Question: In 20X1, its first year of operations, Horn Gren, Inc., manufactured 110,000 units of its single product, ties. Variable manufacturing costs were $6 per

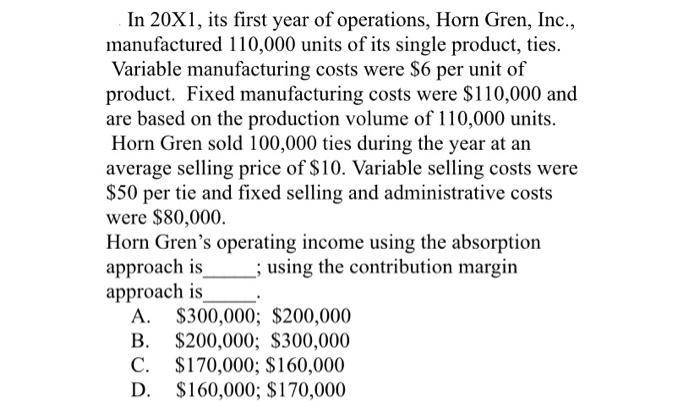

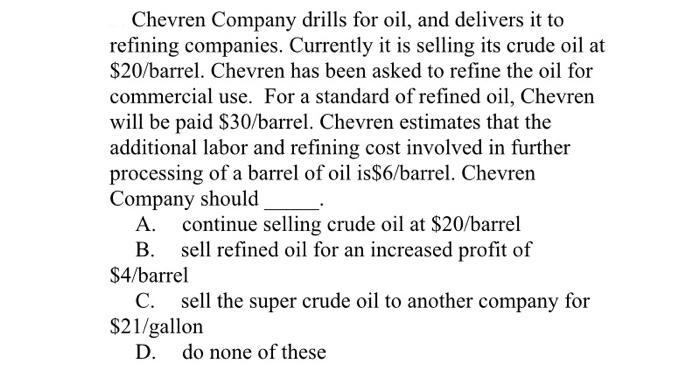

In 20X1, its first year of operations, Horn Gren, Inc., manufactured 110,000 units of its single product, ties. Variable manufacturing costs were $6 per unit of product. Fixed manufacturing costs were $110,000 and are based on the production volume of 110,000 units. Horn Gren sold 100,000 ties during the year at an average selling price of $10. Variable selling costs were $50 per tie and fixed selling and administrative costs were $80,000. Horn Gren's operating income using the absorption approach is approach is A. $300,000; $200,000 B. $200,000; $300,000 C. $170,000; $160,000 D. $160,000; $170,000 ; using the contribution margin Chevren Company drills for oil, and delivers it to refining companies. Currently it is selling its crude oil at $20/barrel. Chevren has been asked to refine the oil for commercial use. For a standard of refined oil, Chevren will be paid $30/barrel. Chevren estimates that the additional labor and refining cost involved in further processing of a barrel of oil is$6/barrel. Chevren Company should . continue selling crude oil at $20/barrel sell refined oil for an increased profit of . $4/barrel . $21/gallon sell the super crude oil to another company for D. do none of these

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

1 C 170000 160000 2 A CALCULATE OPERATING INCOME USING ABSORPTION COST... View full answer

Get step-by-step solutions from verified subject matter experts