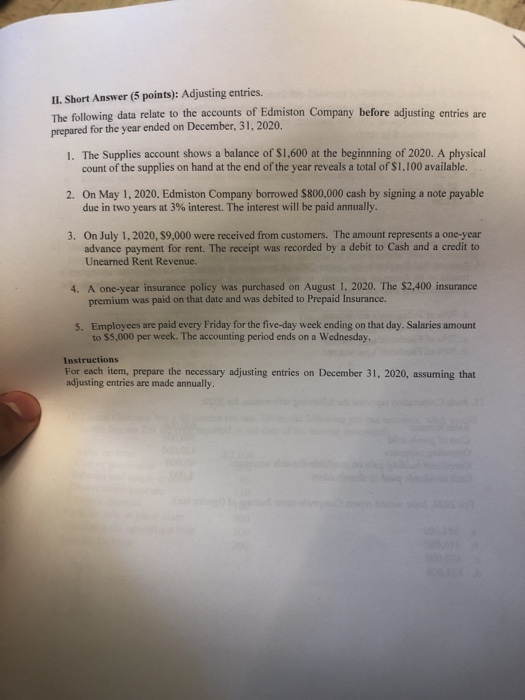

Question: II. Short Answer (5 points): Adjusting entries. The following data relate to the accounts of Edmiston Company before adjusting entries are prepared for the year

II. Short Answer (5 points): Adjusting entries. The following data relate to the accounts of Edmiston Company before adjusting entries are prepared for the year ended on December 31, 2020. 1. The Supplies account shows a balance of $1,600 at the beginning of 2020. A physical count of the supplies on hand at the end of the year reveals a total of S1,100 available. 2. On May 1, 2020. Edmiston Company borrowed $800.000 cash by signing a note payable due in two years at 3% interest. The interest will be paid annually. 3. On July 1, 2020, S9,000 were received from customers. The amount represents a one-year advance payment for rent. The receipt was recorded by a debit to Cash and a credit to Unearned Rent Revenue. 4. A one-vear insurance policy was purchased on August 1, 2020. The $2,400 insurance premium was paid on that date and was debited to Prepaid Insurance. 5. Employees are paid every Friday for the five-day week ending on that day. Salaries amount to $5,000 per week. The accounting period ends on a Wednesday. Instructions For each item, prepare the necessary adjusting entries on December 31, 2020, assuming that adjusting entries are made annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts