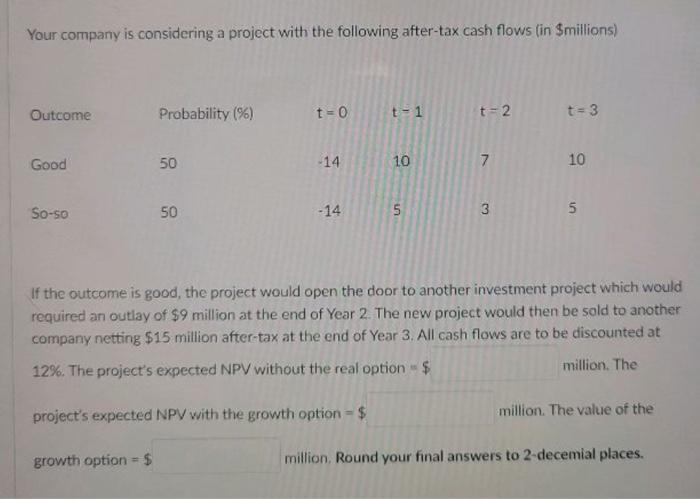

Question: I'm having difficulties figuring out this question Your company is considering a project with the following after-tax cash flows (in $millions) Outcome Probability (9) t=0

I'm having difficulties figuring out this question

Your company is considering a project with the following after-tax cash flows (in $millions) Outcome Probability (9) t=0 t-1 t-2 t=3 Good 50 -14 10 7 10 So-so 50 -14 5 5 3 5 5 If the outcome is good, the project would open the door to another investment project which would required an outlay of $9 million at the end of Year 2. The new project would then be sold to another company netting $15 million after-tax at the end of Year 3. All cash flows are to be discounted at 12%. The project's expected NPV without the real option - $ million. The project's expected NPV with the growth option = $ million. The value of the growth option = $ million, Round your final answers to 2-decemial places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts