Question: Old MathJax webview if you bought a call option with a .5 delta of 0.45, what is the best strategy to hedge your position ?

Old MathJax webview

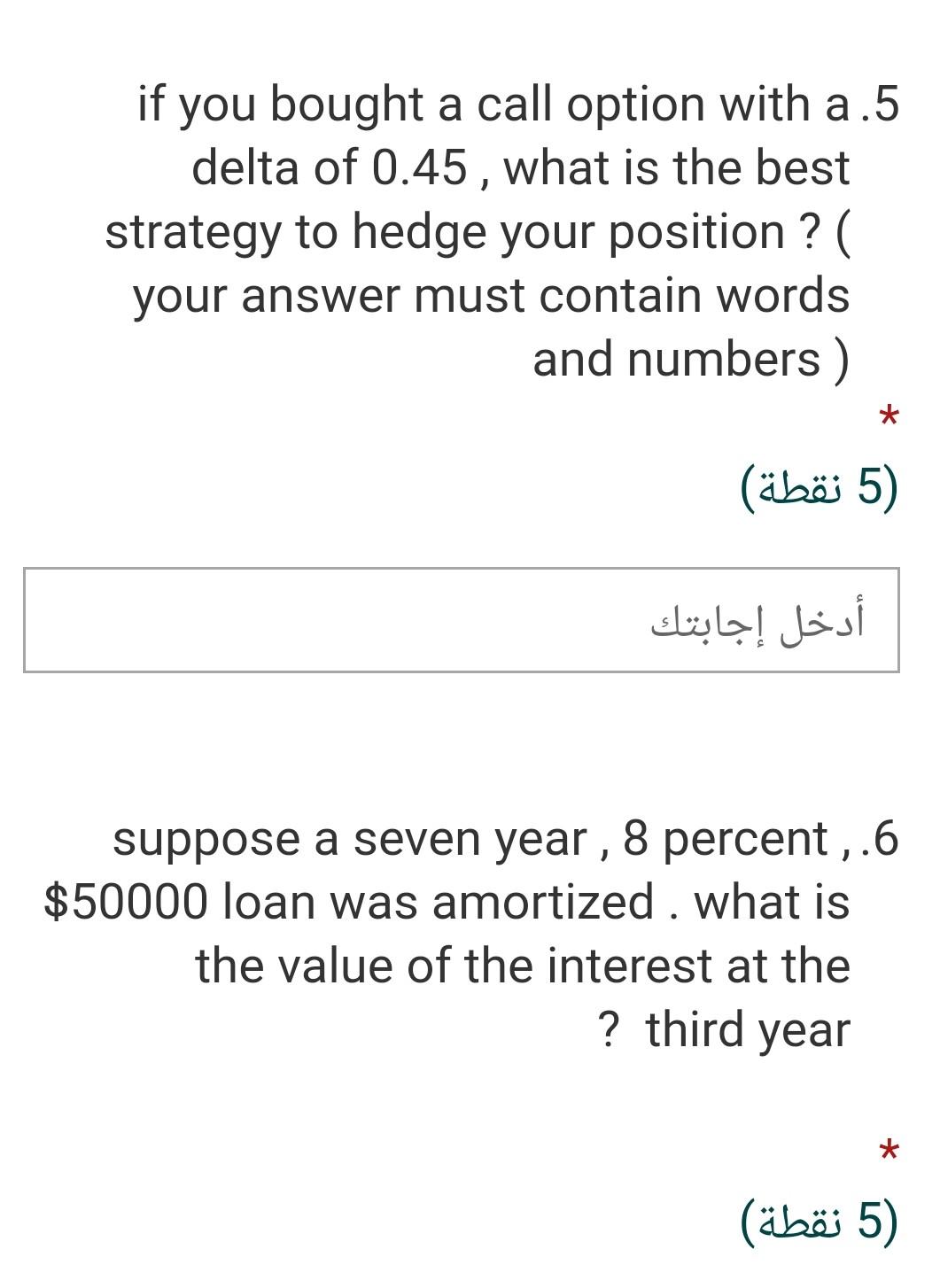

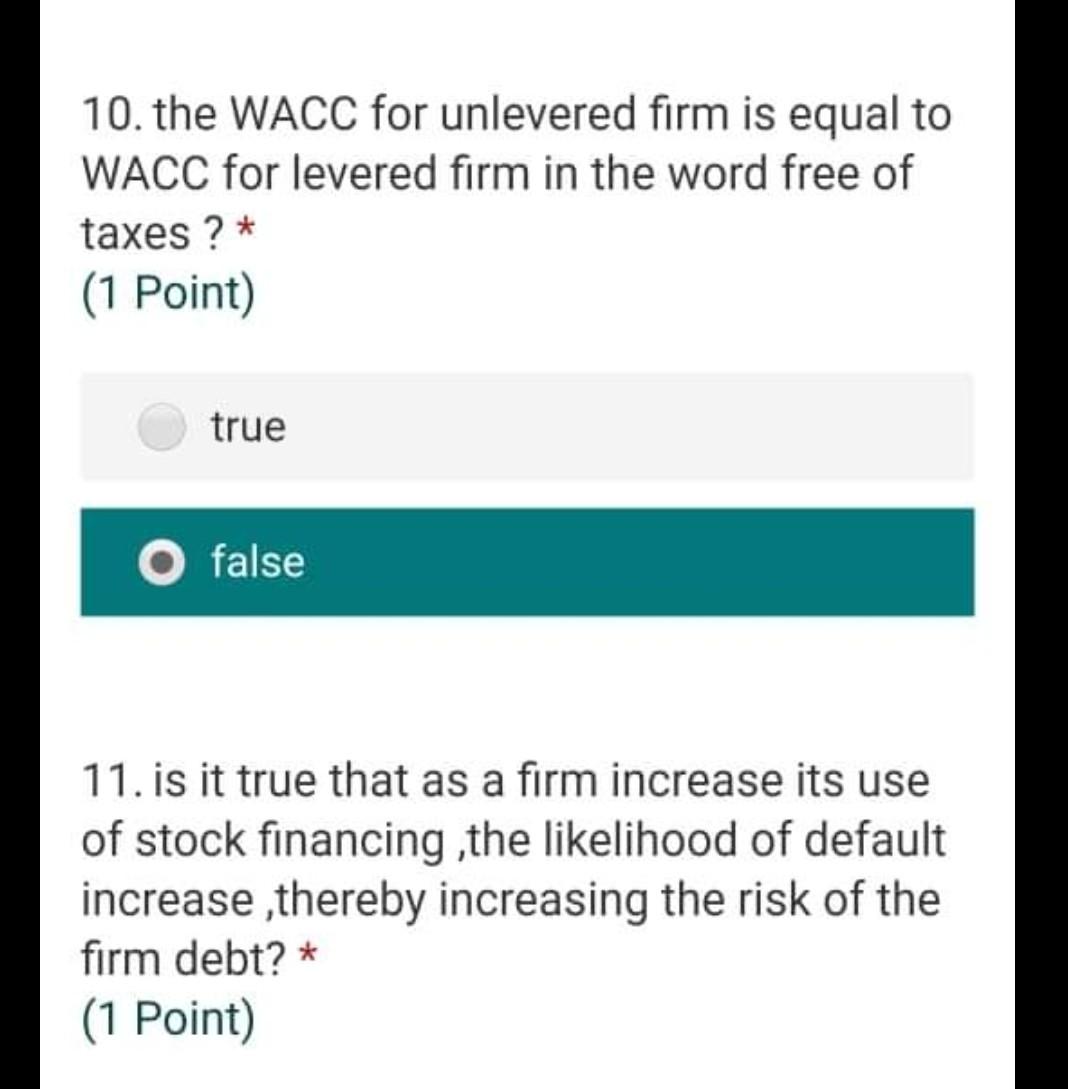

if you bought a call option with a .5 delta of 0.45, what is the best strategy to hedge your position ? ( your answer must contain words and numbers ) (5 ) suppose a seven year , 8 percent ,.6 $50000 loan was amortized . what is the value of the interest at the ? third year (5 ) 10. the WACC for unlevered firm is equal to WACC for levered firm in the word free of taxes? * (1 Point) true false 11. is it true that as a firm increase its use of stock financing the likelihood of default increase thereby increasing the risk of the firm debt? * (1 Point)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock