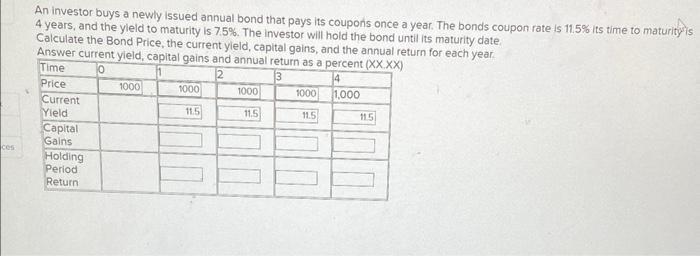

Question: ces An investor buys a newly issued annual bond that pays its coupons once a year. The bonds coupon rate is 11.5% its time

ces An investor buys a newly issued annual bond that pays its coupons once a year. The bonds coupon rate is 11.5% its time to maturity is 4 years, and the yield to maturity is 7.5%. The investor will hold the bond until its maturity date. Calculate the Bond Price, the current yield, capital gains, and the annual return for each year. Answer current yield, capital gains and annual return as a percent (XX.XX) Time 10 2 14 Price Current Yield Capital Gains Holding Period Return 1000 1000 11.5 1000 11.5 1000 11.5 1,000 11.5

Step by Step Solution

3.37 Rating (144 Votes )

There are 3 Steps involved in it

To calculate the bond price we can use the formula for the present value of a bond Bond Price Coupon Payment 1 Yield to Maturity1 Coupon Payment 1 Yie... View full answer

Get step-by-step solutions from verified subject matter experts