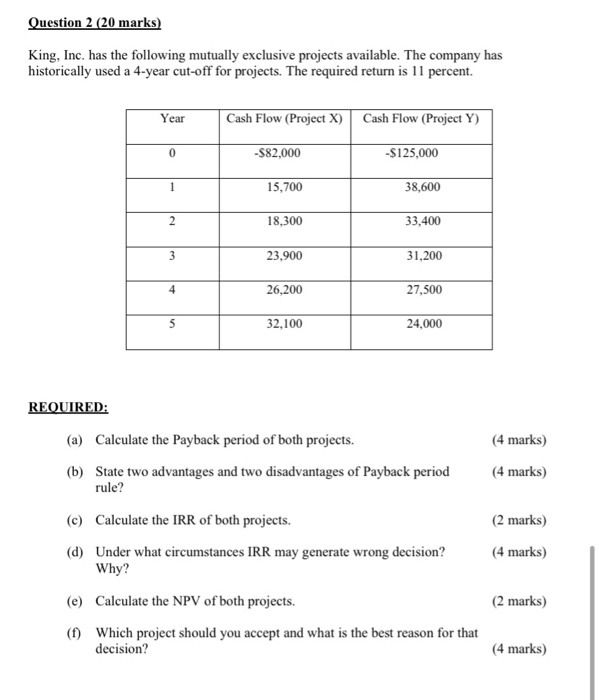

Question: Question 2 (20 marks) King, Inc. has the following mutually exclusive projects available. The company has historically used a 4-year cut-off for projects. The required

Question 2 (20 marks) King, Inc. has the following mutually exclusive projects available. The company has historically used a 4-year cut-off for projects. The required return is 11 percent. Year Cash Flow (Project X) Cash Flow (Project Y) -582,000 -$125,000 15,700 38,600 18,300 33,400 23,900 31,200 26,200 27,500 32,100 24,000 REQUIRED: (a) Calculate the Payback period of both projects. (4 marks) (b) State two advantages and two disadvantages of Payback period rule? (4 marks) (c) Calculate the IRR of both projects. (2 marks) (4 marks) (d) Under what circumstances IRR may generate wrong decision? Why? (e) Calculate the NPV of both projects. (2 marks) (1) Which project should you accept and what is the best reason for that decision? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts