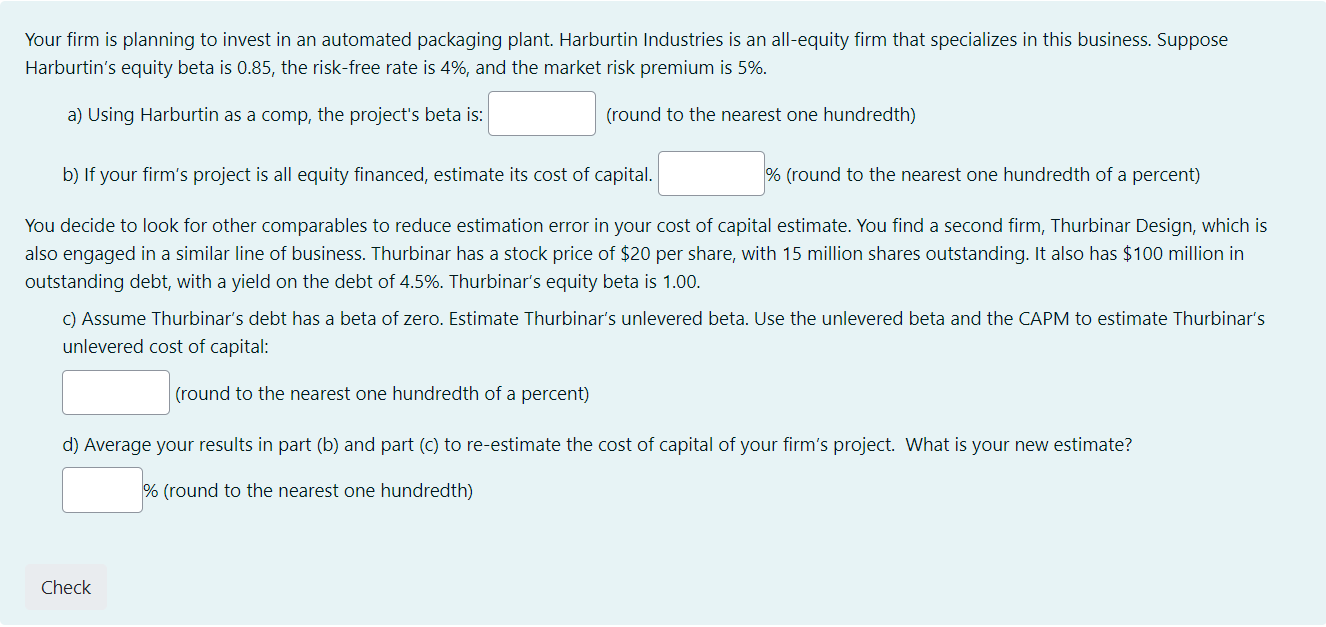

Question: I'm having issues with C. Can you please help. Your rm is planning to invest in an automated packaging plant. Harburtin Industries is an alleequity

I'm having issues with C.

Can you please help.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock