Question: Im going to send this entire practice because its connected and i dont understand it. DRE NWSA 20-2 X RapidIdenti X Taxes, Hous x Taxes,

Im going to send this entire practice because its connected and i dont understand it.

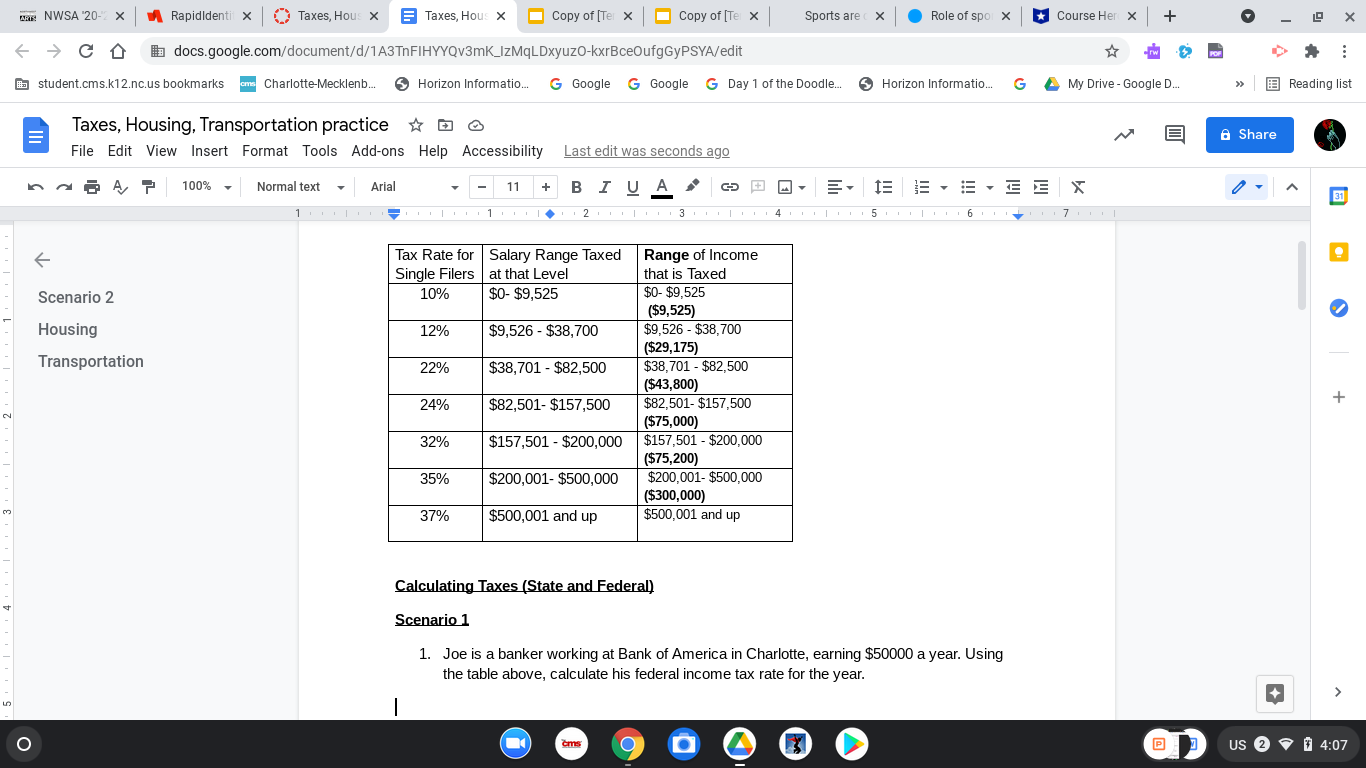

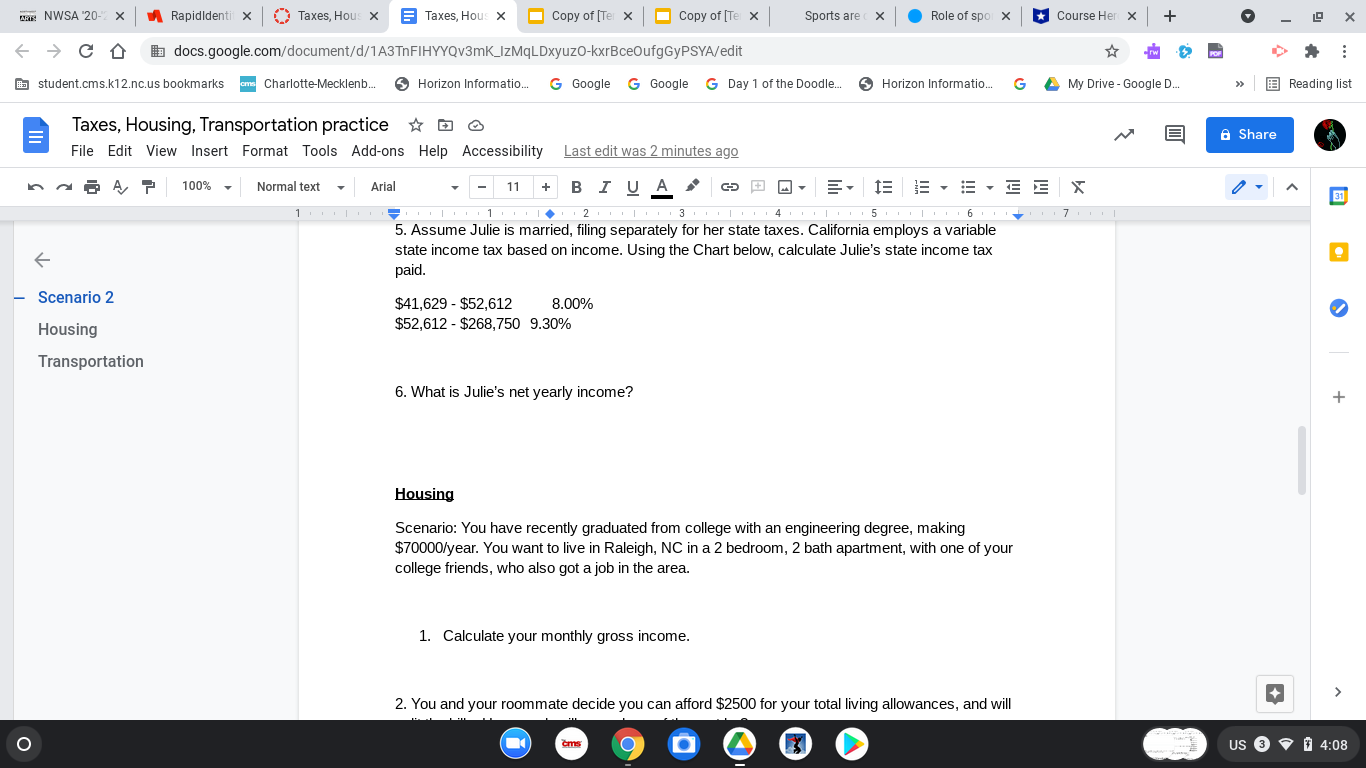

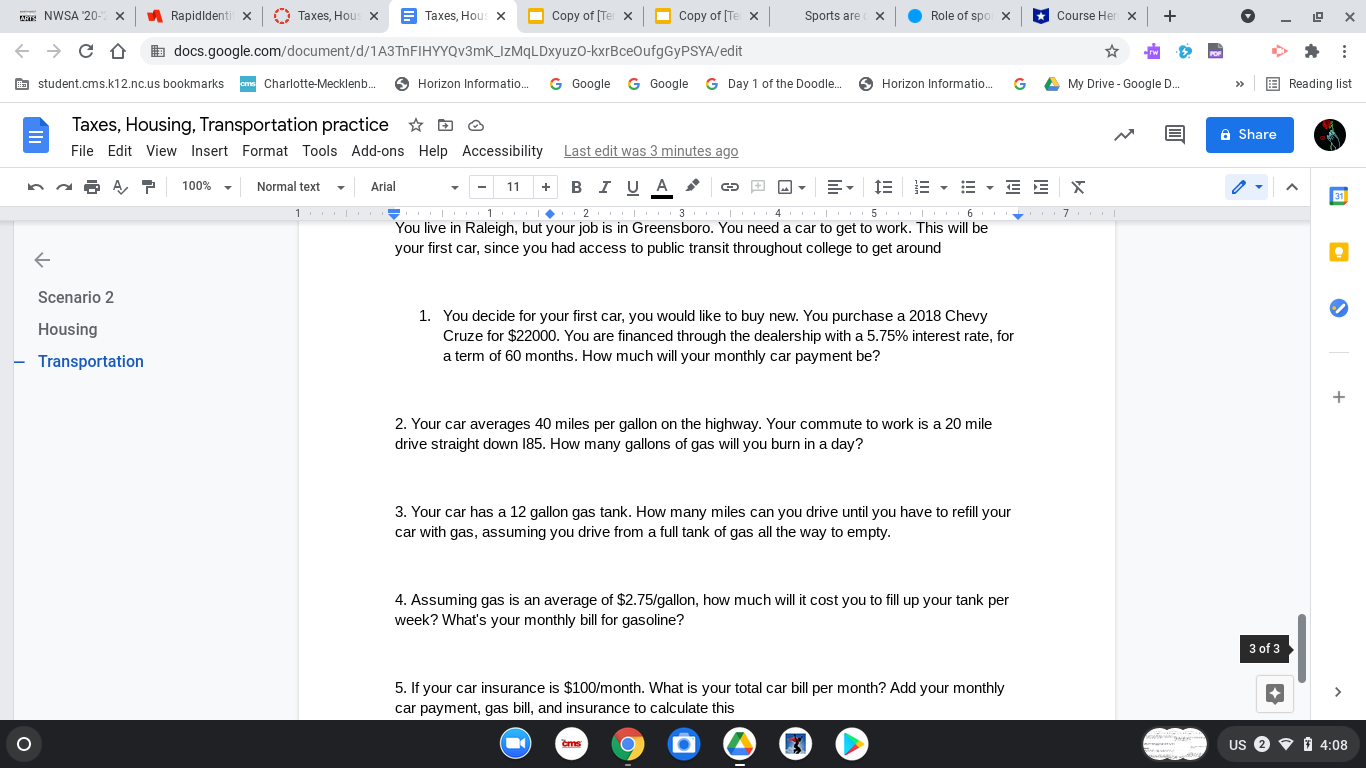

DRE NWSA 20-2 X RapidIdenti X Taxes, Hous x Taxes, Hous X Copy of [Tel X Copy of [Tel X Sports are ( X Role of spo x Course Her X + X C D docs.google.com/document/d/1A3TnFIHYYQv3mK_IzMqLDxyuzo-kxrBceOufgGyPSYA/edit student.cms.k12.nc.us bookmarks om Charlotte-Mecklenburgon Information. G Google G Google G Day 1 of the Doodle. Horizon Information. G & My Drive - Google D. >Reading list Taxes, Housing, Transportation practice * 6 Share File Edit View Insert Format Tools Add-ons Help Accessibility Last edit was seconds ago 100% Normal text Arial - 11 B I U A . C PO . E BEE. EEX 31 3 1 1 1 1 1 1 1 4 1 1 1 1 1 1 1 5 1 1 1 1 1 1 1 6 1 1 1 17 1 1 1 Tax Rate for Salary Range Taxed Range of Income Single Filers at that Level that is Taxed Scenario 2 10% $0- $9,525 $0- $9,525 ($9,525) Housing 12% $9,526 - $38,700 $9,526 - $38,700 ($29,175 Transportation 22% $38,701 - $82,500 $38,701 - $82,500 ($43,800) 24% $82,501- $157,500 $82,501- $157,500 + ($75,000) 32% $157,501 - $200,000 $157,501 - $200,000 ($75,200) 35% $200,001- $500,000 $200,001- $500,000 ($300,000) 37% $500,001 and up $500,001 and up Calculating Taxes (State and Federal) Scenario 1 1. Joe is a banker working at Bank of America in Charlotte, earning $50000 a year. Using the table above, calculate his federal income tax rate for the year. + O ams A US 2 9 # 4:07DRE NWSA 20-2 X RapidIdenti X Taxes, Hous x Taxes, Hous X Copy of [Tel X Copy of [Tel X Sports are ( X Role of spo x Course Her X + X C D docs.google.com/document/d/1A3TnFIHYYQv3mK_IzMqLDxyuzo-kxrBceOufgGyPSYA/edit student.cms.k12.nc.us bookmarks om Charlotte-Mecklenburgon Information. G Google G Google G Day 1 of the Doodle. Horizon Information. G & My Drive - Google D. >Reading list Taxes, Housing, Transportation practice * 6 Share File Edit View Insert Format Tools Add-ons Help Accessibility Last edit was 2 minutes ago 100% Normal text Arial - 11 1 + B I U A / C P O . E . BEE E. EEX A 31 . 1 . 3 1 . 5. Assume Julie is married, filing separately for her state taxes. California employs a variable state income tax based on income. Using the Chart below, calculate Julie's state income tax paid. Scenario 2 $41,629 - $52,612 8.00% Housing $52,612 - $268,750 9.30% Transportation 6. What is Julie's net yearly income? + Housing Scenario: You have recently graduated from college with an engineering degree, making $70000/year. You want to live in Raleigh, NC in a 2 bedroom, 2 bath apartment, with one of your college friends, who also got a job in the area. 1. Calculate your monthly gross income. + 2. You and your roommate decide you can afford $2500 for your total living allowances, and will O ams US 3 9 4:08DRE NWSA 20-2 X RapidIdenti X Taxes, Hous x Taxes, Hous X Copy of [Tel X Copy of [Tel X Sports are ( X Role of spo x Course Her X + X C D docs.google.com/document/d/1A3TnFIHYYQv3mK_IzMqLDxyuzo-kxrBceOufgGyPSYA/edit student.cms.k12.nc.us bookmarks om Charlotte-Mecklenburgon Information. G Google G Google G Day 1 of the Doodle. Horizon Information. G & My Drive - Google D. >Reading list Taxes, Housing, Transportation practice * 6 Share File Edit View Insert Format Tools Add-ons Help Accessibility Last edit was 3 minutes ago 100% Normal text Arial - 11 + B J U A / C P O . E . BE E . E . E E X A 31 3 1 1 4 . 1 5 . ' 1 16 . . 1 17 . You live in Raleigh, but your job is in Greensboro. You need a car to get to work. This will be your first car, since you had access to public transit throughout college to get around Scenario 2 1. You decide for your first car, you would like to buy new. You purchase a 2018 Chevy Housing Cruze for $22000. You are financed through the dealership with a 5.75% interest rate, for Transportation a term of 60 months. How much will your monthly car payment be? + 2. Your car averages 40 miles per gallon on the highway. Your commute to work is a 20 mile drive straight down 185. How many gallons of gas will you burn in a day? 3. Your car has a 12 gallon gas tank. How many miles can you drive until you have to refill your car with gas, assuming you drive from a full tank of gas all the way to empty. 4. Assuming gas is an average of $2.75/gallon, how much will it cost you to fill up your tank per week? What's your monthly bill for gasoline? 3 of 3 5. If your car insurance is $100/month. What is your total car bill per month? Add your monthly + car payment, gas bill, and insurance to calculate this O ams US 2 9 4:08