Question: I'm asking you to please stop this question the question that I previously had posted up was already answered I had accidentally posted the wrong

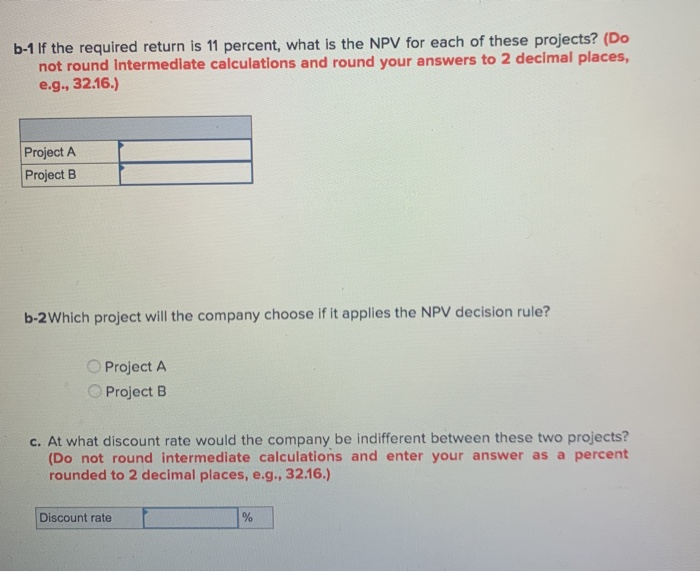

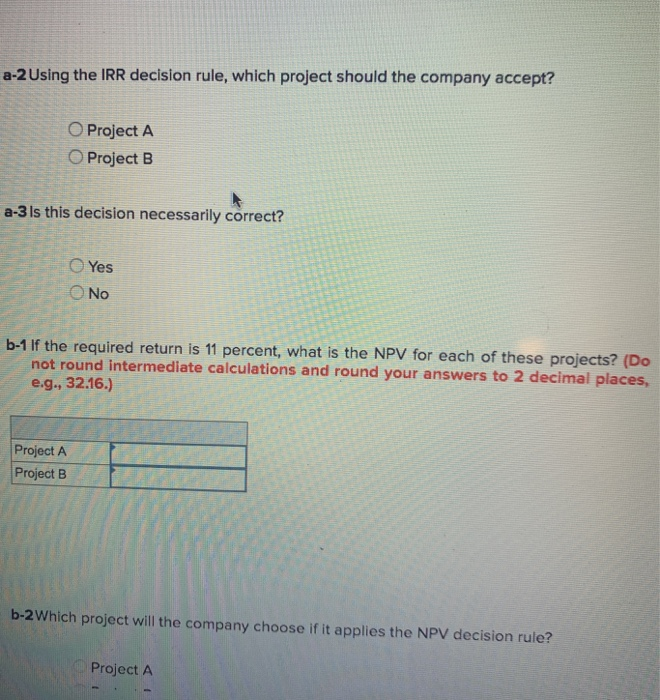

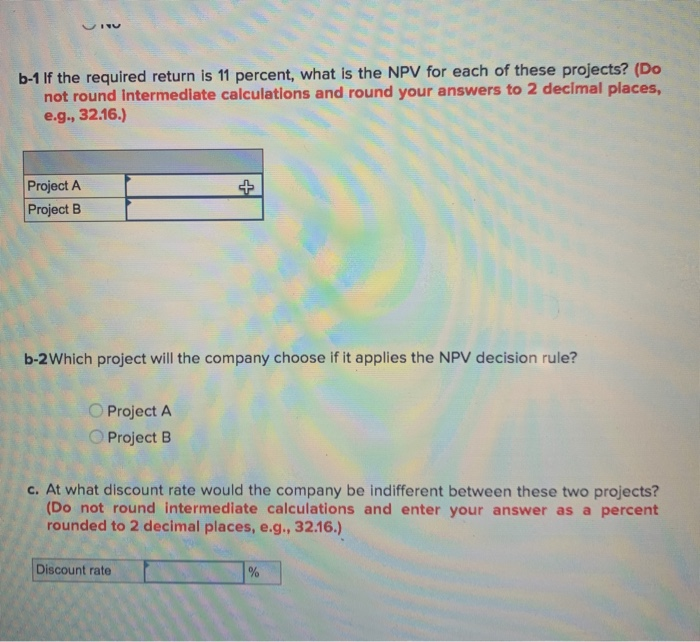

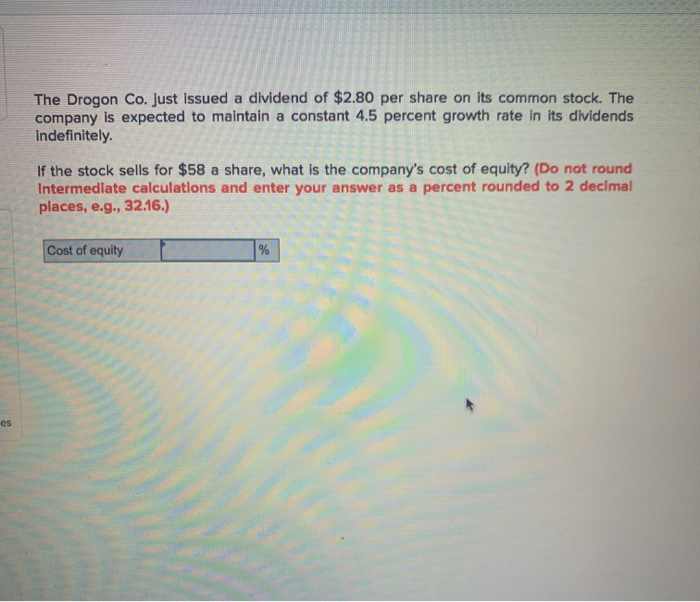

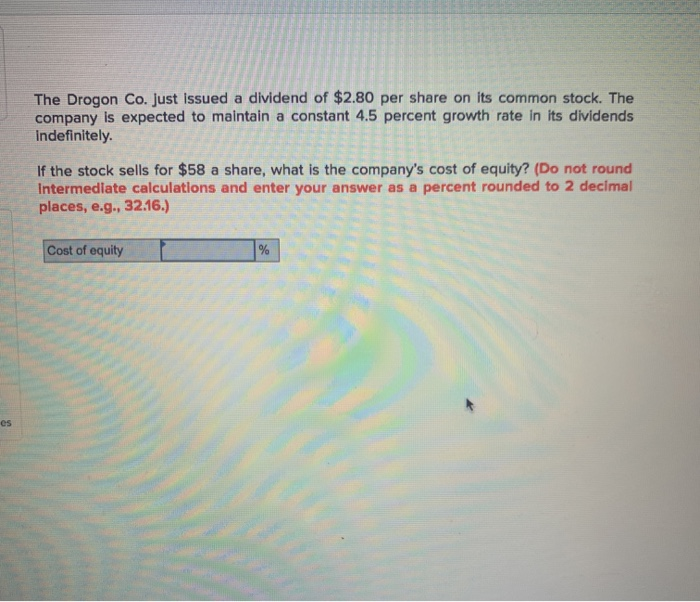

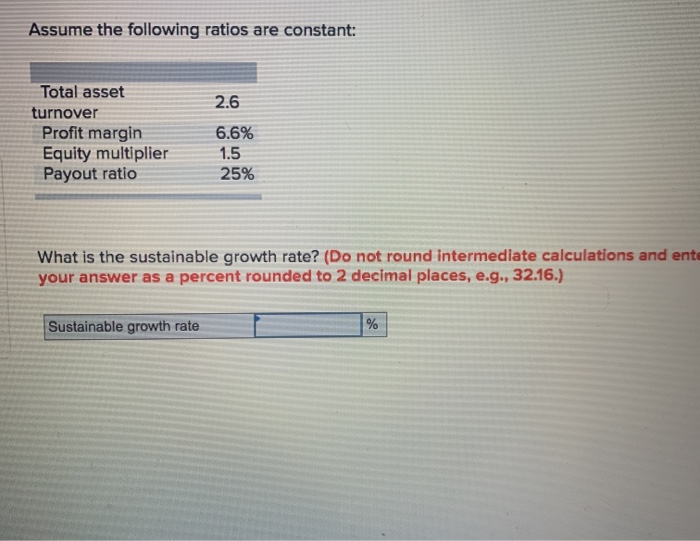

b-1 If the required return is 11 percent, what is the NPV for each of these projects? (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Project A Project B b-2Which project will the company choose if it applies the NPV decision rule? Project A Project B C. At what discount rate would the company be indifferent between these two projects? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Discount rate 2-2 Using the IRR decision rule, which project should the company accept? O Project A Project B a-3 Is this decision necessarily correct? Yes No b-1 If the required return is 11 percent, what is the NPV for each of these projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Project A Project B b-2Which project will the company choose if it applies the NPV decision rule? Project A b-1 If the required return is 11 percent, what is the NPV for each of these projects? (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Project A Project B b-2Which project will the company choose if it applies the NPV decision rule? Project A O Project B c. At what discount rate would the company be indifferent between these two projects? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Discount rate olo The Drogon Co. Just Issued a dividend of $2.80 per share on its common stock. The company is expected to maintain a constant 4.5 percent growth rate in its dividends Indefinitely. If the stock sells for $58 a share, what is the company's cost of equity? (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Cost of equity % The Drogon Co. Just Issued a dividend of $2.80 per share on its common stock. The company is expected to maintain a constant 4.5 percent growth rate in its dividends Indefinitely. If the stock sells for $58 a share, what is the company's cost of equity? (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Cost of equity % es Assume the following ratios are constant: Total asset turnover Profit margin Equity multiplier Payout ratio 2.6 6.6% 1.5 25% What is the sustainable growth rate? (Do not round intermediate calculations and ente your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Sustainable growth rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts