Question: (ii) You decide to implement a short butterfly spread using Genting puts as shown below. To do so, you short one (1) put at a

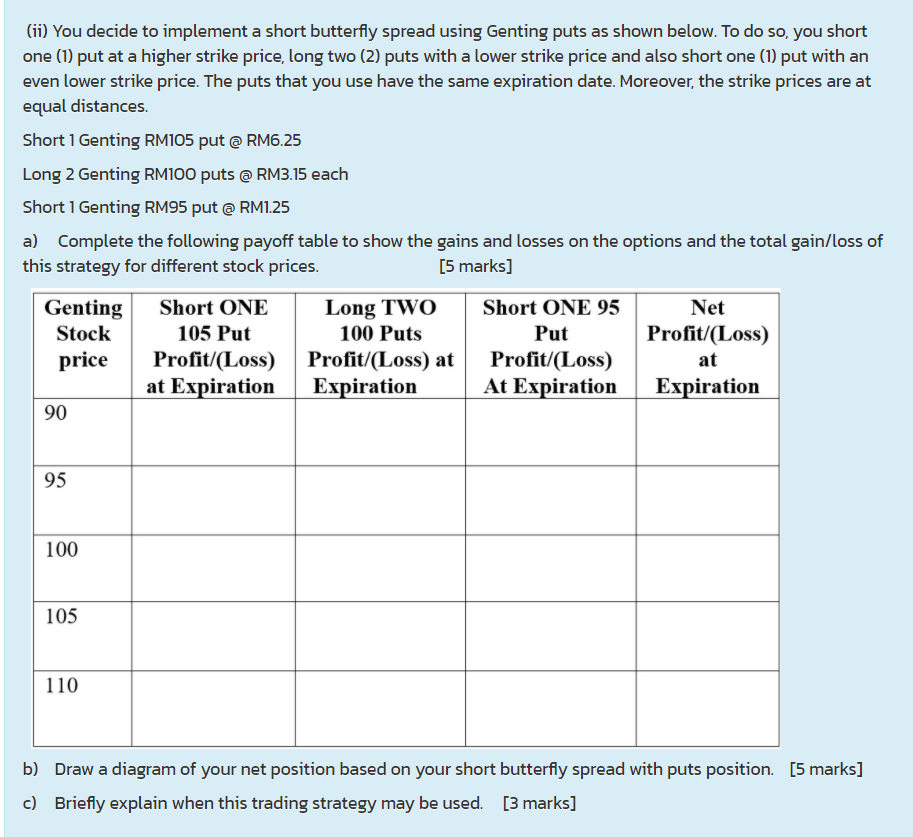

(ii) You decide to implement a short butterfly spread using Genting puts as shown below. To do so, you short one (1) put at a higher strike price, long two (2) puts with a lower strike price and also short one (1) put with an even lower strike price. The puts that you use have the same expiration date. Moreover, the strike prices are at equal distances. Short 1 Genting RM105 put @ RM6.25 Long 2 Genting RM100 puts @ RM3.15 each Short 1 Genting RM95 put @ RM1.25 a) Complete the following payoff table to show the gains and losses on the options and the total gain/loss of this strategy for different stock prices. [5 marks] Genting Stock price Short ONE 105 Put Profit/(Loss) at Expiration Long TWO 100 Puts Profit/(Loss) at Expiration Short ONE 95 Put Profit/(Loss) At Expiration Net Profit/(Loss) at Expiration 90 95 100 105 110 b) Draw a diagram of your net position based on your short butterfly spread with puts position. [5 marks] c) Briefly explain when this trading strategy may be used. [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts