Question: I'm looking for the answer to number 5. 5. Given Robinson's 2013 and 2014 financial information presented in problems 2 and 4, a. Compute its

I'm looking for the answer to number 5.

5. Given Robinson's 2013 and 2014 financial information presented in problems 2 and 4,

a. Compute its operating and cash conversion cycle in each year.

b. What was Robinson's net investment in working capital eah year?

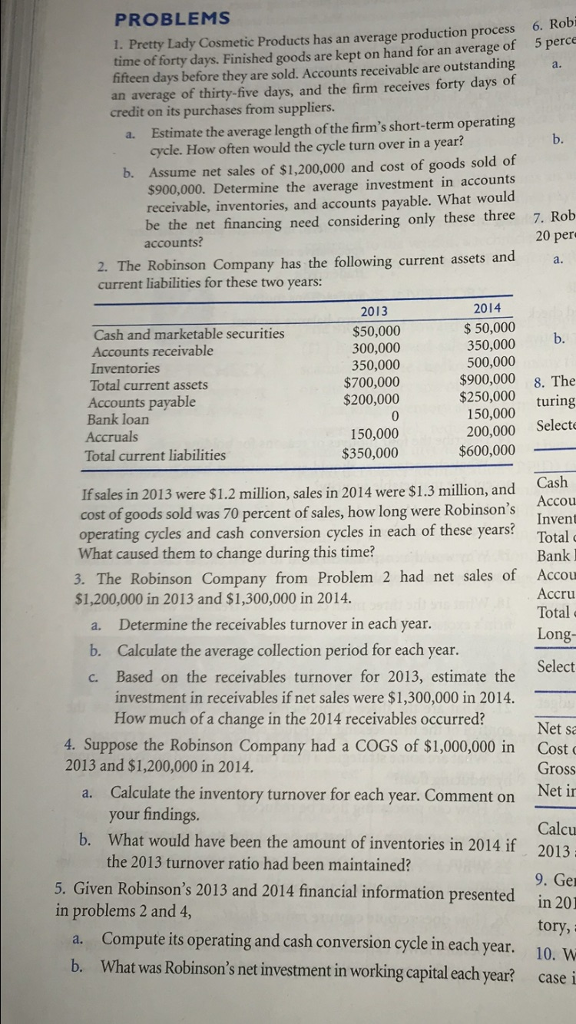

PROBLEMS 1. Pretty Lady Cosmetic Products has an average production process time of forty days. Finished goods are kept on hand for an average of fifteen days before they are sold. Accounts receivable are outstanding an average of thirty-five days, and the firm receives forty days of 6. Rob 5 perce a credit on its purchases from suppliers Estimate the average length of the firm's short-term operating a. cycle. How often would the cycle turn over in a year? b. Assume net sales of $1,200,000 and cost of goods sold of $900,000. Determine the average investment in accounts receivable, inventories, and accounts payable. What would be the net financing need considering only these three 7. Rob accounts? 20 per a. 2. The Robinson Company has the following current assets and current liabilities for these two years: 2013 $50,000 300,000 350,000 $700,000 $200,000 Cash and marketable securities Accounts receivable $ 50,000 350,000 b 500,000 $900,000 8. The Total current assets Accounts payable Bank loan Accruals Total current liabilities $250,000 turing 150,000 200,000 Selecte 0 150,000 $350,000 $600,000 _ If sales in 2013 were $1.2 million, sales in 2014 were $1.3 million, and sold was 70 percent of sales, how long were Robnon'scou Invent operating cycles and cash conversion cycles in each of these years? Total What caused them to change during this time? Bank 3. The Robinson Company from Problem 2 had net sales of Accou Accru $1,200,000 in 2013 and $1,300,000 in 2014. Total Determine the receivables turnover in each year Calculate the average collection period for each year. a. b. Select Based on the receivables turnover for 2013, estimate the investment in receivables ifnet sales were $1,300,000 in 2014. c. How much of a change in the 2014 receivables occurred?Net sa 4. Suppose the Robinson Company had a COGS of $1,000,000 in Cost Gross 2013 and $1,200,000 in 2014 a. Calculate the inventory turnover for each year. Comment on Net in your findings Calcu 2013 What would have been the amount of inventories in 2014 if 5. Given Robinson's 2013 and 2014 financial information presented Compute its operating and cash conversion cycle in each year b. the 2013 turnover ratio had been maintained? er in 20 1 in problems 2 and 4, tory, 10. W case i a. . What was Robinson's net investment in working capital each year? b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts