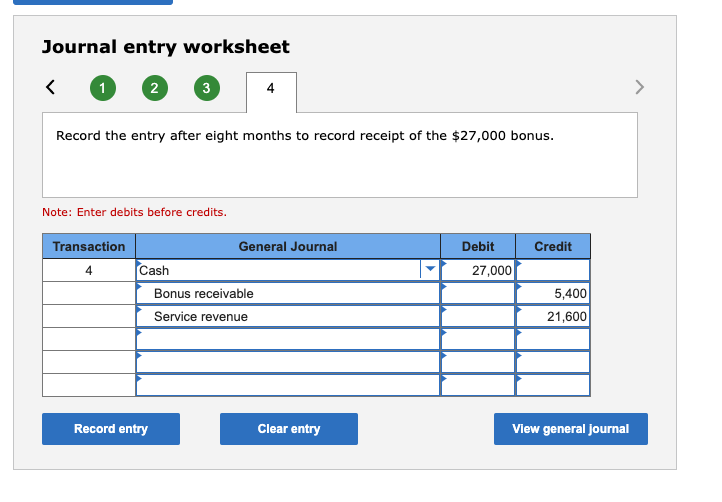

Question: I'm not looking for the answer to this problem, I'm just hoping someone can explain to me why reducing the bonus receivable account by $5,400

I'm not looking for the answer to this problem, I'm just hoping someone can explain to me why reducing the bonus receivable account by $5,400 when we receive the bonus at the end of the contract? I know why we're reducing the bonus receivable, but I'm not sure why reducing it specifically by $5,400 when the last bonus receivable debited was $675. Wouldn't reduce it by that amount instead of $5,400?

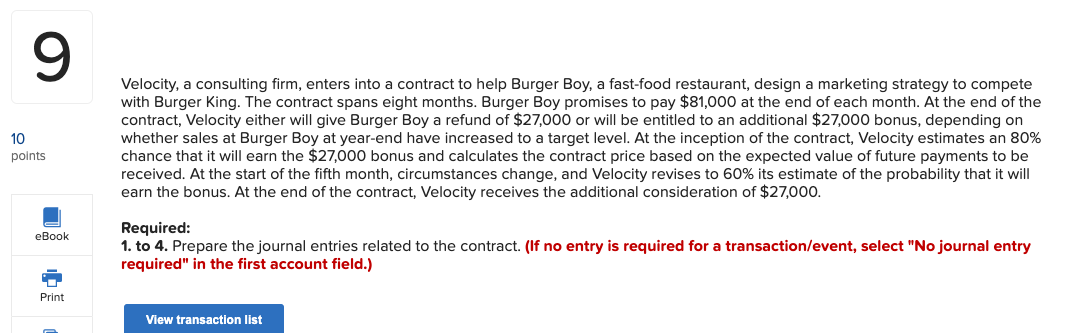

Velocity, a consulting firm, enters into a contract to help Burger Boy, a fast-food restaurant, design a marketing strategy to compete with Burger King. The contract spans eight months. Burger Boy promises to pay $81,000 at the end of each month. At the end of the contract, Velocity either will give Burger Boy a refund of $27,000 or will be entitled to an additional $27,000 bonus, depending on whether sales at Burger Boy at year-end have increased to a target level. At the inception of the contract, Velimates an 80% chance that it will earn the $27,000 bonus and calculates the contract price based on the expected value of received. At the start of the fifth month, circumstances change, and Velocity revises to 60% its estimate of the probability that it with earn the bonus. At the end of the contract, Velocity receives the additional consideration of $27,000. Required: 1. to 4. Prepare the journal entries related to the contract. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the entry after eight months to record receipt of the $27,000 bonus. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts