Question: im not sure what i did wrong, but as you can see my attempt (first image) does not match with the assignment bank statement. ill

im not sure what i did wrong, but as you can see my attempt (first image) does not match with the assignment bank statement.

ill upvote if someone can correct it.

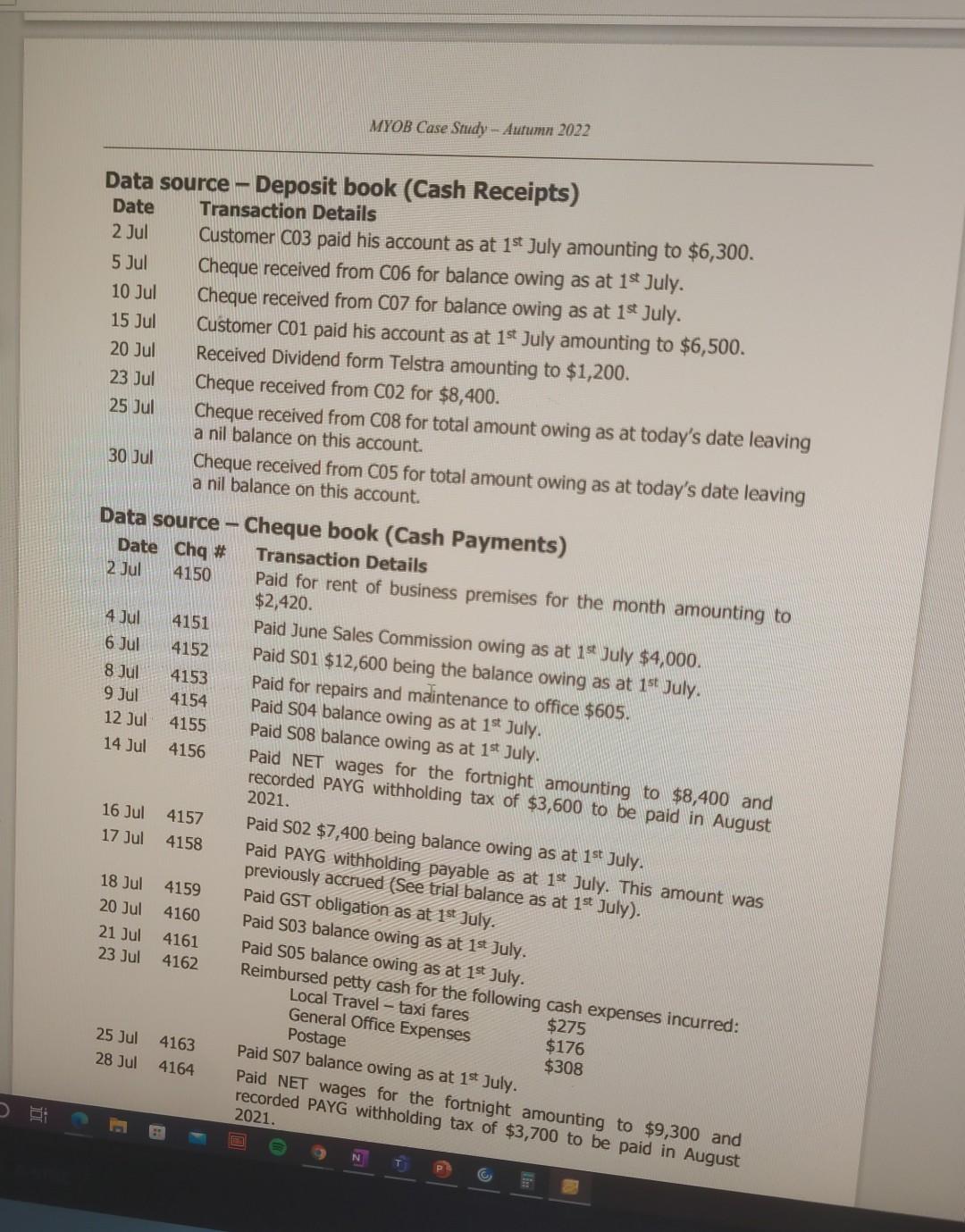

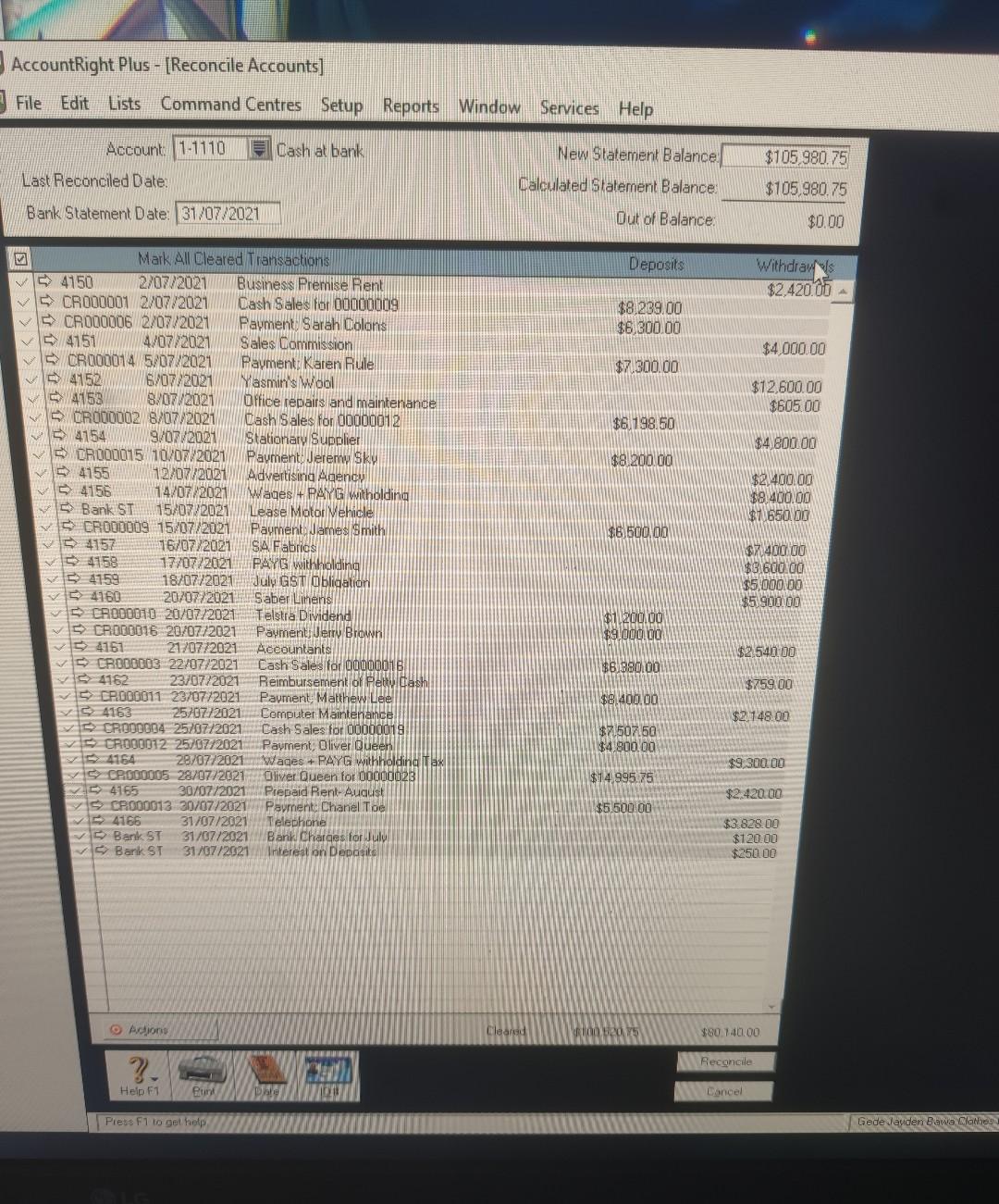

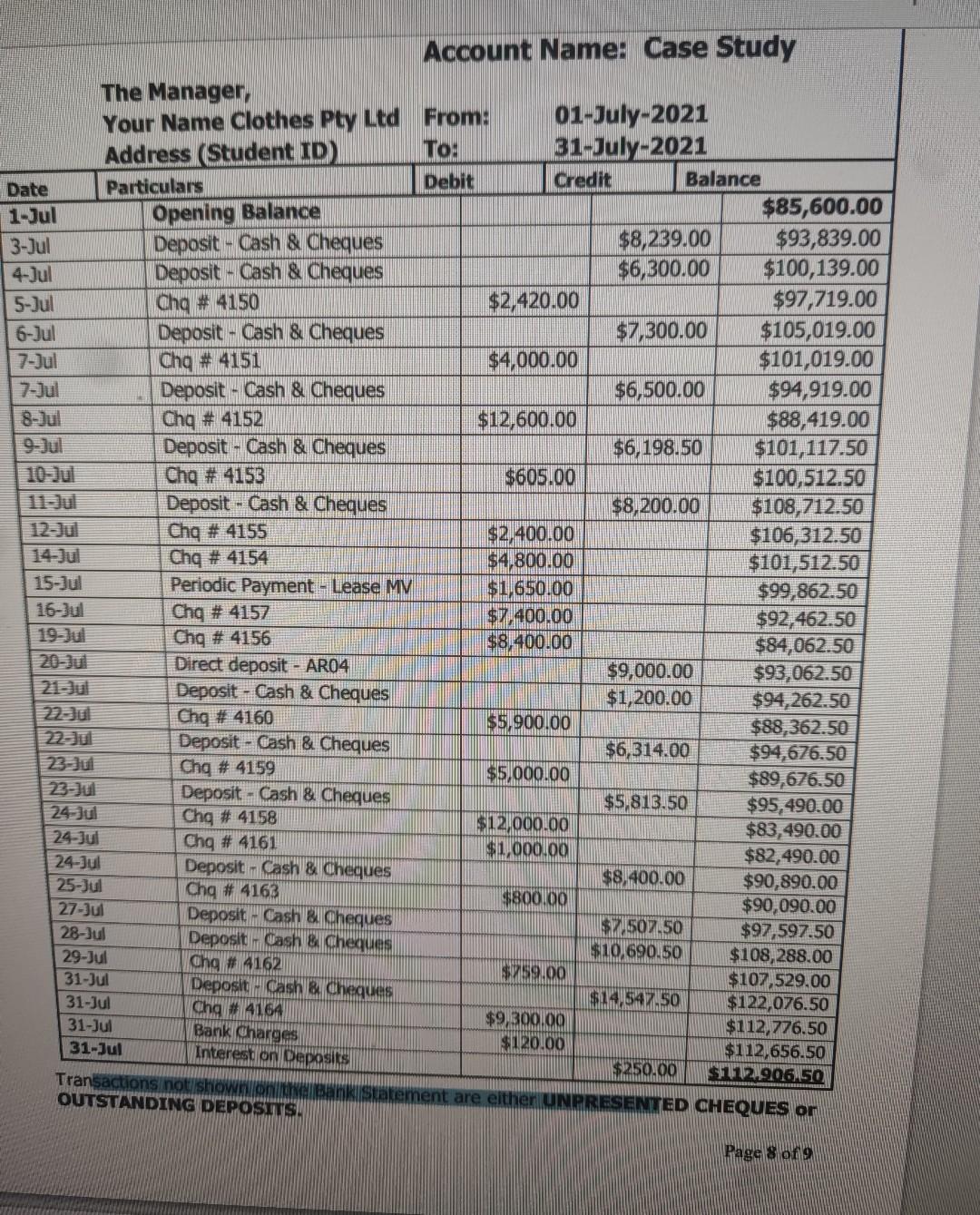

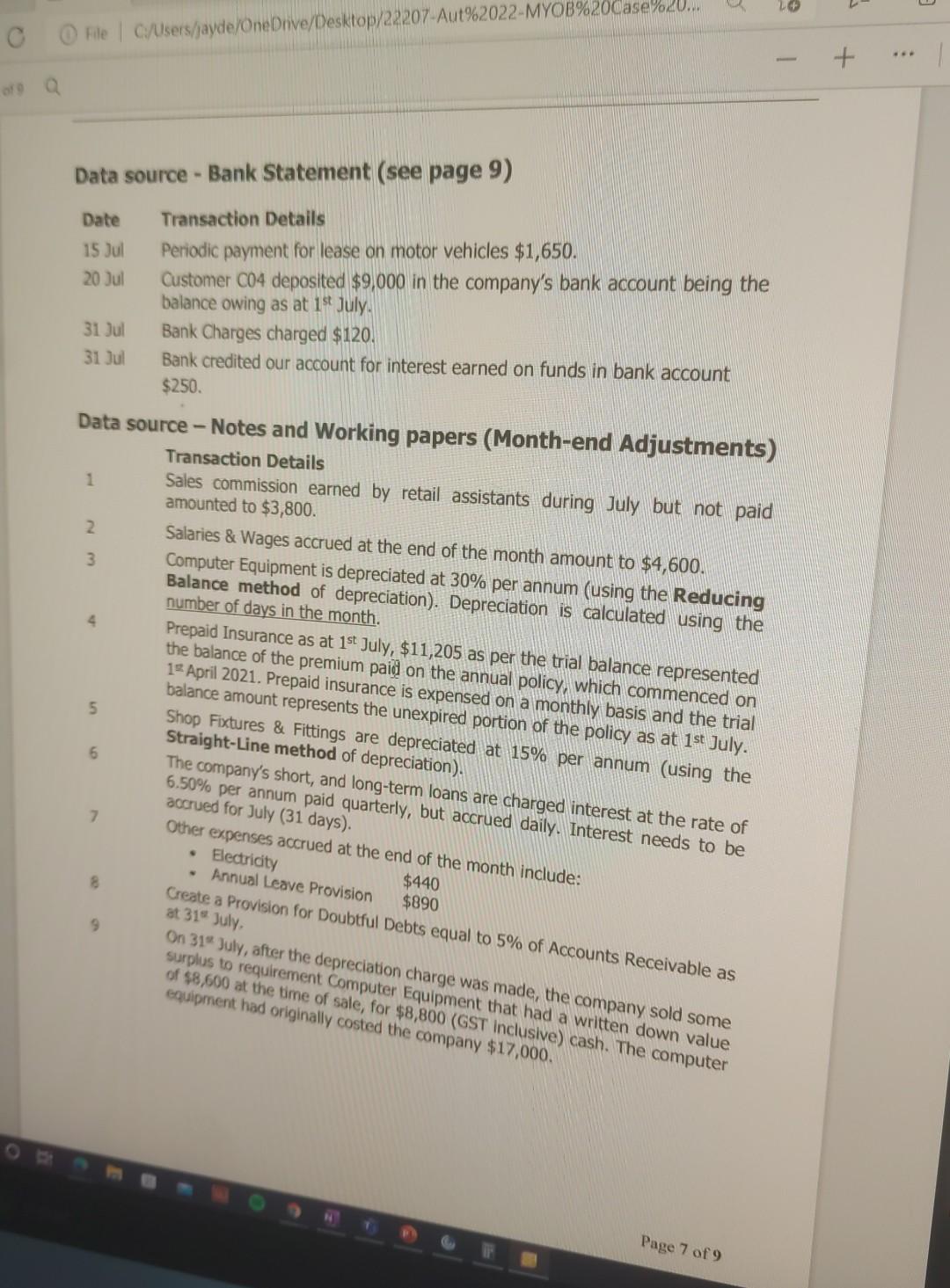

MYOB Case Study - Autumn 2022 Data source - Deposit book (Cash Receipts) Date Transaction Details 2 Jul Customer C03 paid his account as at 1st July amounting to $6,300. 5 Jul Cheque received from C06 for balance owing as at 1st July. 10 Jul Cheque received from C07 for balance owing as at 1st July. 15 Jul Customer C01 paid his account as at 1st July amounting to $6,500. 20 Jul Received Dividend form Telstra amounting to $1,200. 23 Jul Cheque received from CO2 for $8,400. 25 Jul Cheque received from C08 for total amount owing as at today's date leaving a nil balance on this account. 30 Jul Cheque received from C05 for total amount owing as at today's date leaving a nil balance on this account. Data source - Cheque book (Cash Payments) Date Chg # Transaction Details 2 Jul 4150 Paid for rent of business premises for the month amounting to $2,420. 4 Jul 4151 Paid June Sales Commission owing as at 15 July $4,000. 6 Jul 4152 Paid S01 $12,600 being the balance owing as at 1st July. 8 Jul 4153 Paid for repairs and maintenance to office $605. 9 Jul 4154 Paid S04 balance owing as at 1st July. 12 Jul 4155 Paid S08 balance owing as at 1st July. 14 Jul 4156 Paid NET wages for the fortnight amounting to $8,400 and recorded PAYG withholding tax of $3,600 to be paid in August 2021. 16 Jul 4157 Paid SO2 $7,400 being balance owing as at 1st July. 17 Jul 4158 Paid PAYG withholding payable as at 1st July. This amount was previously accrued (See trial balance as at 1st July). 18 Jul 4159 Paid GST obligation as at 1st July. 20 Jul 4160 Paid S03 balance owing as at 1st July. 21 Jul 4161 Paid S05 balance owing as at 1st July. 23 Jul 4162 Reimbursed petty cash for the following cash expenses incurred: Local Travel - taxi fares $275 General Office Expenses $176 4163 $308 Paid S07 balance owing as at 1st July. 4164 Paid NET wages for the fortnight amounting to $9,300 and recorded PAYG withholding tax of $3,700 to be paid in August Postage 25 Jul 28 Jul 2021. AccountRight Plus - [Reconcile Accounts] File Edit Lists Command Centres Setup Reports Window Services Help Account 1-1110 Dash al bank Last Reconciled Date: New Statement Balance Calculated Statement Balance Out of Balance $105 980.75 $105.980.75 $0.00 Bank Statement Date: 31/07/2021 Deposits Withdraws $2,420.00 $8,239.00 $6.300.00 $4,000.00 $7.300.00 $12,600.00 $605.00 $6.198.50 $4,800.00 $8.200.00 $2.400.00 $9.400.00 $1,650.00 $8.500.00 Mark All Cleared Transactions V 4150 2/07/2021 Business Premise Rent V CR0000012/07/2021 Cash Sales for 00000009 V CR000006 2/07/2021 Payment Sarah Colons 4151 4/07/2021 Sales Commission CR000014 5/07/2021 Payment: Karen Rule 4152 6/07/2021 Yasmin's Wool 4153 8/07/2021 Office repairs and maintenance VOROV0002 8/07/2021 Cash Sales for 00000012 4154 9/07/2021 Stationary Supplier V CR000015 10/07/2021 Payment Jeremy Sky 54155 12/07/2021 Advertising Agency 4156 14/07/2021 Wages + PAYG witholdina Bank ST 15/07/2021 Lease Motor Vehicle CR000009 15/07/2021 Payment James Smith 54157 16/07/2021 SA Fabrics 4158 17/07/2021. PAYG withholding 54159 18/07/2021 July GST Obligation vs 4160 2070772021 Saber Linens CRO00010 20/07/2021 Telstra Dividend CR000016 20/07/2021 Payment, Jerry Brown 4151 21/07/2021 Accountants CRO00003 22/07/2021 Cash Sales for 0000001 BA 14162 23/07/2021 Reimbursement of Petty cash CRO00011 23/07/2021 Payment Matthew Lee 4163 25/07/2021 Computer Maintena CRO00004 25/07/2021 Cash Sales for 00000019 CR000012 25/07/2021 Payment, Oliver Queen 28/07/2021 Wages + PAYG withholdind CRO00005 28/07/2021 Oliver Queen for 00000023 C 4165 30/07/2021 Prepaid Rent-August CR000013 30/07/2021 Payment Chanel Toe 4166 31/07/2021 Telephone Bank ST 31/07/2021 Bank Charges for July - Bank ST 31/07/2021 Interest on Deposite $71.400.00 $3.600 da $5,000.00 $5.900.00 $1.200.00 $9.000.00 $2.540.00 $6.390.00 $759.00 $8.400.00 $2,148.00 KKK $7.50750 $4,800.00 $9,300.00 $14.995.75 $2.420.00 $5.500.00 RK $3.828.00 $120.00 $250.00 Arcjons READ BOYS $80.140.00 Reconcile ?. Help FT Puni Cancel Press F1 to get help Gede Jayden Bawalones Account Name: Case Study The Manager, Your Name Clothes Pty Ltd From: 01-July-2021 Address Student ID) TO: 31-July-2021 Date Particulars Debit Credit Balance 1-Jul Opening Balance $85,600.00 3-Jul Deposit - Cash & Cheques $8,239.00 $93,839.00 4-Jul Deposit - Cash & Cheques $6,300.00 $100,139.00 5-Jul Chq # 4150 $2,420.00 $97,719.00 6-Jul Deposit - Cash & Cheques $7,300.00 $105,019.00 7-Jul Chq # 4151 $4,000.00 $101,019.00 7-Jul Deposit - Cash & Cheques $6,500.00 $94,919.00 8-Jul Chq # 4152 $12,600.00 $88,419.00 Deposit - Cash & Cheques $6,198.50 $101,117.50 Chg # 4153 $605.00 $100,512.50 Deposit - Cash & Cheques $8,200.00 $108,712.50 Chg # 4155 $2,400.00 $106,312.50 Chg # 4154 $4,800.00 $101,512.50 15-Jul Periodic Payment - Lease MV $1,650.00 $99,862.50 16-Jul Chg # 4157 $7 400.00 $92,462.50 19-Jul Chg # 4156 $8,400.00 $84,062.50 Direct deposit - AR04 $9,000.00 $93,062.50 Deposit - Cash & Cheques $1,200.00 $94,262.50 Chg # 4160 $5,900.00 $88,362.50 Deposit - Cash & Cheques $6,314.00 $94,676.50 23-301 Chg # 4159 $5,000.00 $89,676.50 22- Jul Deposit - Cash & Cheques $5,813.50 24 Jul $95,490.00 Chg # 4158 $12,000.00 $83,490.00 24-Jul Chg # 4161 $1,000.00 $82,490.00 24-Jul Deposit - Cash & Cheques $8,400.00 25-Jul $90,890.00 Chg # 4163 $800.00 27-Jul $90,090.00 Deposit - Cash & Cheques 28-Jul $ 507.50 Deposit - Cash & Cheques $97,597.50 29-Jul $10.690.50 Chg # 4162 $108,288.00 $59.00 31-Jul Deposit - Cash & Cheques $107,529.00 31-Jul Chg # 4164 $14.547.50 $122,076.50 $9,300.00 31-Jul $112,776.50 31-Jul $120.00 Interest on Deposits $112,656.50 $250.00 Transactions nous $112.90650 OUTSTANDING DEPOSITS. Statement are either UNPRESENTED CHEQUES on Bank Charges Page 8 of 9 3 O File C/Users/jayde/OneDrive/Desktop/22207-Aut%2022-MYOB%20Case%20... of Data source - Bank Statement (see page 9) Date 15 Jul 20 Jul Transaction Details Periodic payment for lease on motor vehicles $1,650. Customer C04 deposited $9,000 in the company's bank account being the balance owing as at 1st July Bank Charges charged $120. Bank credited our account for interest earned on funds in bank account $250. 31 Jul 31 Jul 1 2 Data source - Notes and Working papers (Month-end Adjustments) Transaction Details Sales commission earned by retail assistants during July but not paid amounted to $3,800. Salaries & Wages accrued at the end of the month amount to $4,600. Computer Equipment is depreciated at 30% per annum (using the Reducing Balance method of depreciation). Depreciation is calculated using the number of days in the month. Prepaid Insurance as at 1st July, $11,205 as per the trial balance represented the balance of the premium paid on the annual policy, which commenced on 12 April 2021. Prepaid insurance is expensed on a monthly basis and the trial balance amount represents the unexpired portion of the policy as at 1st July. Shop Fixtures & Fittings are depreciated at 15% per annum (using the Straight-Line method of depreciation). 3 5 6 7 8 The company's short, and long-term loans are charged interest at the rate of 6.50% per annum paid quarterly, but accrued daily. Interest needs to be accrued for July (31 days). Other expenses accrued at the end of the month include: Electricity $440 . Annual Leave Provision $890 Create a Provision for Doubtful Debts equal to 5% of Accounts Receivable as at 31 July On 31 July, after the depreciation charge was made, the company sold some Surplus to requirement Computer Equipment that had a written down value of $8,600 at the time of sale, for $8,800 (GST Inclusive) cash. The computer equipment had originally costed the company $17,000. 9 Page 7 of 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts