Question: ii. Component sets price and usage variance iii. Labour rate and efficiency variance iv. Variable production expenditure and efficiency variance v. Fixed production expenditure and

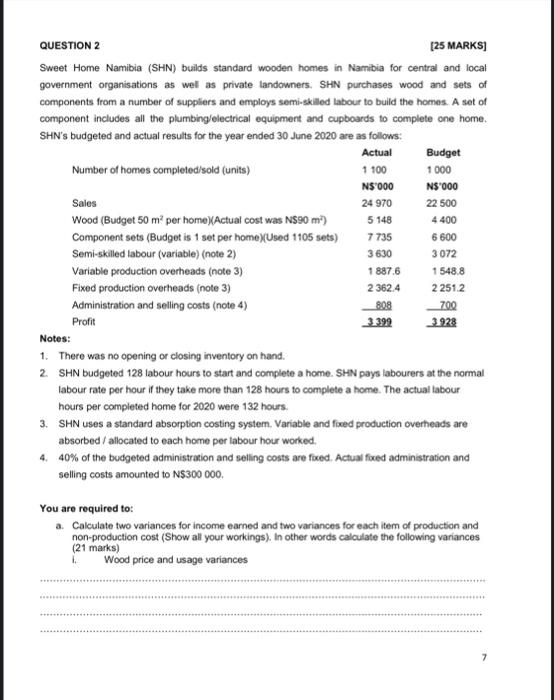

QUESTION 2 [25 MARKS Sweet Home Namibia (SHN) builds standard wooden homes in Namibia for central and local government organisations as well as private landowners. SHN purchases wood and sets of components from a number of suppliers and employs semi-skilled labour to build the homes. A set of component includes all the plumbing electrical equipment and cupboards to complete one home. SHN's budgeted and actual results for the year ended 30 June 2020 are as follows: Actual Budget Number of homes completed sold (units) 1 100 1000 NS 000 NS"000 Sales 24 970 22 500 Wood (Budget 50 m per home)Actual cost was N$90 m) 5 148 4 400 Component sets (Budget is 1 set per home)(Used 1105 sets) 7735 6600 Semi-skilled labour (variable) (note 2) 3630 3072 Variable production overheads (note 3) 1887.6 1 548,8 Fixed production overheads (note 3) 2 362.4 2 251.2 Administration and selling costs (note 4) 808 700 Profit 3399 3.928 Notes: 1. There was no opening or closing inventory on hand. 2. SHN budgeted 128 labour hours to start and complete a home. SHN pays labourers at the normal labour rate per hour if they take more than 128 hours to complete a home. The actual labour hours per completed home for 2020 were 132 hours. 3. SHN uses a standard absorption costing system. Variable and fixed production overheads are absorbed / allocated to each home per labour hour worked. 4. 40% of the budgeted administration and selling costs are fixed. Actual foced administration and selling costs amounted to N$300 000 You are required to: a. Calculate two variances for income earned and two variances for each item of production and non-production cost (Show all your workings). In other words calculate the following variances (21 marks) Wood price and usage variances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts