Question: Im very lost with this question please assist so i can have a better understanding Quisoo Systems has 6.47 billion shares outstanding and a share

Im very lost with this question please assist so i can have a better understanding

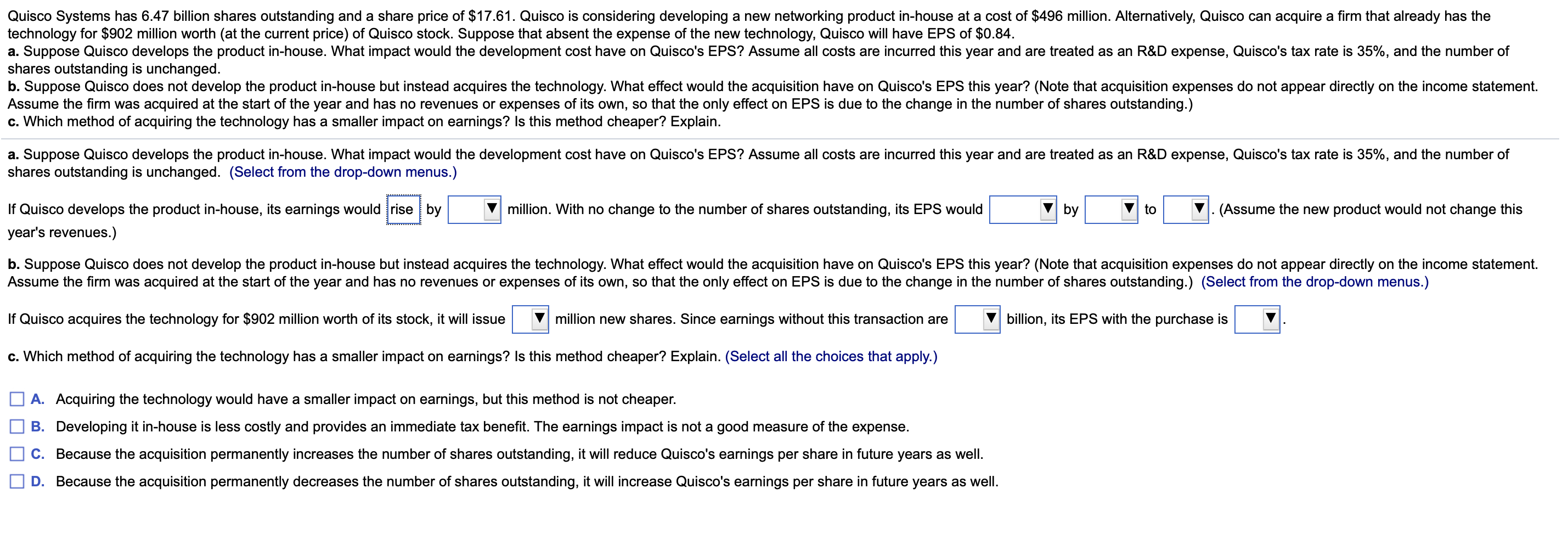

Quisoo Systems has 6.47 billion shares outstanding and a share price of $17.61. Quisco is considering developing a new networking product in-house at a cost of $496 million. Alternatively, Quisco can acquire a rm that already has the technology for $902 million worth (at the current price) of Quisco stock. Suppose that absent the expense of the new technology, Quisco will have EPS of $0.84. 3. Suppose Quisoo develops the product in-house. What impact would the development cost have on Quisco's EPS? Assume all costs are incurred this year and are treated as an R&D expense. Quisco's tax rate is 35%, and the number of shares outstanding is unchanged. b. Suppose Quisco does not develop the product in-house but instead acquires the technology. What effect would the acquisition have on Quisco's EPS this year'? (Note that acquisition expenses do not appear directly on the income statement, Assume the rm was acquired at the start of the year and has no revenues or expenses of its own, so that the only effect on EPS is due to the change in the number of shares outstanding.) c. Which method of acquiring the technology has a smaller impact on eamings? Is this method cheaper? Explain. 8. Suppose Quisoo develops the product in-house. What impact would the development cost have on Quisco's EPS? Assume all costs are incurred this year and are treated as an R&D expense, Quisco's tax rate is 35%, and the number of shares outstanding is unchanged. (Select from the dropdown menus.) It Quisco develops the product in-house, its eamings would lrise I by '1 million. With no change to the number of shares outstanding, its EPS would i: by 1 to 1 . (Assume the new product would not change this year's revenues.) b. Suppose Quisco does not develop the product in-house but instead acquires the technology. What effect would the acquisition have on Quisco's EPS this year? (Note that acquisition expenses do not appear directly on the income statement. Assume the rm was acquired at the start of the year and has no revenues or expenses of its own, so that the only effect on EPS is due to the change in the number of shares outstanding.) (Select from the drop-down menus.) It Quisco acquires the technology for $902 million worth of its stock, it will issue V million new shares. Since earnings without this transaction are V billion, its EPS with the purchase is 'V . c. Which method of acquiring the technology has a smaller impact on earnings? Is this method cheaper? Explain. (Select all the choices that apply.) Acquiring the technology would have a smaller impact on earnings, but this method is not cheaper. Developing it in-house is less costly and provides an immediate tax benet. The earnings impact is not a good measure of the expense. Because the acquisition permanently increases the number of shares outstanding, it will reduce Quisco's eamings per share in future years as well. 9.0!\"? Because the acquisition permanently decreases the number of shares outstanding, it will increase Quisco's earnings per share in future years as well

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts