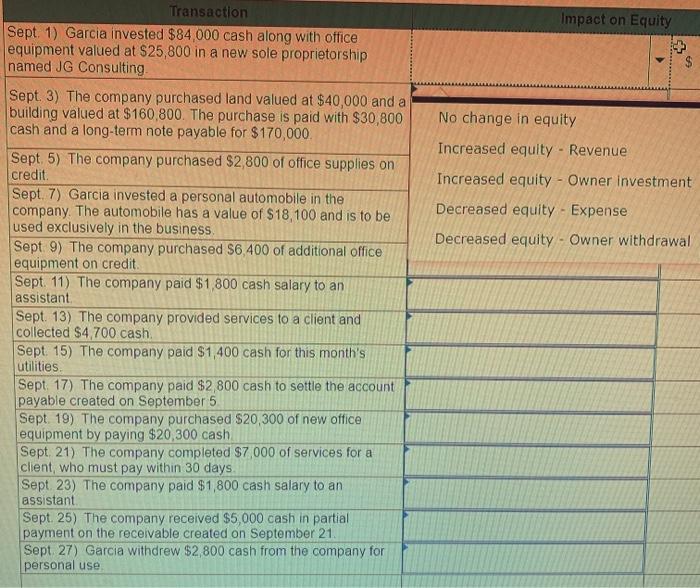

Question: Impact on Equity 1 $ No change in equity Increased equity - Revenue Increased equity - Owner Investment Decreased equity - Expense Decreased equity -

Impact on Equity 1 $ No change in equity Increased equity - Revenue Increased equity - Owner Investment Decreased equity - Expense Decreased equity - Owner withdrawal Transaction Sept. 1) Garcia invested $84,000 cash along with office equipment valued at $25,800 in a new sole proprietorship named JG Consulting Sept. 3) The company purchased land valued at $40,000 and a building valued at $160,800. The purchase is paid with $30,800 cash and a long-term note payable for $170,000 Sept. 5) The company purchased $2,800 of office supplies on credit Sept. 7) Garcia invested a personal automobile in the company. The automobile has a value of $18, 100 and is to be used exclusively in the business Sept 9) The company purchased $6.400 of additional office equipment on credit Sept. 11) The company paid $1,800 cash salary to an assistant Sept. 13) The company provided services to a client and collected $4,700 cash Sept 15) The company paid $1,400 cash for this month's utilities Sept 17) The company paid $2,800 cash to settle the account payable created on September 5 Sept 19) The company purchased $20,300 of new office equipment by paying $20,300 cash Sept 21) The company completed $7.000 of services for a client, who must pay within 30 days Sept 23) The company paid $1,800 cash salary to an assistant Sept 25) The company received $5,000 cash in partial payment on the receivable created on September 21 Sept. 27) Garcia withdrew $2,800 cash from the company for personal use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts