Question: I'm stuck on some HW problems, Can someone please answer the following questions? It is a multi-part question. Please hurry up and answer! I need

I'm stuck on some HW problems, Can someone please answer the following questions? It is a multi-part question. Please hurry up and answer! I need these answers ASAP!!! Thumbs up Guaranteed for best answer!

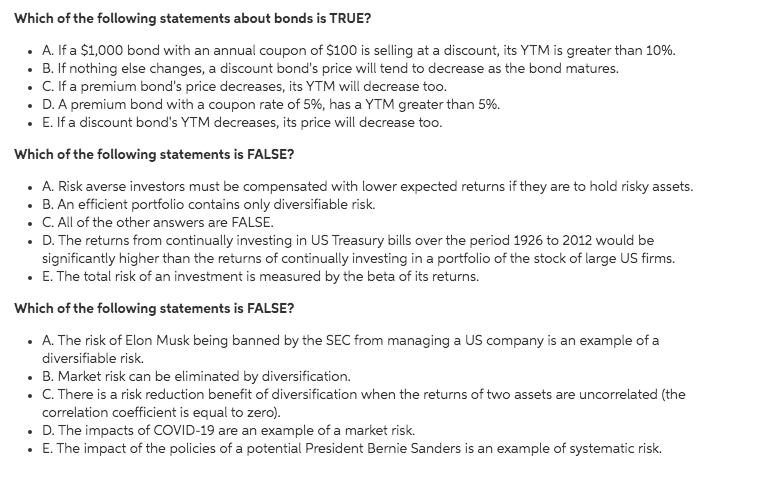

Which of the following statements about bonds is TRUE? . A. If a $1,000 bond with an annual coupon of $100 is selling at a discount, its YTM is greater than 10%. B. If nothing else changes, a discount bond's price will tend to decrease as the bond matures. C. If a premium bond's price decreases, its YTM will decrease too. D. A premium bond with a coupon rate of 5%, has a YTM greater than 5%. E. If a discount bond's YTM decreases, its price will decrease too. Which of the following statements is FALSE? A. Risk averse investors must be compensated with lower expected returns if they are to hold risky assets. . B. An efficient portfolio contains only diversifiable risk. . C. All of the other answers are FALSE. . D. The returns from continually investing in US Treasury bills over the period 1926 to 2012 would be significantly higher than the returns of continually investing in a portfolio of the stock of large US firms. E. The total risk of an investment is measured by the beta of its returns. Which of the following statements is FALSE? A. The risk of Elon Musk being banned by the SEC from managing a US company is an example of a diversifiable risk. . B. Market risk can be eliminated by diversification. . C. There is a risk reduction benefit of diversification when the returns of two assets are uncorrelated (the correlation coefficient is equal to zero). D. The impacts of COVID-19 are an example of a market risk. E. The impact of the policies of a potential President Bernie Sanders is an example of systematic risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts