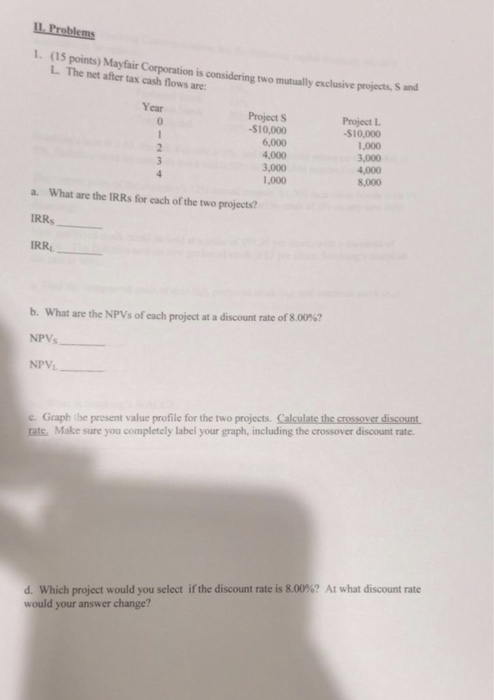

Question: II. Problems 1. (15 points) Mayfair Corporation is considering two mutually exclusive projects, S and L. The net after tax cash flows are: Year Project

II. Problems 1. (15 points) Mayfair Corporation is considering two mutually exclusive projects, S and L. The net after tax cash flows are: Year Project S -$10,000 6,000 4,000 3,000 1,000 Project L -$10,000 1,000 3,000 4,000 8,000 a. What are the IRRs for each of the two projects? IRRs RRI_ b, what are the NPVs of each project at a discount rate of 800%? NPVs- c. Graph the present value profile for the two projects. Calculate the crossover discount tats. Make sure you completely label your graph, including the crossover discount rate. d, which project would you select if the discount rate is 8.00%? At what discount rate would your answer change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts