Question: im having a hard time finding whats K and more importantly finding r. I know I have to use ln or use log but I

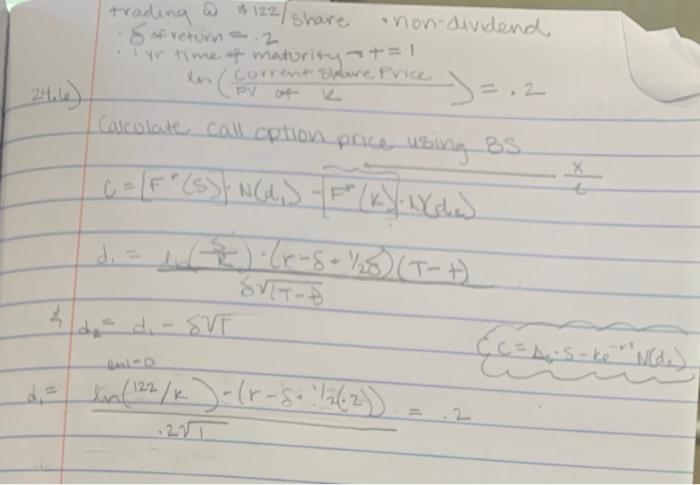

im having a hard time finding whats K and more importantly finding r. I know I have to use ln or use log but I forgot the rules and how to get the equation so I can use it to solve for d1 that I can then use to solve for d2.

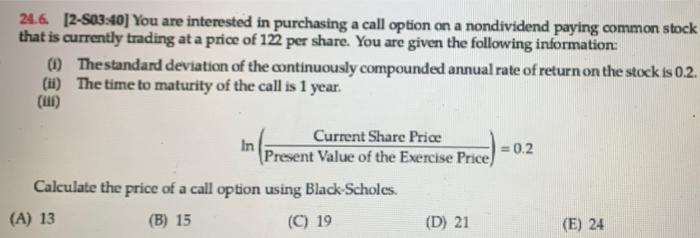

im having a hard time finding whats K and more importantly finding r. I know I have to use ln or use log but I forgot the rules and how to get the equation so I can use it to solve for d1 that I can then use to solve for d2.24.6. [2-S03:40) You are interested in purchasing a call option on a nondividend paying common stock that is currently trading at a price of 122 per share. You are given the following information: (6) Thestandard deviation of the continuously compounded annual rate of return on the stock is 0.2. (11) The time to maturity of the call is 1 year. In Current Share Price Present Value of the Exercise Price) = 0.2 Calculate the price of a call option using Black Scholes. (A) 13 (B) 15 (C) 19 (D) 21 (E) 24 PV of w trading & * 122/ share non-dividend 8 of returns 2 lyr time of maturity +=1 Current Share Price =.2 Calculate call option price using BS. c = F"(S) / N(d, JF 0-13653NCS (KY. NXched di= Leng+ 125) (T-t) SVITA 3 de di- SVT Ec=Aris - kende) di lin (122/K) - (r-s: 12 (2) d 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts