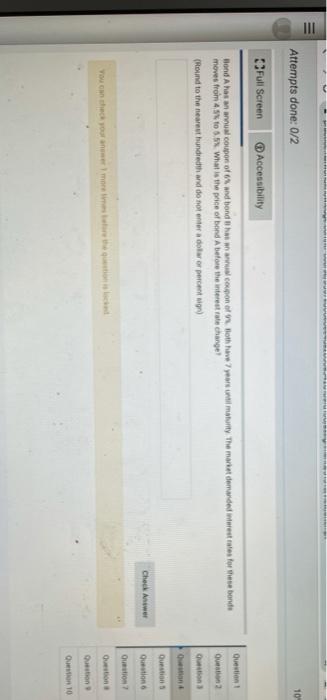

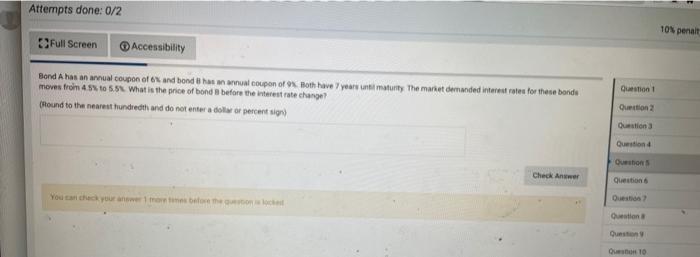

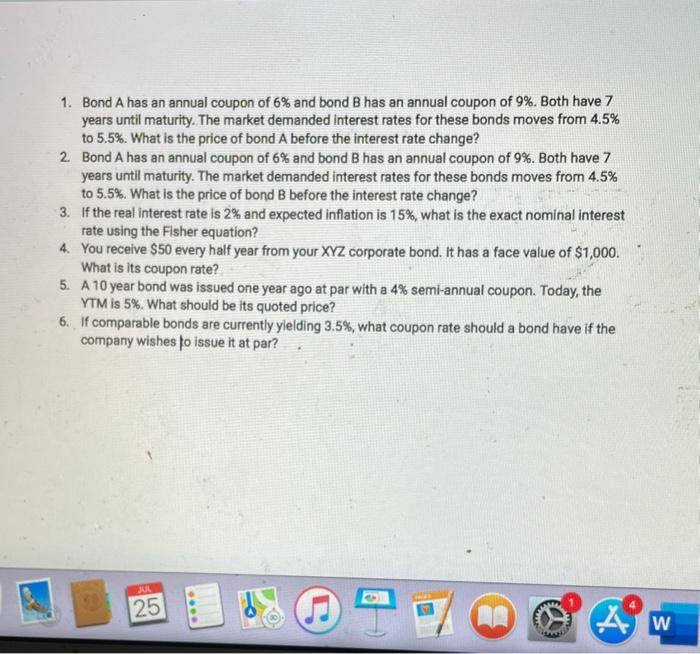

Question: III 10 Attempts done: 0/2 Full Screen Accessibility Question Question Bond A has a coupon of ox and hond www xpon to www 7 years

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock