Question: I'm stuck on this practice problem, please help with a detailed explanation! The GTAA is considering a investment in a new concessions concept at Grant

I'm stuck on this practice problem, please help with a detailed explanation!

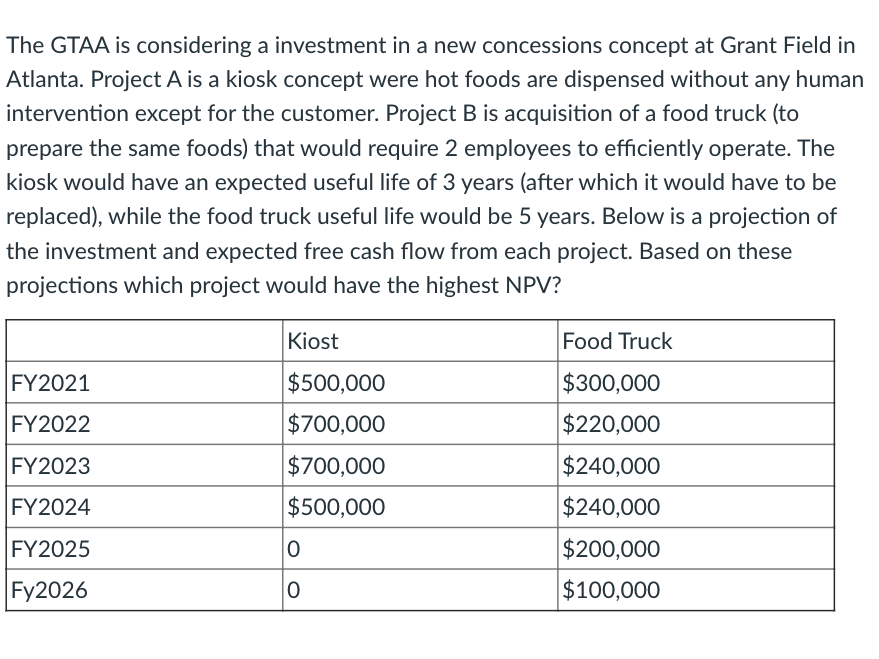

The GTAA is considering a investment in a new concessions concept at Grant Field in Atlanta. Project A is a kiosk concept were hot foods are dispensed without any human intervention except for the customer. Project B is acquisition of a food truck (to prepare the same foods) that would require 2 employees to efficiently operate. The kiosk would have an expected useful life of 3 years (after which it would have to be replaced), while the food truck useful life would be 5 years. Below is a projection of the investment and expected free cash flow from each project. Based on these projections which project would have the highest NPV? Kiost Food Truck FY2021 $300,000 $500,000 $700,000 FY2022 $220,000 FY2023 $700,000 $240,000 FY2024 $500,000 $240,000 FY2025 0 $200,000 Fy2026 0 $100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts