Question: ii. Question 26.4 Create a new PDF document if you choose to answer this question, put your Student ID at the top of each page

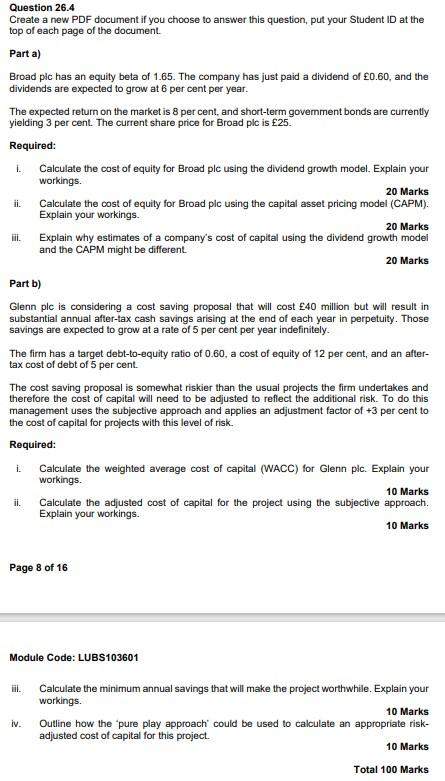

ii. Question 26.4 Create a new PDF document if you choose to answer this question, put your Student ID at the top of each page of the document. Parta) Broad pic has an equity beta of 1.65. The company has just paid a dividend of 0.60, and the dividends are expected to grow at 6 per cent per year. The expected return on the market is 8 per cent, and short-term government bonds are currently yielding 3 per cent. The current share price for Broad plc is 25. Required: 1. Calculate the cost of equity for Broad plc using the dividend growth model. Explain your workings. 20 Marks Calculate the cost of equity for Broad plc using the capital asset pricing model (CAPM). Explain your workings. 20 Marks Explain why estimates of a company's cost of capital using the dividend growth model and the CAPM might be different 20 Marks Part b) Glenn plc is considering a cost saving proposal that will cost 40 million but will result in substantial annual after-tax cash savings arising at the end of each year in perpetuity. Those savings are expected to grow at a rate of 5 per cent per year indefinitely The firm has a target debt-to-equity ratio of 0.60, a cost of equity of 12 per cent, and an after- tax cost of debt of 5 per cent. The cost saving proposal is somewhat riskier than the usual projects the firm undertakes and therefore the cost of capital will need to be adjusted to reflect the additional risk. To do this management uses the subjective approach and applies an adjustment factor of +3 per cent to the cost of capital for projects with this level of risk. Required: i. Calculate the weighted average cost of capital (WACC) for Glenn plc. Explain your workings. Calculate the adjusted cost of capital for the project using the subjective approach. Explain your workings. 10 Marks 10 Marks ii. Page 8 of 16 Module Code: LUBS103601 Calculate the minimum annual savings that will make the project worthwhile. Explain your workings. 10 Marks Outline how the pure play approach could be used to calculate an appropriate risk- adjusted cost of capital for this project. 10 Marks iv. Total 100 Marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts