Question: Really stuck on this question! Needs to be done by 2pm! 19) (10 pts) Tally World, Inc. sales are expected to increase by 25% from

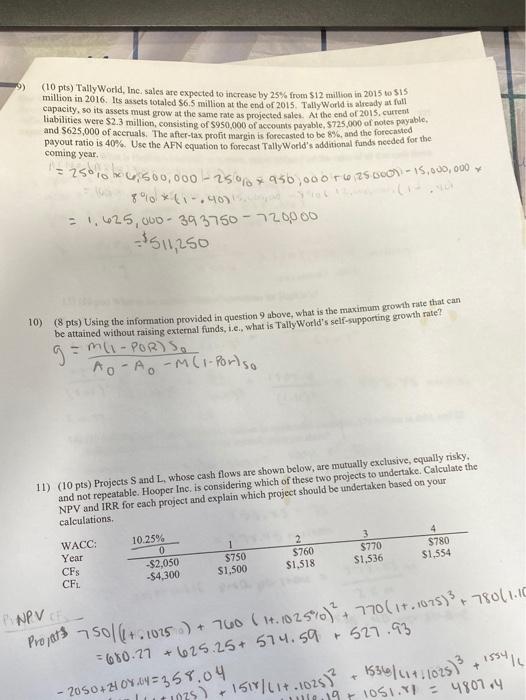

19) (10 pts) Tally World, Inc. sales are expected to increase by 25% from $12 million in 2015 0 SS million in 2016. Its assets totaled $6.5 million at the end of 2015. Tally World is already strane capacity, so its assets must grow at the same rate as projected sales. At the end of 2015.cuter notes payable, and 5625,000 of accruals. The after-tax profit margin is forecasted to be 8%, and the forecast payout ratio is 40%. Use the AFN equation to forecast Tally World's additional funds needed for the coming year. = 2510,500,000 - 250 950,000 625.00 - 15.000.000 *(1.40) = 1,625,000 - 393750 - 720000 $511,250 10) (8 pts) Using the information provided in question above, what is the maximum growth rate that can be attained without raising external funds, ie, what is Tally World's self-supporting growth rate? 9 -ml-PORDS. AO-AO-M (1-porlso 11) (10 pts) Projects S and L, whose cash flows are shown below, are mutually exclusive, equally risky. and not repeatable. Hooper Inc. is considering which of these two projects to undertake. Calculate the NPV and IRR for each project and explain which project should be undertaken based on your calculations 10.25% 0 -$2,050 -$4,300 WACC: Year CFs CFL 1 $750 $1,500 3 $770 $1,536 $760 $1,518 $780 $1,554 PINPV Projets 7501(+- 1015) + 760 ( 11.102510 + 770/17, 1075)3 + 78011.10 = 680.27 +625.25 +574.59 +527.93 - 2050+1 0.09 = 358.04 1075) 150(17.1025) + K36414.10251? + 155414 9 + 1051 .: 4807.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts