Question: im sure A. is wrong... a. Using the domestic CAPM, what is Ganado's weighted average cost of capital if the firm's equity risk premium is

im sure A. is wrong...

im sure A. is wrong...

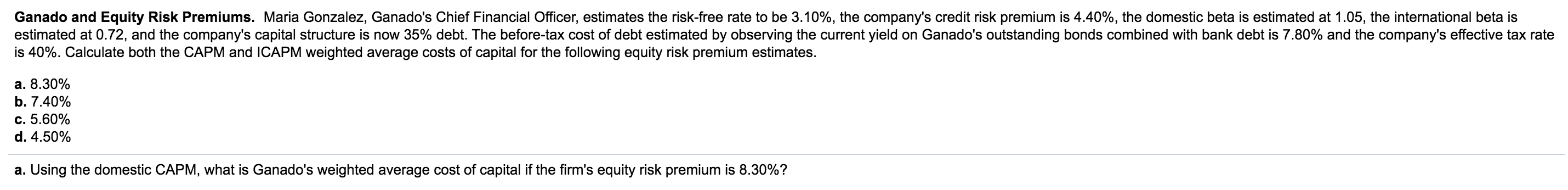

a. Using the domestic CAPM, what is Ganado's weighted average cost of capital if the firm's equity risk premium is 8.30%?

Using the ICAPM, what is Ganado's weighted average cost of capital if the firm's equity risk premium is 8.30%?

b. Using the domestic CAPM, what is Ganado's weighted average cost of capital if the firm's equity risk premium is 7.40%?

Using the ICAPM, what is Ganado's weighted average cost of capital if the firm's equity risk premium is 7.40%?

c. Using the domestic CAPM, what is Ganado's weighted average cost of capital if the firm's equity risk premium is 5.60%?

Using the ICAPM, what is Ganado's weighted average cost of capital if the firm's equity risk premium is 5.60%?

d. Using the domestic CAPM, what is Ganado's weighted average cost of capital if the firm's equity risk premium is 4.50%?

Using the ICAPM, what is Ganado's weighted average cost of capital if the firm's equity risk premium is 4.50%

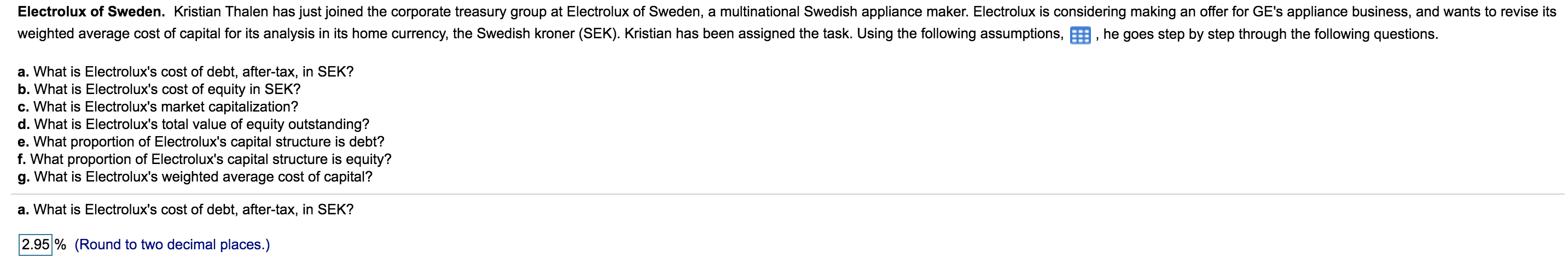

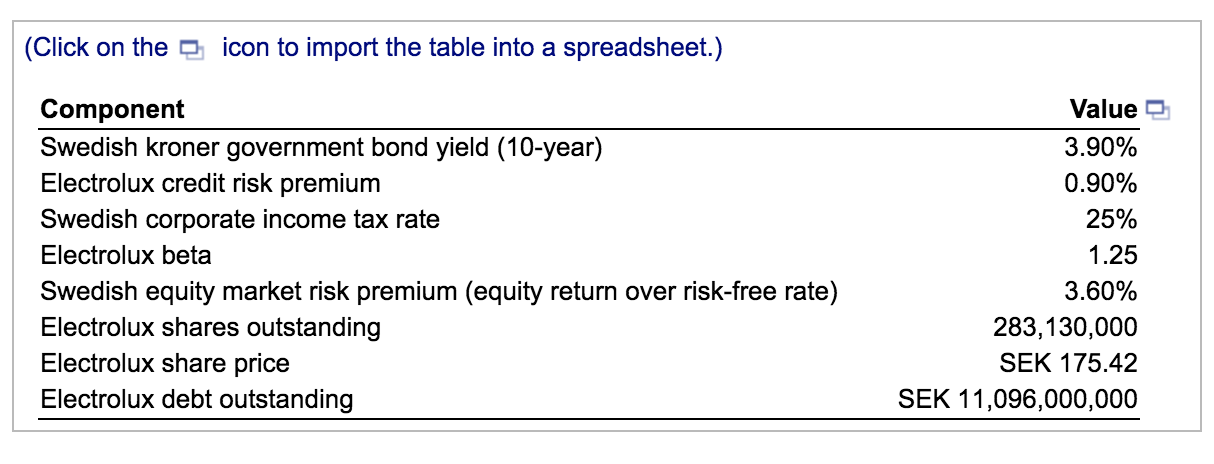

Electrolux of Sweden. Kristian Thalen has just joined the corporate treasury group at Electrolux of Sweden, a multinational Swedish appliance maker. Electrolux is considering making an offer for GE's appliance business, and wants to revise its weighted average cost of capital for its analysis in its home currency, the Swedish kroner (SEK). Kristian has been assigned the task. Using the following assumptions, 3, he goes step by step through the following questions. a. What is Electrolux's cost of debt, after-tax, in SEK? b. What is Electrolux's cost of equity in SEK? c. What is Electrolux's market capitalization? d. What is Electrolux's total value of equity outstanding? e. What proportion of Electrolux's capital structure is debt? f. What proportion of Electrolux's capital structure is equity? g. What is Electrolux's weighted average cost of capital? a. What is Electrolux's cost of debt, after-tax, in SEK? 2.95% (Round to two decimal places.) (Click on the icon to import the table into a spreadsheet.) Component Swedish kroner government bond yield (10-year) Electrolux credit risk premium Swedish corporate income tax rate Electrolux beta Swedish equity market risk premium (equity return over risk-free rate) Electrolux shares outstanding Electrolux share price Electrolux debt outstanding Value 3.90% 0.90% 25% 1.25 3.60% 283,130,000 SEK 175.42 SEK 11,096,000,000 Ganado and Equity Risk Premiums. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 3.10%, the company's credit risk premium is 4.40%, the domestic beta is estimated at 1.05, the international beta is estimated at 0.72, and the company's capital structure is now 35% debt. The before-tax cost of debt estimated by observing the current yield on Ganado's outstanding bonds combined with bank debt is 7.80% and the company's effective tax rate is 40%. Calculate both the CAPM and ICAPM weighted average costs of capital for the following equity risk premium estimates. a. 8.30% b. 7.40% c. 5.60% d. 4.50% a. Using the domestic CAPM, what is Ganado's weighted average cost of capital if the firm's equity risk premium is 8.30%? Electrolux of Sweden. Kristian Thalen has just joined the corporate treasury group at Electrolux of Sweden, a multinational Swedish appliance maker. Electrolux is considering making an offer for GE's appliance business, and wants to revise its weighted average cost of capital for its analysis in its home currency, the Swedish kroner (SEK). Kristian has been assigned the task. Using the following assumptions, 3, he goes step by step through the following questions. a. What is Electrolux's cost of debt, after-tax, in SEK? b. What is Electrolux's cost of equity in SEK? c. What is Electrolux's market capitalization? d. What is Electrolux's total value of equity outstanding? e. What proportion of Electrolux's capital structure is debt? f. What proportion of Electrolux's capital structure is equity? g. What is Electrolux's weighted average cost of capital? a. What is Electrolux's cost of debt, after-tax, in SEK? 2.95% (Round to two decimal places.) (Click on the icon to import the table into a spreadsheet.) Component Swedish kroner government bond yield (10-year) Electrolux credit risk premium Swedish corporate income tax rate Electrolux beta Swedish equity market risk premium (equity return over risk-free rate) Electrolux shares outstanding Electrolux share price Electrolux debt outstanding Value 3.90% 0.90% 25% 1.25 3.60% 283,130,000 SEK 175.42 SEK 11,096,000,000 Ganado and Equity Risk Premiums. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 3.10%, the company's credit risk premium is 4.40%, the domestic beta is estimated at 1.05, the international beta is estimated at 0.72, and the company's capital structure is now 35% debt. The before-tax cost of debt estimated by observing the current yield on Ganado's outstanding bonds combined with bank debt is 7.80% and the company's effective tax rate is 40%. Calculate both the CAPM and ICAPM weighted average costs of capital for the following equity risk premium estimates. a. 8.30% b. 7.40% c. 5.60% d. 4.50% a. Using the domestic CAPM, what is Ganado's weighted average cost of capital if the firm's equity risk premium is 8.30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts