Question: ignore the selected answer for the first question, and yes I am aware the last part of the second question is cut off, but it

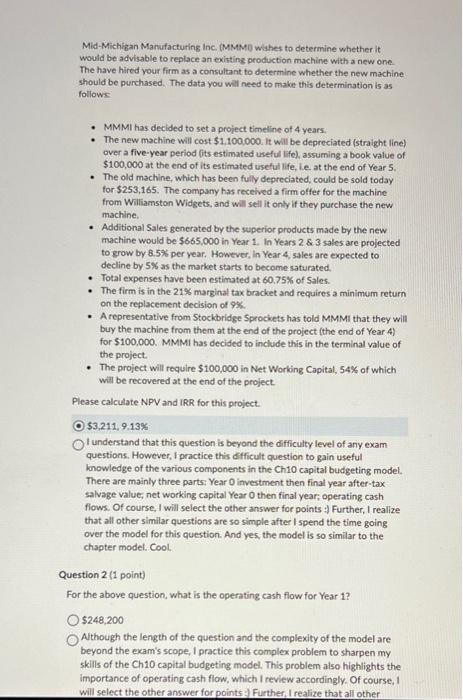

would be advisable to replace an existing production machine with a new one. The have hired your firm as a consultant to determine whether the new machine should be purchased. The data you will need to make this determination is as followe - MMMI has decided to set a project timeline of 4 years. - The new machine will cost \$1.100,000. it will be depreciated (straight line) over a five-year period (its estimated useful life), assuming a book value of $100,000 at the end of its estimated useful life, le at the end of Year 5 . - The old machine, which has been fuily depreciated, could be sold today for $253,165. The company has recelved a firm offer for the machine from Wiliamston Widgets, and will sell it only it they purchase the new machlne. - Additional Sales generated by the superior products made by the new machine would be $665,000 in Year 1 . In Years 2.83 sales are projected to grow by 8.5% per year. However, in Year 4,5a les are expected to decline by 5% as the market starts to become saturated. - Total expenses have been estimated at 60.75% of Sales. - The firm is in the 219 marginal tax bracket and requires a minimum return on the replacement decision of 952 . - A representative from Stockbridge Sprockets has told MMMI that they will buy the machine from them at the end of the project (the end of Year 4 ) for $100,000. MMMI has decided to include this in the terminal value of the project. - The project will require $100,000 in Net Working Capital, 54% of which will be recovered at the end of the project. Piease calculate NPV and IRR for this project. $3,211,9,13% I understand that this question is beyond the difficulty level of any exam questions. However, I practice this difficult question to gain useful knowledge of the various components in the Ch10 capital budgeting model. There are mainly three parts; Year 0 investment then final year after-tax salvage value, net working capital Year 0 then final year; operating cash flows. Of course, I will select the other answer for points : Further, I realize that all other similar questions are so simple after I spend the time going over the model for this question. And yes, the model is so similar to the chapter model. Cool. Question 2 (1 point) For the above question, what is the operating cash flow for Year 1? $248,200 Although the length of the question and the complexity of the model are beyond the exam's scope, I practice this complex problem to sharpen my skills of the Ch10 capital budgeting model. This problem also highlights the importance of operating cash flow, which I review accordingly. Of course, I will select the other answer for points 1 Further. I realize that all other

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts