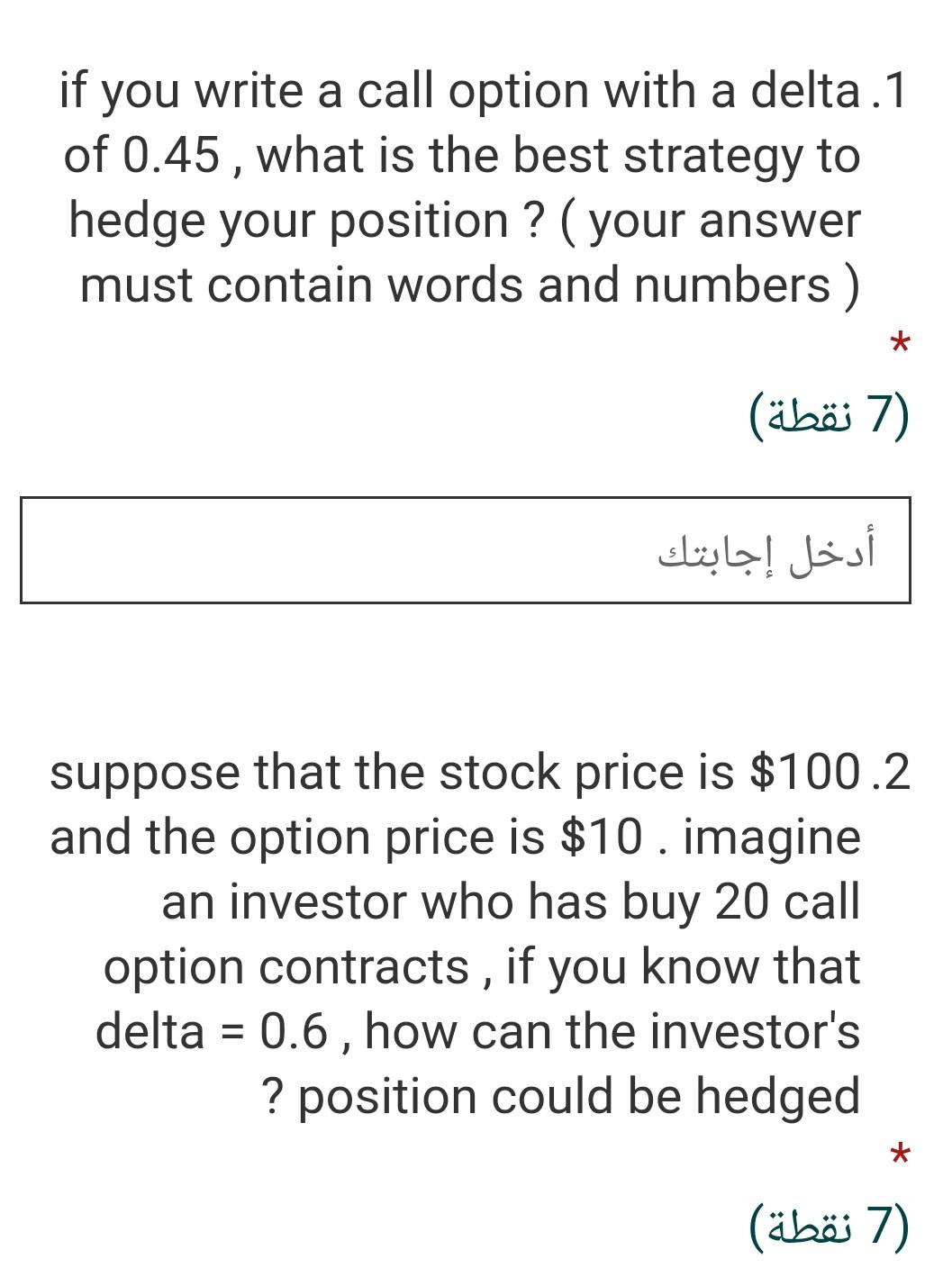

Question: if you write a call option with a delta .1 of 0.45, what is the best strategy to hedge your position ? (your answer must

if you write a call option with a delta .1 of 0.45, what is the best strategy to hedge your position ? (your answer must contain words and numbers ) * (7 ) suppose that the stock price is $100.2 and the option price is $10.imagine an investor who has buy 20 call option contracts, if you know that delta = 0.6, how can the investor's ? position could be hedged (7 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts