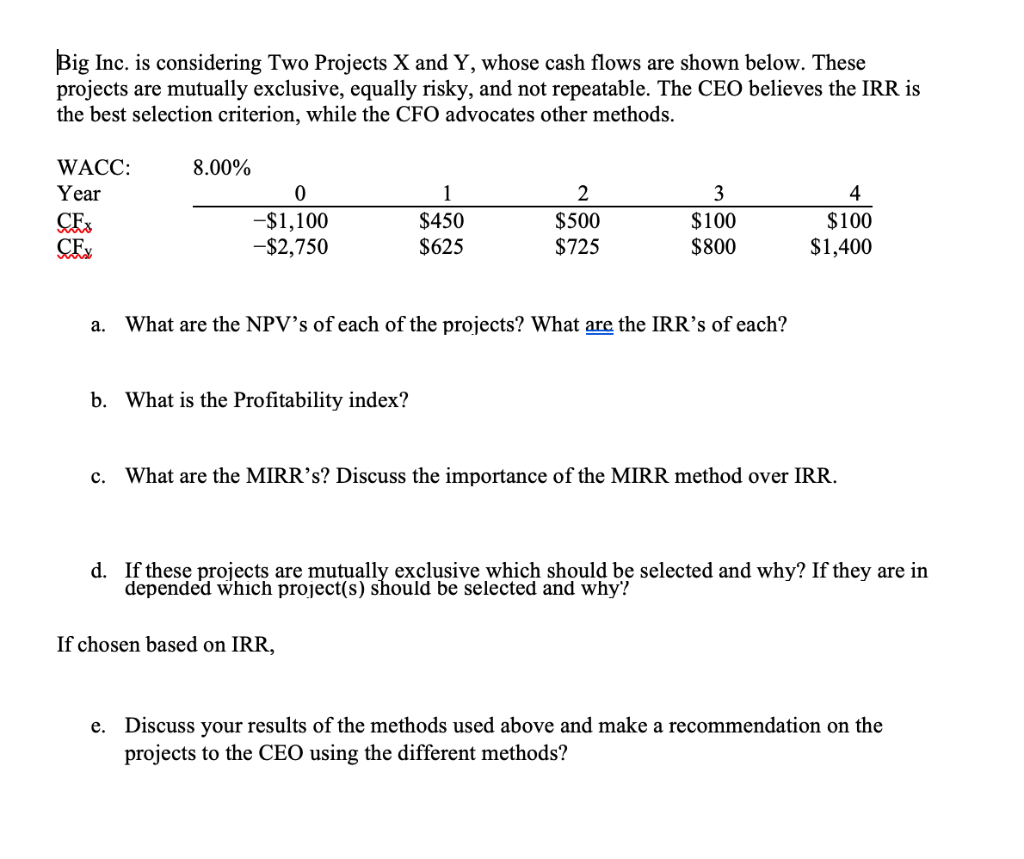

Question: ig Inc. is considering Two Projects X and Y, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable.

ig Inc. is considering Two Projects X and Y, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates other methods 8.00% WACC: Y ear CE 4 $100 $1,100 $2,750 $450 $625 $500 $725 S100 $800 $1,400 a. What are the NPV's of each of the projects? What are the IRR's of each? b. What is the Profitability index? c. What are the MIRR's? Discuss the importance of the MIRR method over IRR d. If these projects are mutually exclusive which should be selected and why? If they are in depended which project(s) should be selected and why If chosen based on IRR Discuss vour results of the methods used above and make a recommendation on the projects to the CEO using the different methods? e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts