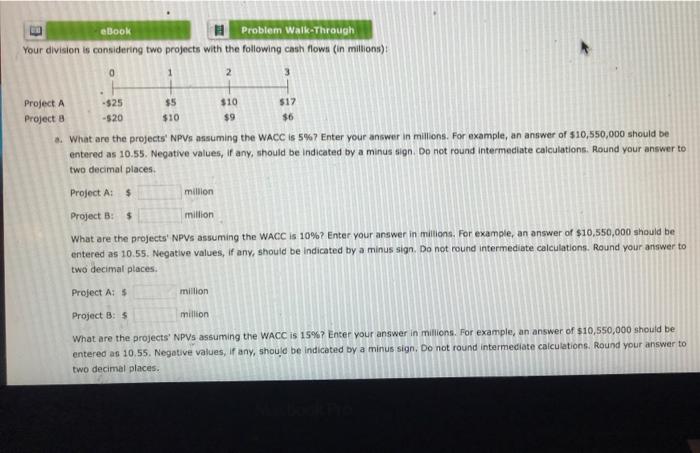

Question: IMMEDIATE THUMBS UP THANKS E eBook Problem Walk-Through Your division is considering two projects with the following cash flows (in Millions)! 0 2 1 Project

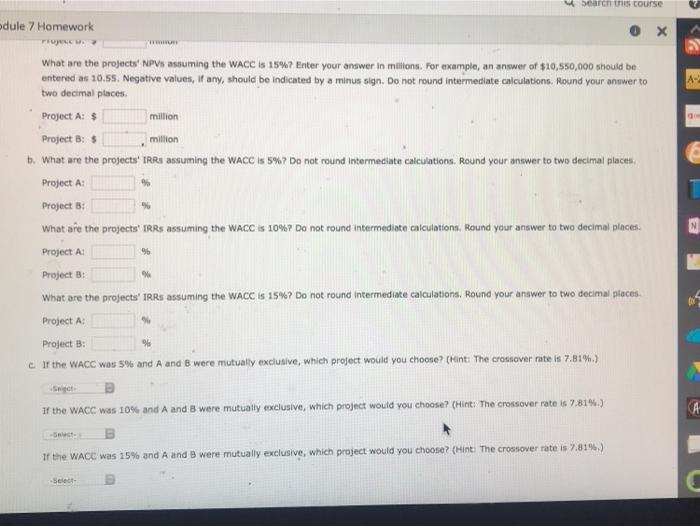

E eBook Problem Walk-Through Your division is considering two projects with the following cash flows (in Millions)! 0 2 1 Project A -525 $5 $10 512 Project -520 $10 $9 $6 6. What are the projects' NPVs assuming the WACC is 5%? Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus dign. Do not round Intermediate calculations. Round your answer to two decimal places Project A: $ million Project B: $ million What are the projects' NPVs assuming the WACC is 10%? Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not round Intermediate calculations. Round your answer to two decimal places Project A: $ million Project : $ million What are the projects' NPVs assuming the WACC is 15%? Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to two decimal places. A search this course odule 7 Homework royee What are the projects' NPVs assuming the WACC is 15? Enter your answer in milions. For example, an answer of $10,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not round Intermediate calculations. Round your answer to two decimal places Project A: $ million Project B: $ million b. What are the projects' TRRs assuming the WACC is 5%? Do not round Intermediate calculations. Round your answer to two decimal places Project A: Project : What are the projects IRAs assuming the WACC is 10%? Do not round intermediate calculations, Round your answer to two decimal places. Project A N 96 Project : What are the projects' IRRs assuming the WACC is 15%? Do not round intermediate calculations, Round your answer to two decimal places Project A: Project B: c. If the WACC was 5% and A and B were mutually exclusive, which project would you choose? (Hint: The crossover rate is 7.81%) If the WACC was 10% and A and B were mutually exclusive, which project would you choose? (Hint: The crossover rate is 7.81%) If the WACC was 15% and A and B were mutually exclusive, which project would you choose? (Hint: The crossover rate is 7.819.) Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts