Question: II. SELECT THE BEST ANSWER (60 points) 1. Generally accepted accounting principles require that certain lease agreements be accounted for its purchases. The theoretical basis

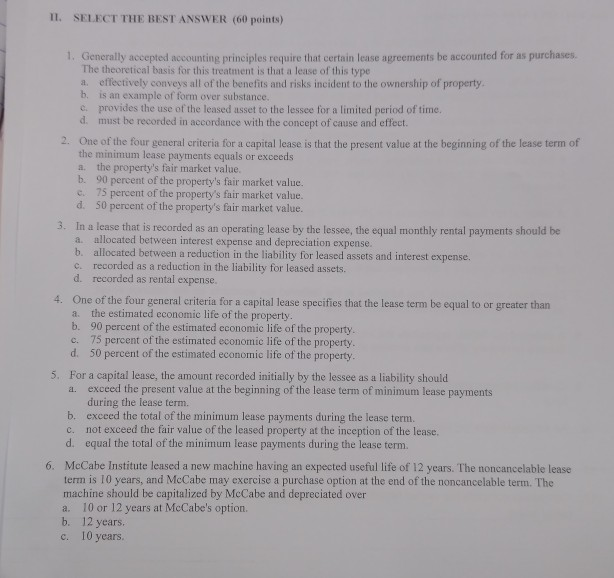

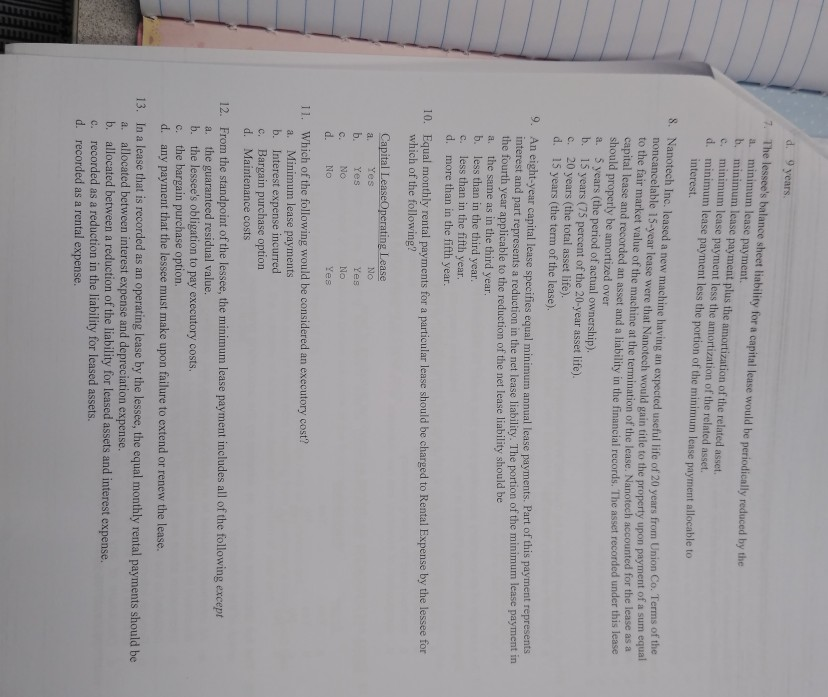

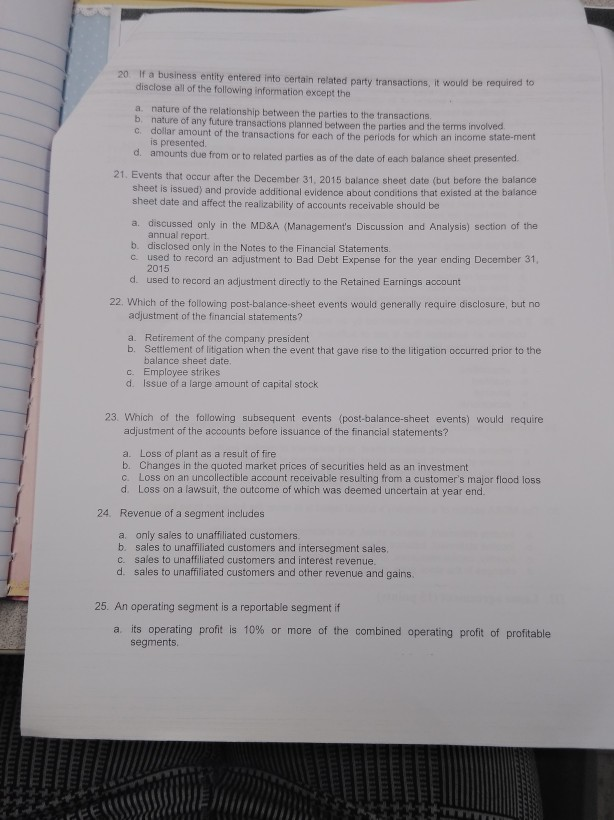

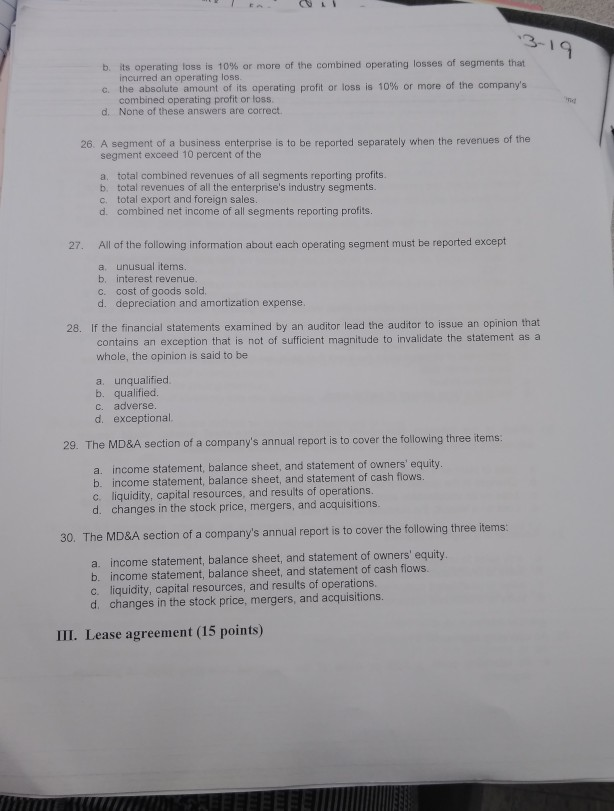

II. SELECT THE BEST ANSWER (60 points) 1. Generally accepted accounting principles require that certain lease agreements be accounted for its purchases. The theoretical basis for this treatment is that a lease of this type a effectively conveys all of the benefits and risks incident to the ownership of property b is an example of form over substance. e provides the use of the leased asset to the lessee for a limited period of time. d. must be recorded in accordance with the concept of cause and effect. 2. One of the four general criteria for a capital lease is that the present value at the beginning of the lease term of the minimum lease payments equals or exceeds a the property's fair market value. b. 90 percent of the property's fair market value. 75 percent of the property's fair market value. d. 50 percent of the property's fair market value. 3. In a lease that is recorded as an operating lease by the lessee, the equal monthly rental payments should be a allocated between interest expense and depreciation expense. b. allocated between a reduction in the liability for leased assets and interest expense. c. recorded as a reduction in the liability for leased assets. d recorded as rental expense. 4. One of the four general criteria for a capital lease specifies that the lease term be equal to or greater than a. the estimated economic life of the property. b. 90 percent of the estimated economic life of the property. c. 75 percent of the estimated economic life of the property. d. 50 percent of the estimated economic life of the property. 5For a capital lease, the amount recorded initially by the lessee as a liability should a exceed the present value at the beginning of the lease term of minimum lease payments during the lease term. b. exceed the total of the minimum lense payments during the lease term. c. not exceed the fair value of the leased property at the inception of the lease. d. equal the total of the minimum lease payments during the lease term. 6. McCabe Institute leased a new machine having an expected useful life of 12 years. The noncancelable lease term is 10 years, and McCabe may exercise a purchase option at the end of the noncancelable term. The machine should be capitalized by McCabe and depreciated over a. 10 or 12 years at McCabe's option b. 12 years. C. 10 years. d. 9 years The lessee's balance sheet liability for a capital lease would be periodically reduced by the a minimum lease payment. b. minimum lease payment plus the amortization of the related asset. e minimum lease payment less the amortization of the related asset. d. minimum lease payment less the portion of the minimum lease payment allocable to interest. Nanotech Inc. leased a new machine having an expected useful life of 20 years from Union Co. cancelable 15-year lease were that Nanotech would gain title to the property upon payment of a sum de tal market value of the machine at the termination of the lease. Nanotech accounted for the case capital teuse and recorded an asset and a liability in the financial records. The asset recorded under this should properly be amortized over a. 5 years (the period of actual ownership). b. 15 years (75 percent of the 20-year asset life). c. 20 years (the total asset life). d. 15 years the term of the lease). An eight-year capital lease specifies equal minimum annual lease payments. Part of this payment represents interest and part represents a reduction in the net lease liability. The portion of the minimum lease payment in the fourth year applicable to the reduction of the net lease liability should be a. the same as in the third year. b less than in the third year. c. less than in the fifth year. d. more than in the fifth year. 10. Equal monthly rental payments for a particular lease should be charged to Rental Expense by the lessee for which of the following? Capital LeaseOperating Lease a. TOS No b. Yes Yes c. NO No d. No Yes 11. Which of the following would be considered an executory cost? a. Minimum lease payments b. Interest expense incurred c. Bargain purchase option d. Maintenance costs 12. From the standpoint of the lessee, the minimum lease payment includes all of the following except a. the guaranteed residual value. b. the lessee's obligation to pay executory costs. c. the bargain purchase option. d. any payment that the lessee must make upon failure to extend or renew the lease. 13. In a lease that is recorded as an operating lease by the lessee, the equal monthly rental payments should be a. allocated between interest expense and depreciation expense. b. allocated between a reduction of the liability for leased assets and interest expense. c. recorded as a reduction in the liability for leased assets. d. recorded as a rental expense. 20 Ia business entity entered into certain related party transactions, it would be required to disclose all of the following information except the a nature of the relationship between the parties to the transactions b. nature of any future transactions planned between the parties and the terms involved C dollar amount of the transactions for each of the periods for which an income state-ment is presented d amounts due from or to related parties as of the date of och balance sheet presented 21. Events that occur after the December 31 2015 balance sheet date (but before the balance sheet is issued) and provide additional evidence about conditions that existed at the balance sheet date and affect the realizability of accounts receivable should be a. discussed only in the MD&A (Management's Discussion and Analysis) section of the annual report b. disclosed only in the Notes to the Financial Statements c used to record an adjustment to Bad Debt Expense for the year ending December 31 2015 d. used to record an adjustment directly to the Retained Earnings account 22. Which of the following post-balance sheet events would generally require disclosure, but no adjustment of the financial statements? a. Retirement of the company president b. Settlement of litigation when the event that gave rise to the litigation occurred prior to the balance sheet date. C Employee strikes d. Issue of a large amount of capital stock 23. Which of the following subsequent events (post-balance sheet events) would require adjustment of the accounts before issuance of the financial statements? C a. Loss of plant as a result of fire b. Changes in the quoted market prices of securities held as an investment Loss on an uncollectible account receivable resulting from a customer's major flood loss d Loss on a lawsuit, the outcome of which was deemed uncertain at year end. 24. Revenue of a segment includes a only sales to unaffiliated customers. b. sales to unaffiliated customers and intersegment sales c. sales to unaffiliated customers and interest revenue. d. sales to unaffiliated customers and other revenue and gains 25. An operating segment is a reportable segment if a its operating profit is 10% or more of the combined operating profit of profitable segments 13-19 b. its operating loss is 10% or more of the combined operating losses of segments that incurred an operating loss. the absolute amount of its operating profit or loss is 10% or more of the company's combined operating profit or loss. d. None of these answers are correct 26. A segment of a business enterprise is to be reported separately when the revenues of the segment exceed 10 percent of the a total combined revenues of all segments reporting profits b. total revenues of all the enterprise's industry segments. c. total export and foreign sales. d. combined net income of all segments reporting profits. 27. All of the following information about each operating segment must be reported except a unusual items. b. interest revenue. c. cost of goods sold. d. depreciation and amortization expense. 28. If the financial statements examined by an auditor lead the auditor to issue an opinion that contains an exception that is not of sufficient magnitude to invalidate the statement as a whole, the opinion is said to be a unqualified b. qualified c. adverse. d. exceptional 29. The MD&A section of a company's annual report is to cover the following three items a. income statement, balance sheet, and statement of owners' equity. b. income statement, balance sheet, and statement of cash flows. C liquidity, capital resources, and results of operations. d. changes in the stock price, mergers, and acquisitions. 30. The MD&A section of a company's annual report is to cover the following three items! a. income statement, balance sheet, and statement of owners' equity. b. income statement, balance sheet, and statement of cash flows. liquidity, capital resources, and results of operations d changes in the stock price, mergers, and acquisitions. C III. Lease agreement (15 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts