Question: I'm having issues trying to figure out the remaining problems of this question in corporate finance... a. Calculate the indicated ratios for Barry. Round your

I'm having issues trying to figure out the remaining problems of this question in corporate finance...

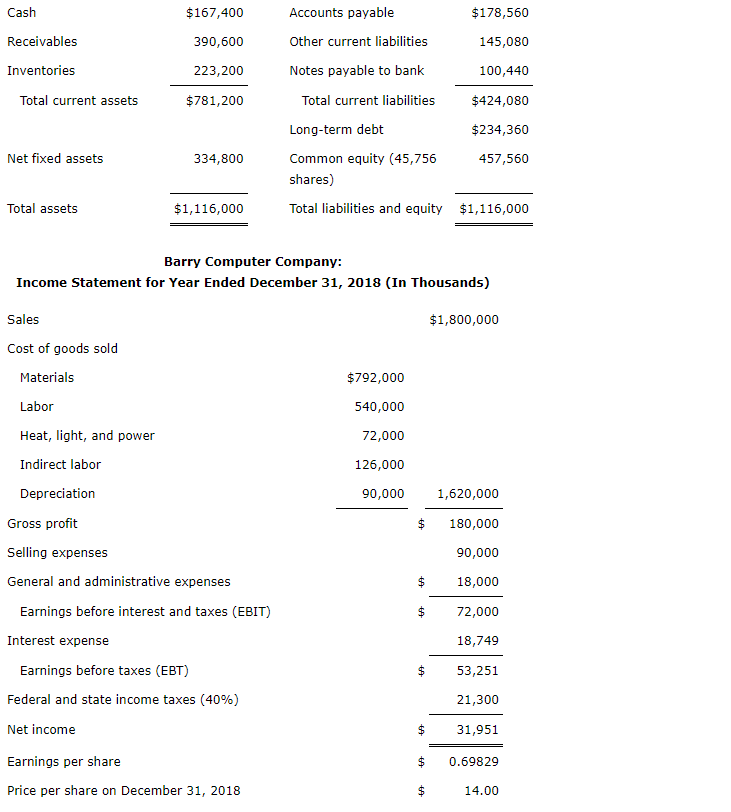

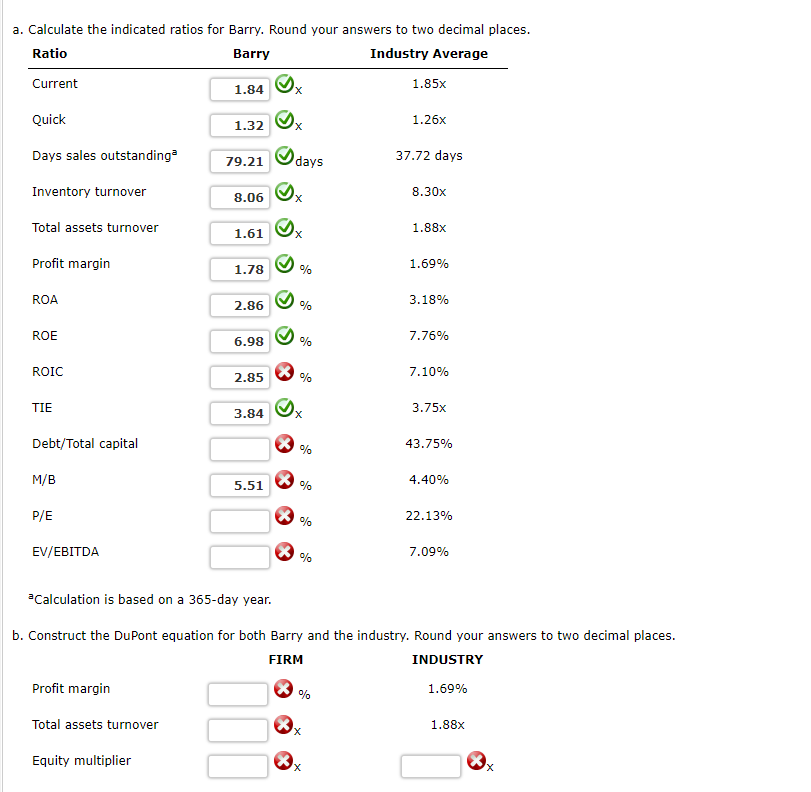

a. Calculate the indicated ratios for Barry. Round your answers to two decimal places. Ratio Barry Industry Average Current 1.84 1.85% X Quick 1.26x 1.32 Days sales outstanding 79.21 days 37.72 days Inventory turnover 8.06 8.30x Total assets turnover 1.61 1.88x Profit margin 1.78 % 1.69% ROA 3.18% 2.86 % ROE 6.98 3 % 7.76% ROIC X 7.10% 2.85 % TIE 3.75x 3.84 Debt/Total capital 43.75% % M/B > * * * > 5.51 4.40% % P/E % 22.13% EV/EBITDA 7.09% % Calculation is based on a 365-day year. b. Construct the DuPont equation for both Barry and the industry. Round your answers to two decimal places. FIRM INDUSTRY Profit margin % 1.69% Total assets turnover X 1.88x X Equity multiplier x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts