Question: I'm so confused, please help me out with this, please show your work so I can learn as well. Thank you! (5) Let the price

I'm so confused, please help me out with this, please show your work so I can learn as well. Thank you!

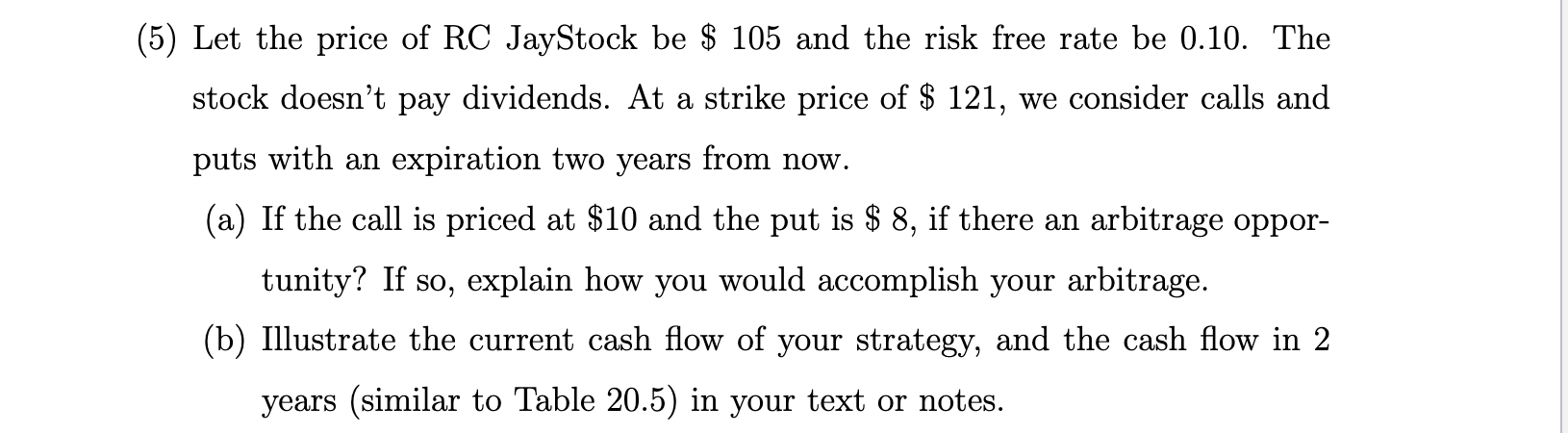

(5) Let the price of RC JayStock be $105 and the risk free rate be 0.10 . The stock doesn't pay dividends. At a strike price of $121, we consider calls and puts with an expiration two years from now. (a) If the call is priced at $10 and the put is $8, if there an arbitrage opportunity? If so, explain how you would accomplish your arbitrage. (b) Illustrate the current cash flow of your strategy, and the cash flow in 2 years (similar to Table 20.5) in your text or notes. (5) Let the price of RC JayStock be $105 and the risk free rate be 0.10 . The stock doesn't pay dividends. At a strike price of $121, we consider calls and puts with an expiration two years from now. (a) If the call is priced at $10 and the put is $8, if there an arbitrage opportunity? If so, explain how you would accomplish your arbitrage. (b) Illustrate the current cash flow of your strategy, and the cash flow in 2 years (similar to Table 20.5) in your text or notes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts