Question: I'm having an issue understanding this question: Can someone help me? I think it is much easier than I am making it but the book

I'm having an issue understanding this question:  Can someone help me? I think it is much easier than I am making it but the book we are using doesn't do a great job explaining it and this is the only part of inventory management that I am having any issue with. Thank you in advance!

Can someone help me? I think it is much easier than I am making it but the book we are using doesn't do a great job explaining it and this is the only part of inventory management that I am having any issue with. Thank you in advance!

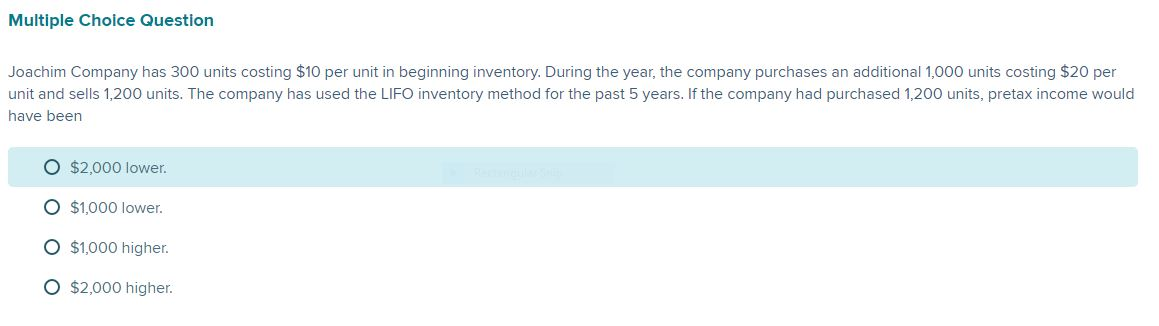

Multiple Choice Question Joachim Company has 300 units costing $10 per unit in beginning inventory. During the year, the company purchases an additional 1,000 units costing $20 per unit and sells 1,200 units. The company has used the LIFO inventory method for the past 5 years. If the company had purchased 1,200 units, pretax income would have been O $2,000 lower. O $1,000 lower. O $1,000 higher O $2,000 higher

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts