Question: ill like! Which statement is not correct? Lenders prefer adjustable rate mortgage (ARM). To convince borrowers to choose ARM lenders need give some candy by

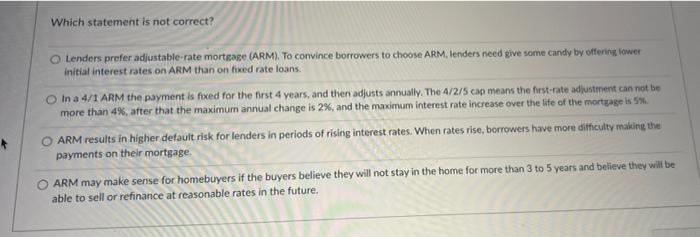

Which statement is not correct? Lenders prefer adjustable rate mortgage (ARM). To convince borrowers to choose ARM lenders need give some candy by offering lower initial interest rates on ARM than on foxed rate loans. In a 4/1 ARM the payment is fixed for the first 4 years, and then adjusts annually. The 4/2/5 cap means the first-rate adjustment can not be more than 4%, after that the maximum annual change is 2%, and the maximum interest rate increase over the life of the mortgage ls 5. ARM results in higher default risk for lenders in periods of rising interest rates. When rates rise, borrowers have more difficulty making the payments on their mortgage ARM may make sense for homebuyers if the buyers believe they will not stay in the home for more than 3 to 5 years and believe they will be able to sell or refinance at reasonable rates in the future

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts