Question: QUESTION** Sensitivity analysis - Consider and analyze two additional scenarios (one optimistic scenario and one pessimistic scenario). In each scenario you will need to change

QUESTION** Sensitivity analysis - Consider and analyze two additional scenarios (one optimistic scenario and one pessimistic scenario). In each scenario you will need to change the NOI and/or NOI growth and/or the terminal CAP rate. You will need to articulate the reasons for the possible changes and their magnitude.

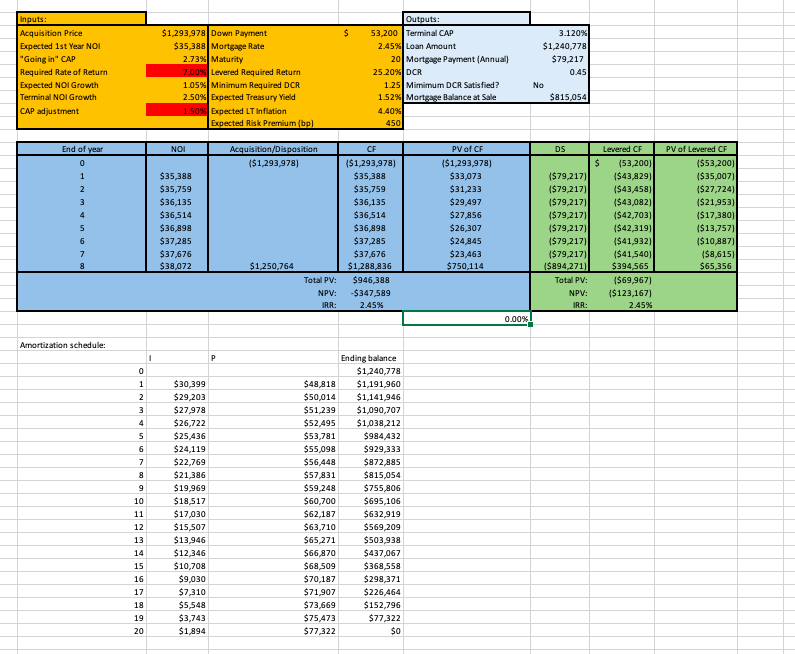

Excel sheet included:

puts: Outputs; Acquisition Price $1,293,978| Down Payment 53,200 Terminal CAP 3.12095 Expected 1st Year NOI $35,388 Mortgage Rate 2 45%%| Loan Amount $1,240,778 'Going in" CAP 173% Maturity 20 Mortgage Payment (Annual] $79,217 Required Rate of Return 36 Levered Required Return 25 20%%| DOR 0.45 Expected NOI Growth 059% Minimum Required DCR 1.25 Mimimum DCR Satisfied? No Terminal NOI Growth 2.50% Expected Treasury Yield 1.52%% Mortgage Balance at Sale $815,054 CAP adjustment 1 509% Expected LT Inflation 4.4095 Expected Risk Premium (bp] 450 End of year NO Acquisition/Disposition CF V of CF DS Levered OF PV of Levered CF ($1,293,978] ($1,293,978] ($1,293,978] $ (53,2001 $53,200] $35,388 $35,388 $33,073 ($79,217] ($43,829] ($35,007] $35,759 $35,759 $31,233 ($79,217] ($43,458] ($27,724] $36,135 $36,135 $29,497 ($79,217] ($43,082] ($21,953 $36,514 $36,514 $27,856 ($79,217] ($42,703] ($17,380] $36,898 $36,898 $26,307 ($79,217] ($42,319] ($13,757) $37,285 $37,285 $24,845 ($79,217] ($41,932] ($10,887] $37,676 $37,676 $23,463 ($79,217] ($41,540] ($8,615) $38,072 $1,250,764 $1,288,836 $750,114 $894,271] $394,565 $65,356 Total PV: $946,388 Total PV $69,9671 NPV: $347,589 NPV ($123,167] IRR: 2.45% IAR: 2.4595 0.009% Amortization schedule P Ending balance $1 240,778 $30,399 $48 818 $1,191,960 $29,203 $50,014 $1,141,946 $27,978 $51,239 $1,090,707 WA A WO N K $26,722 $52,495 $1,038,212 $25,436 $53,781 $984,432 $24,119 $55,098 $929,333 $22,769 $56,448 $872,885 $21,386 $57,831 $815,054 $19,969 $59,248 $755,806 10 $18,517 $60,700 $695,106 11 $17,030 $62,187 $632,919 12 $15,507 $63,710 $569,209 13 $13,946 $65,271 $503,938 14 $12,346 $66,870 $437,067 15 $10,708 $68 509 $368,558 16 $9,030 $70,187 $298,371 17 $7,310 $71,907 $226,464 18 $5,548 $73,669 $152,796 19 $3,743 $75,473 $77,322 20 $1,894 $77,322 SO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts