Question: im having trouble with this exercise Hitzu Co. sold a copier (that costs $4,800 ) for $6,000 cash with a two-year parts warranty to a

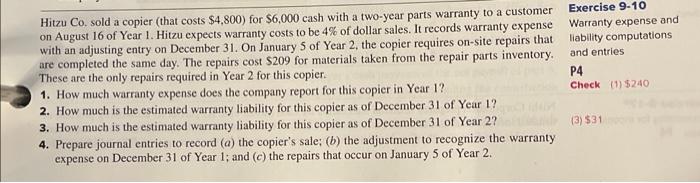

Hitzu Co. sold a copier (that costs $4,800 ) for $6,000 cash with a two-year parts warranty to a customer on August 16 of Year 1. Hitzu expects warranty costs to be 4% of dollar sales. It records warranty expense with an adjusting entry on December 31 . On January 5 of Year 2 , the copier requires on-site repairs that are completed the same day. The repairs cost $209 for materials taken from the repair parts inventory. These are the only repairs required in Year 2 for this copier. 1. How much warranty expense does the company report for this copier in Year 1 ? 2. How much is the estimated warranty liability for this copier as of December 31 of Year 1 ? 3. How much is the estimated warranty liability for this copier as of December 31 of Year 2 ? 4. Prepare journal entries to record (a) the copier's sale; (b) the adjustment to recognize the warranty expense on December 31 of Year 1 ; and (c) the repairs that occur on January 5 of Year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts