Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ii. 111. The balance sheets of Maple Ltd. and Leafs Ltd. on December 30, 2020 were as follows. Cash and receivable Maple $ 96,000

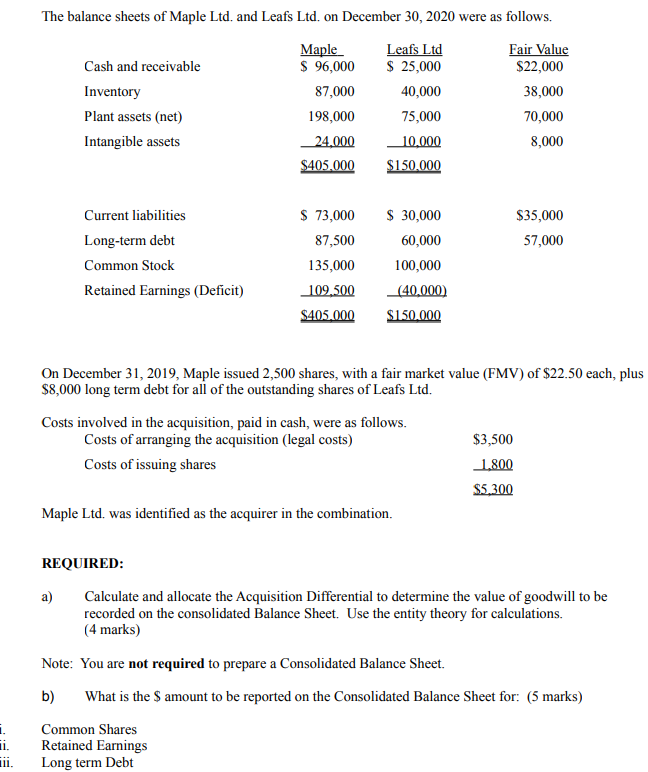

ii. 111. The balance sheets of Maple Ltd. and Leafs Ltd. on December 30, 2020 were as follows. Cash and receivable Maple $ 96,000 Leafs Ltd Fair Value $ 25,000 $22,000 Inventory 87,000 40,000 38,000 Plant assets (net) 198,000 75,000 70,000 Intangible assets 24,000 10,000 8,000 $405.000 $150,000 Current liabilities $ 73,000 $ 30,000 $35,000 Long-term debt 87,500 60,000 57,000 Common Stock 135,000 100,000 Retained Earnings (Deficit) 109,500 (40,000) $405,000 $150,000 On December 31, 2019, Maple issued 2,500 shares, with a fair market value (FMV) of $22.50 each, plus $8,000 long term debt for all of the outstanding shares of Leafs Ltd. Costs involved in the acquisition, paid in cash, were as follows. Costs of arranging the acquisition (legal costs) Costs of issuing shares Maple Ltd. was identified as the acquirer in the combination. $3,500 1,800 $5,300 REQUIRED: a) Calculate and allocate the Acquisition Differential to determine the value of goodwill to be recorded on the consolidated Balance Sheet. Use the entity theory for calculations. (4 marks) Note: You are not required to prepare a Consolidated Balance Sheet. b) What is the $ amount to be reported on the Consolidated Balance Sheet for: (5 marks) Common Shares Retained Earnings Long term Debt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started