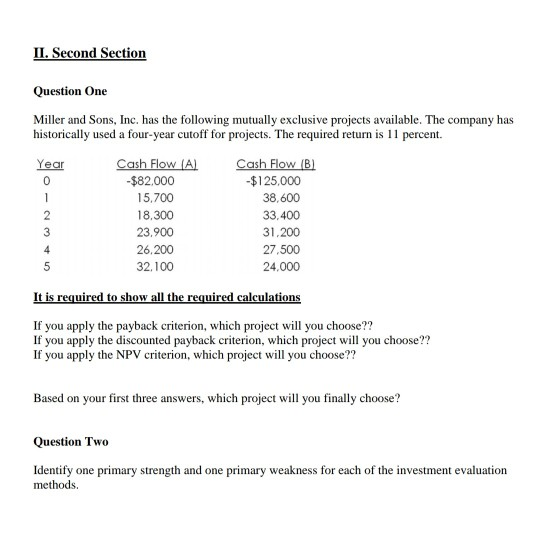

Question: II. Second Section Question One Miller and Sons, Inc. has the following mutually exclusive projects available. The company has historically used a four-year cutoff for

II. Second Section Question One Miller and Sons, Inc. has the following mutually exclusive projects available. The company has historically used a four-year cutoff for projects. The required return is 11 percent. Year Cash Flow (A) Cash Flow (B) 0 -$82,000 -$125,000 15.700 38,600 18.300 33.400 23.900 31.200 26,200 27.500 5 32.100 24.000 1 2 3 4 It is required to show all the required calculations If you apply the payback criterion, which project will you choose?? If you apply the discounted payback criterion, which project will you choose?? If you apply the NPV criterion, which project will you choose?? Based on your first three answers, which project will you finally choose? Question Two Identify one primary strength and one primary weakness for each of the investment evaluation methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts