Question: I'm looking for help for only 1G,H,I,J and Number 2 also please! Comparative financial statement data of Dangerfield Candies Corp. appears below: (Click the icon

I'm looking for help for only 1G,H,I,J and Number 2 also please!

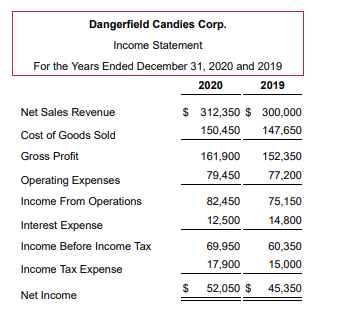

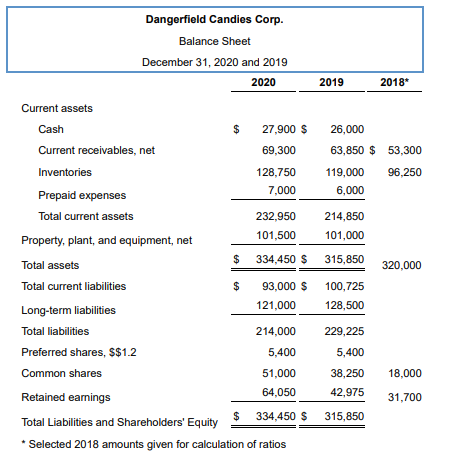

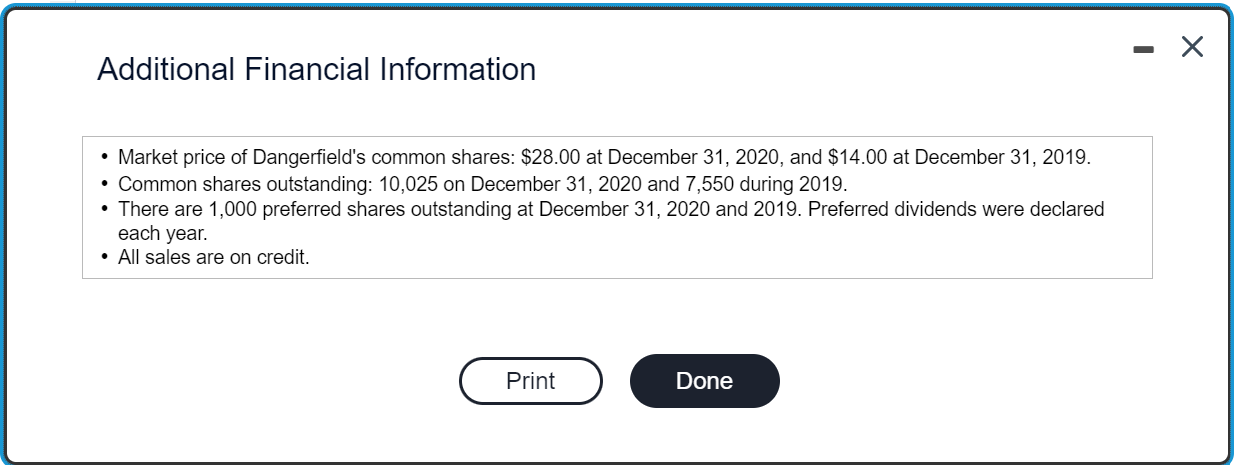

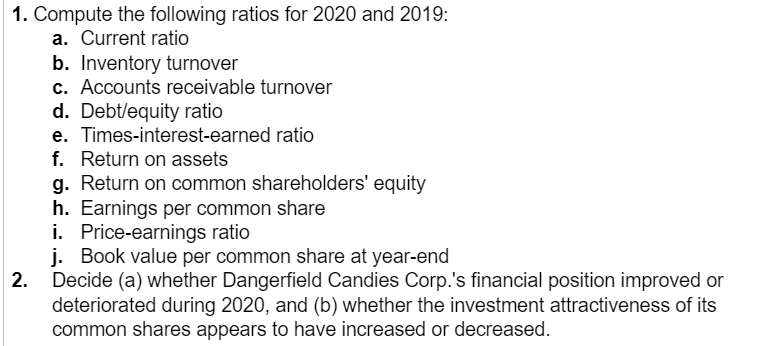

Comparative financial statement data of Dangerfield Candies Corp. appears below: (Click the icon to view the income statement.) (Click the icon to view the balance sheet.) (Click the icon to view the additional financial information.) Dangerfield Candies Corp. Income Statement For the Years Ended December 31, 2020 and 2019 Dangerfield Candies Corp. Balance Sheet December 31,2020 and 2019 202020192018 Current assets * Selected 2018 amounts given for calculation of ratios Additional Financial Information - Market price of Dangerfield's common shares: \$28.00 at December 31, 2020, and \$14.00 at December 31, 2019. - Common shares outstanding: 10,025 on December 31, 2020 and 7,550 during 2019. - There are 1,000 preferred shares outstanding at December 31, 2020 and 2019. Preferred dividends were declared each year. - All sales are on credit. 1. Compute the following ratios for 2020 and 2019 : a. Current ratio b. Inventory turnover c. Accounts receivable turnover d. Debt/equity ratio e. Times-interest-earned ratio f. Return on assets g. Return on common shareholders' equity h. Earnings per common share i. Price-earnings ratio j. Book value per common share at year-end 2. Decide (a) whether Dangerfield Candies Corp.'s financial position improved or deteriorated during 2020 , and (b) whether the investment attractiveness of its common shares appears to have increased or decreased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts