Question: im doing a math project but however I need a little bit of help. its a bit confusing. but down below the instructions have said

im doing a math project but however I need a little bit of help. its a bit confusing. but down below the instructions have said to choose a bank and I have chosen American first for mine. but however America first doesn't really give the APR but only the APY. I've spoken to my professor and he said to use this formula method "an APY of 4.10% gives an APR of 4.02% compounded monthly. he said to use the formula for all questions. He also gave a little hint that the final result of the answer would be a. small number. is there anyway somebody can please help me .

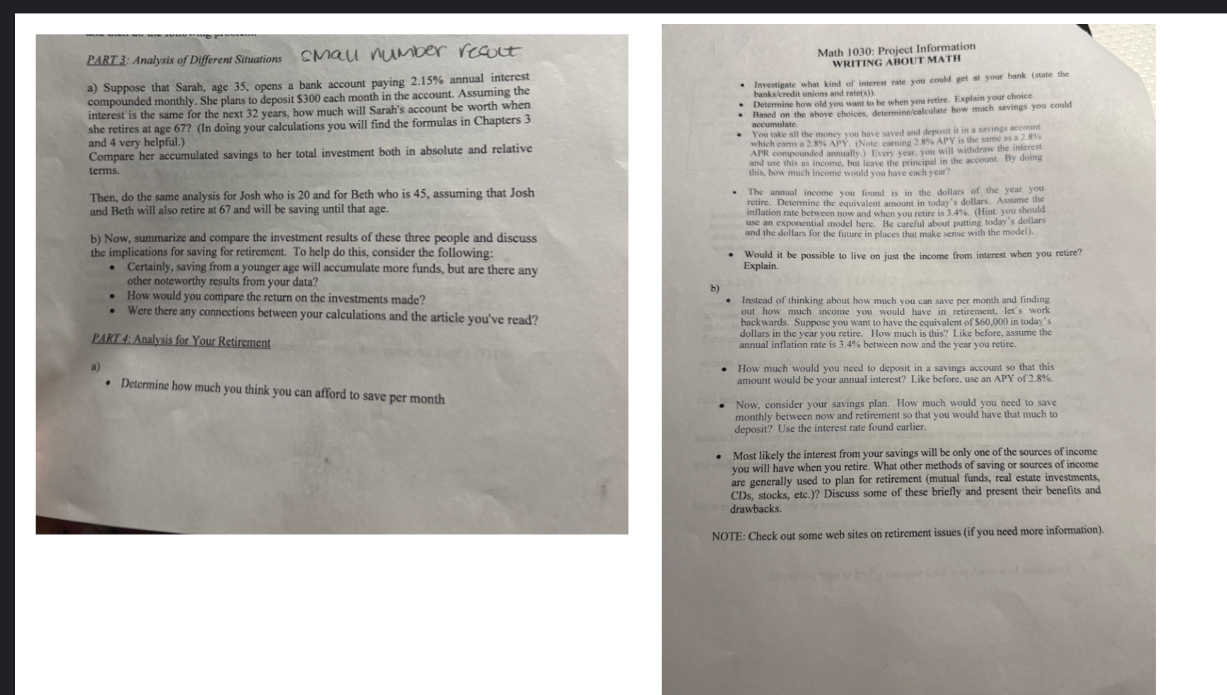

PART 3: Analysis of Different Situations small number recoct Math 1030: Project Information WRITING ABOUT MATH a) Suppose that Sarah, age 35, opens a bank account paying 2.15% annual interest Investigate what kind of interest rate you could get at your bank (state the compounded monthly. She plans to deposit $300 each month in the account. Assuming the banks/credit unions and rate(s)). interest is the same for the next 32 years, how much will Sarah's account be worth when Determine how old you want to be when you retire. Explain your choice. she retires at age 677 (In doing your calculations you will find the formulas in Chapters 3 Based on the above choices, determine/calculate how much savings you could accumulate. and 4 very helpful.) Yon take all the money you have saved and deposit it in a savings account Compare her accumulated savings to her total investment both in absolute and relative which earns a 2.8% APY. (Note: earning 2.8% APY is the same as a 2.8% APR compounded annually.) Every year, you will withdraw the interest terms. and use this as income, but leave the principal in the account. By doing this, how much income would you have each year? Then, do the same analysis for Josh who is 20 and for Beth who is 45, assuming that Josh The annual income you found is in the dollars of the year you and Beth will also retire at 67 and will be saving until that age. retire. Determine the equivalent amount in today's dollars. Assume the inflation rate between now and when you retire is 3.4%. (Hint: you should use an exponential model here. Be careful about putting today's dollars b) Now, summarize and compare the investment results of these three people and discuss and the dollars for the future in places that make sense with the model). the implications for saving for retirement. To help do this, consider the following: . Certainly, saving from a younger age will accumulate more funds, but are there any Would it be possible to live on just the income from interest when you retire? Explain. other noteworthy results from your data? How would you compare the return on the investments made? b) Instead of thinking about how much you can save per month and finding Were there any connections between your calculations and the article you've read? out how much income you would have in retirement, let's work backwards. Suppose you want to have the equivalent of $60,000 in today's PART 4: Analysis for Your Retirement dollars in the year you retire. How much is this? Like before, assume the annual inflation rate is 3.4% between now and the year you retire. How much would you need to deposit in a savings account so that this . Determine how much you think you can afford to save per month amount would be your annual interest? Like before, use an APY of 2.8%. Now, consider your savings plan. How much would you need to save monthly between now and retirement so that you would have that much to deposit? Use the interest rate found earlier. Most likely the interest from your savings will be only one of the sources of income you will have when you retire. What other methods of saving or sources of income are generally used to plan for retirement (mutual funds, real estate investments, CDs, stocks, etc.)? Discuss some of these briefly and present their benefits and drawbacks. NOTE: Check out some web sites on retirement issues (if you need more information)

PART 3: Analysis of Different Situations small number recoct Math 1030: Project Information WRITING ABOUT MATH a) Suppose that Sarah, age 35, opens a bank account paying 2.15% annual interest Investigate what kind of interest rate you could get at your bank (state the compounded monthly. She plans to deposit $300 each month in the account. Assuming the banks/credit unions and rate(s)). interest is the same for the next 32 years, how much will Sarah's account be worth when Determine how old you want to be when you retire. Explain your choice. she retires at age 677 (In doing your calculations you will find the formulas in Chapters 3 Based on the above choices, determine/calculate how much savings you could accumulate. and 4 very helpful.) Yon take all the money you have saved and deposit it in a savings account Compare her accumulated savings to her total investment both in absolute and relative which earns a 2.8% APY. (Note: earning 2.8% APY is the same as a 2.8% APR compounded annually.) Every year, you will withdraw the interest terms. and use this as income, but leave the principal in the account. By doing this, how much income would you have each year? Then, do the same analysis for Josh who is 20 and for Beth who is 45, assuming that Josh The annual income you found is in the dollars of the year you and Beth will also retire at 67 and will be saving until that age. retire. Determine the equivalent amount in today's dollars. Assume the inflation rate between now and when you retire is 3.4%. (Hint: you should use an exponential model here. Be careful about putting today's dollars b) Now, summarize and compare the investment results of these three people and discuss and the dollars for the future in places that make sense with the model). the implications for saving for retirement. To help do this, consider the following: . Certainly, saving from a younger age will accumulate more funds, but are there any Would it be possible to live on just the income from interest when you retire? Explain. other noteworthy results from your data? How would you compare the return on the investments made? b) Instead of thinking about how much you can save per month and finding Were there any connections between your calculations and the article you've read? out how much income you would have in retirement, let's work backwards. Suppose you want to have the equivalent of $60,000 in today's PART 4: Analysis for Your Retirement dollars in the year you retire. How much is this? Like before, assume the annual inflation rate is 3.4% between now and the year you retire. How much would you need to deposit in a savings account so that this . Determine how much you think you can afford to save per month amount would be your annual interest? Like before, use an APY of 2.8%. Now, consider your savings plan. How much would you need to save monthly between now and retirement so that you would have that much to deposit? Use the interest rate found earlier. Most likely the interest from your savings will be only one of the sources of income you will have when you retire. What other methods of saving or sources of income are generally used to plan for retirement (mutual funds, real estate investments, CDs, stocks, etc.)? Discuss some of these briefly and present their benefits and drawbacks. NOTE: Check out some web sites on retirement issues (if you need more information)Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts