Question: III = 100% 1 1 Normal text Arial - 11 + 3 Income Statement Sold 97,500 12 Bottle Cases Yearly $25.63/Case Annual Sales 2.5

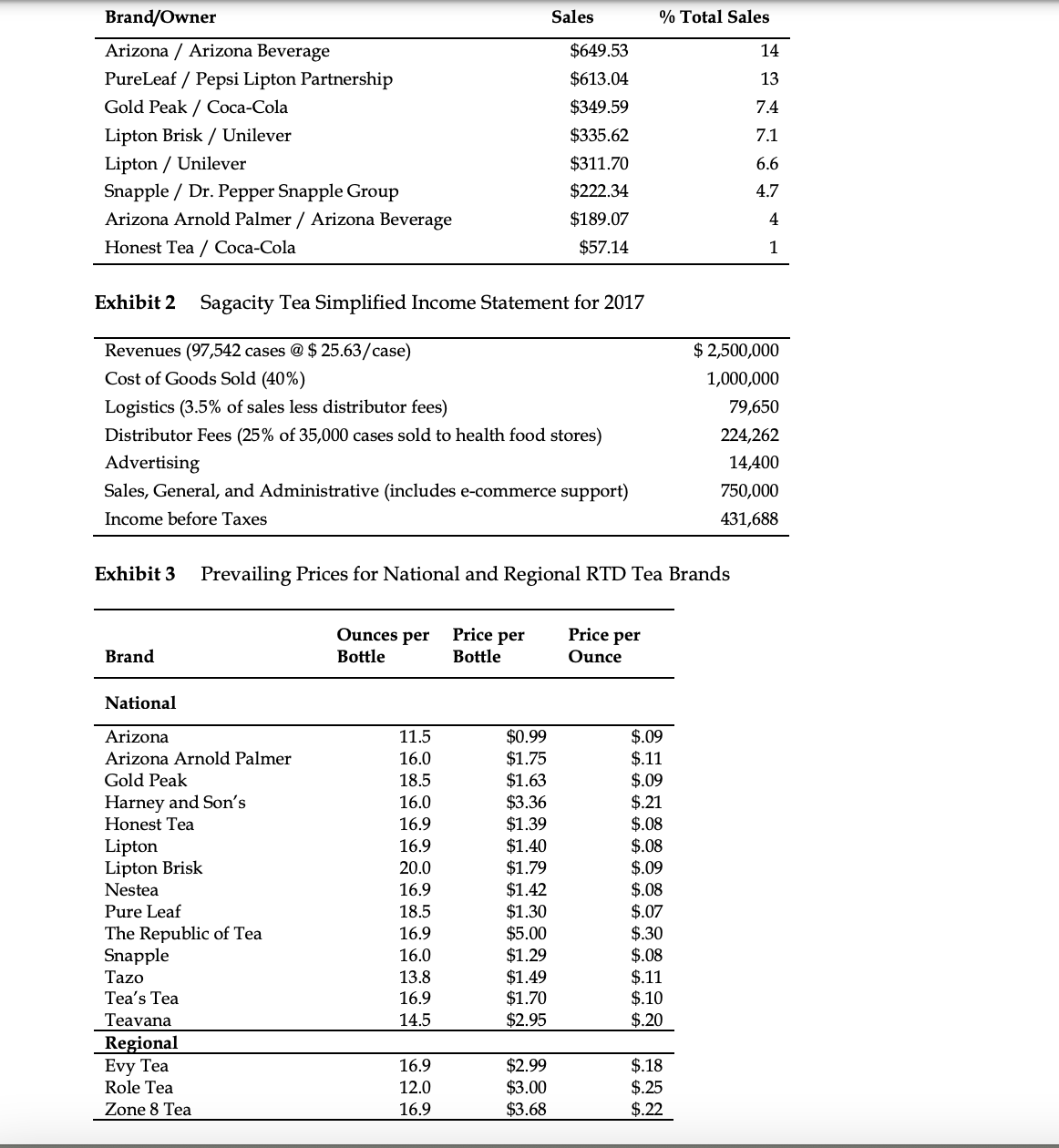

III = 100% 1 1 Normal text Arial - 11 + 3 Income Statement Sold 97,500 12 Bottle Cases Yearly $25.63/Case Annual Sales 2.5 Million RTD Tea Sales 6 Billion in 2017(Overall Market) 4 5 6 7 3.3% growth per year To secure premium shelf space for a new food product in the 50 largest U.S. chains, a producer would need to spend more than $5 million. Off-invoice case allowances, Averaging 15.1% of unit cost 5% Broker Fee About 4,875 cases (5% of sales) were purchased from Sagacity's own website Retail markup of 25-30% Sagacity sold for $2.60 to 2.75 a bottle Advertising expenditures that rarely exceeded $1,200 per month Moran estimated sales of 10,000 cases in the new region during Sagacity's first year. ^ III = 100% 1 1 Normal text Arial - 11 2 3 4 + 5 6 7 f. $3,000 per month for targeted online ads during the rollout's first six months. ($36,000) g. Potential $10,000 to introduce new matcha flavor, plus additional slotting fees. i. Attempt to secure shelf space in 300 key outlets of a leading regional supermarket chain. 2. Set aside the retail expansion option, at least in the short term, and focus on online sales by enhancing Sagacity's website and e-advertising presence. a. $9,000-10,000 per month on Google AdWords b. Advertise primarily on Facebook ($1.72 average cost per click [CPC]) instead of Google AdWords ($2.32 average CPC). However, consumers browsing on Facebook generally showed less intent to purchase than those searching for specific products or brands on AdWords c. third-party logistics providers averaged about 10% higher than Sagacity's current expenditures on storage, packing, and shipping; these costs fell within the industry average of 3-5% of net sales. 3. Continue Sagacity's successful regional efforts for the time being with the goal of ^ Brand/Owner Arizona Arizona Beverage PureLeaf Pepsi Lipton Partnership Gold Peak Coca-Cola Lipton Brisk Unilever Lipton Unilever Snapple Dr. Pepper Snapple Group Arizona Arnold Palmer / Arizona Beverage Honest Tea Coca-Cola Sales % Total Sales $649.53 14 $613.04 13 $349.59 7.4 $335.62 7.1 $311.70 6.6 $222.34 4.7 $189.07 4 $57.14 1 Exhibit 2 Sagacity Tea Simplified Income Statement for 2017 Revenues (97,542 cases @ $25.63/case) $2,500,000 Cost of Goods Sold (40%) 1,000,000 Logistics (3.5% of sales less distributor fees) 79,650 Distributor Fees (25% of 35,000 cases sold to health food stores) 224,262 Advertising 14,400 Sales, General, and Administrative (includes e-commerce support) Income before Taxes 750,000 431,688 Exhibit 3 Prevailing Prices for National and Regional RTD Tea Brands Brand Ounces per Bottle Price per Bottle Price per Ounce National Arizona 11.5 $0.99 $.09 Arizona Arnold Palmer 16.0 $1.75 $.11 Gold Peak 18.5 $1.63 $.09 Harney and Son's 16.0 $3.36 $.21 Honest Tea 16.9 $1.39 $.08 Lipton 16.9 $1.40 $.08 Lipton Brisk 20.0 $1.79 $.09 Nestea 16.9 $1.42 $.08 Pure Leaf 18.5 $1.30 $.07 The Republic of Tea 16.9 $5.00 $.30 Snapple 16.0 $1.29 $.08 Tazo 13.8 $1.49 $.11 Tea's Tea 16.9 $1.70 $.10 Teavana 14.5 $2.95 $.20 Regional Evy Tea 16.9 $2.99 $.18 Role Tea 12.0 $3.00 $.25 Zone 8 Tea 16.9 $3.68 $.22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts