Question: I'm not sure what I did wrong, but I seem to keep arriving at the incorrect solution listed. Any help along with work to show

I'm not sure what I did wrong, but I seem to keep arriving at the incorrect solution listed. Any help along with work to show me where I went wrong is appreciated!. Thank you!

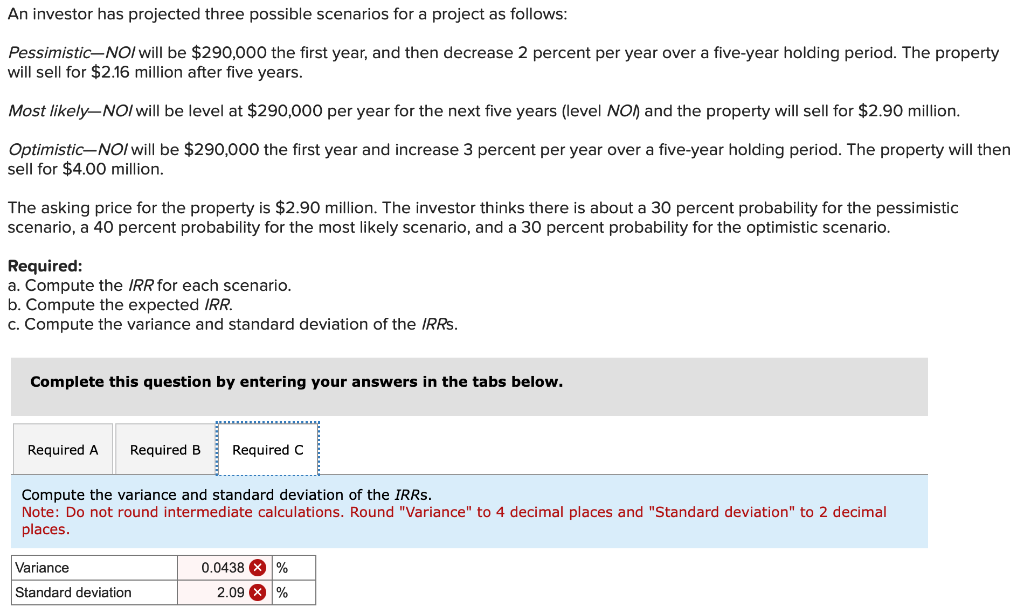

An investor has projected three possible scenarios for a project as follows: Pessimistic-NO/ will be $290,000 the first year, and then decrease 2 percent per year over a five-year holding period. The property will sell for $2.16 million after five years. Most likely-NO/ will be level at $290,000 per year for the next five years (level NOI) and the property will sell for $2.90 million. Optimistic-NO/ will be $290,000 the first year and increase 3 percent per year over a five-year holding period. The property will then sell for $4.00 million. The asking price for the property is $2.90 million. The investor thinks there is about a 30 percent probability for the pessimistic scenario, a 40 percent probability for the most likely scenario, and a 30 percent probability for the optimistic scenario. Required: a. Compute the IRR for each scenario. b. Compute the expected IRR. c. Compute the variance and standard deviation of the IRRs. Complete this question by entering your answers in the tabs below. Compute the variance and standard deviation of the IRRs. Note: Do not round intermediate calculations. Round "Variance" to 4 decimal places and "Standard deviation" to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts