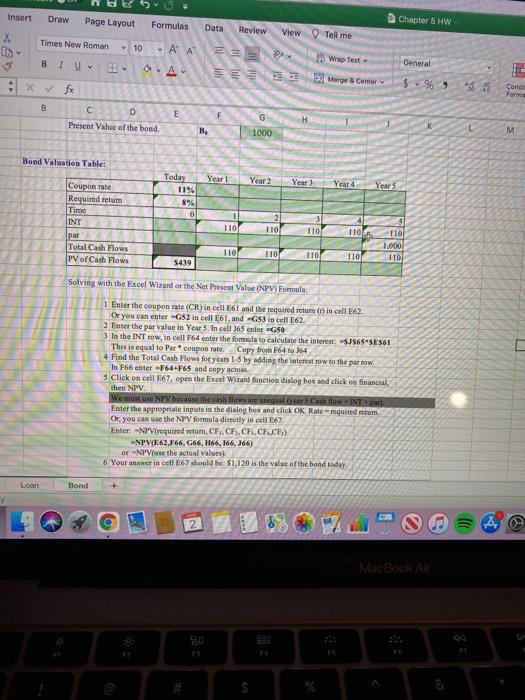

Question: im not sure what im doing wrong. my answers dont match Insert Draw Page Layout Formulas Chapter 5 HW Data Review View Tell me Times

Insert Draw Page Layout Formulas Chapter 5 HW Data Review View Tell me Times New Roman X 0 3 10 - A A BI 3 Wrap Text General ===== Merge Center x x $ 96 9 Conde B E D Present Value of the bond F . 1000 M Bond Valuation Table: Year 1 Year 2 Year Year 4 Years Today 11% 8% 0 Coupon rate Required retum Time INT Ipar Total Cash Flows PV of Cash Flows 110 2 110 110 110 110 1.000 110 110 110 110 110 5439 Solving with the Excel Wizard or the Net Present Valve (NPV Formula 1 Enter the coupon rate (CR) in cell 661 and the required retum (t) in cell E62 Or you can enter 652 in cell E61, and -G53 in cell E62 2 Enter the par value in Year 5. In cell 365 enter 50 3. In the INT row, in cell F64 enter the formale to calculate the interest: J$65*SES61 This is equal to Parcoupon rate Copy from 64 to 164 4 Find the Total Cash Flows for years 1-3 by adding the interest row to the parrow In 166 enter -F64+F65 and copy across Click on cell E67. open the Excel Wizard function dialog box and click on financial, then NPV We must use NPV because the cash flows are nogal 5. Cash INT par) Enter the appropriate inputs in the dialog box and click OK Rate required retum Or, you can use the NPV formula directly in cell E67 Enter: NP Virequired retum. CF.CFCF.CF..CF) NPV(E62.F66, 666,66,166, J66) or NPVuse the actual values). 6 Your answer in cell E67 should be 1,120 is the value of the bond today Loan Bond + 9 MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts