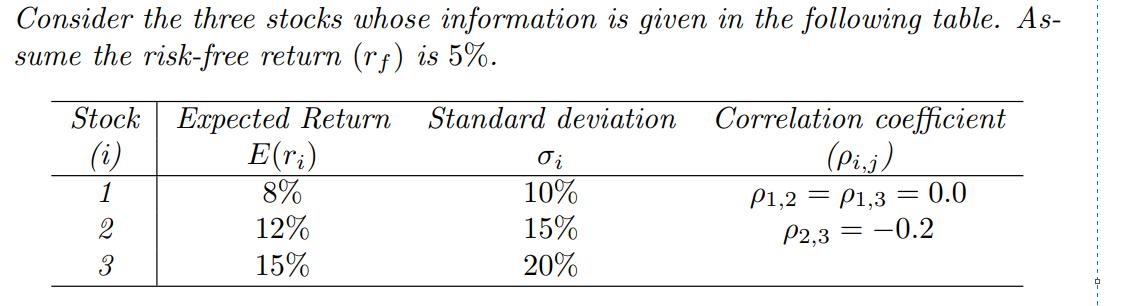

Question: (iii) Find the optimal weight for an efficient portfolio whose expected turn is 16%. re- Consider the three stocks whose information is given in

(iii) Find the optimal weight for an efficient portfolio whose expected turn is 16%. re- Consider the three stocks whose information is given in the following table. As- sume the risk-free return (rf) is 5%. Stock Expected Return Standard deviation Correlation coefficient (i) 1 2 3 E(ri) 8% 12% 15% oi 10% 15% 20% (Pi,j) P1,2 = P1,3 0.0 P2,3 = -0.2

Step by Step Solution

There are 3 Steps involved in it

To find the optimal weight for the third stock in the portfolio we can use the concept of the effici... View full answer

Get step-by-step solutions from verified subject matter experts